Crafting a “money pizza,” while a whimsical concept, alludes to the fundamental principles of portfolio diversification. Imagine your financial resources as ingredients, and your investment choices as the various toppings that make up a complete and satisfying pie. The key is to avoid a monotonous, single-flavor experience (putting all your eggs in one basket) and instead, strive for a balanced composition that caters to your risk appetite, financial goals, and time horizon. However, just like a poorly constructed pizza can be unappetizing, a haphazardly assembled portfolio can be detrimental to your financial health.

Let’s break down the core components needed to create a well-rounded, or "delicious," investment strategy.

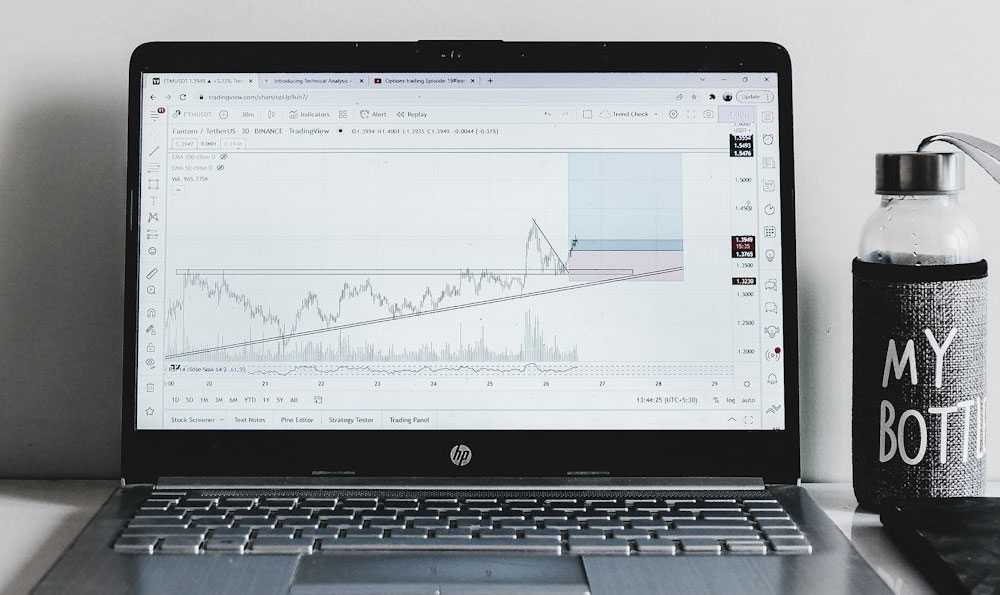

First, understand your risk tolerance. Are you a daring “pepperoni” enthusiast who loves the heat and is comfortable with aggressive growth strategies? Or are you a more conservative “mushroom” lover, preferring safer, more predictable investments? Assessing your risk tolerance involves honestly evaluating how you react to market volatility. Can you sleep soundly during a market downturn, or do you panic and sell? Your answer will heavily influence the types of investments that are suitable for you. Tools like risk assessment questionnaires can be helpful, but self-reflection is just as important. Consider past investment experiences, both positive and negative, and how they made you feel.

Next, clearly define your financial goals. What are you saving for? Is it a down payment on a house, your children's education, retirement, or simply building a comfortable nest egg? Each goal has a different time horizon, which dictates the investment strategies you should employ. Short-term goals (within 5 years) typically require more conservative investments like high-yield savings accounts, money market funds, or short-term bonds. These offer stability and liquidity, crucial for accessing funds when needed. Mid-term goals (5-10 years) can tolerate a slightly higher risk profile, allowing for a mix of bonds and stocks. Long-term goals (10+ years), like retirement, offer the most flexibility, permitting a greater allocation to growth-oriented assets like stocks.

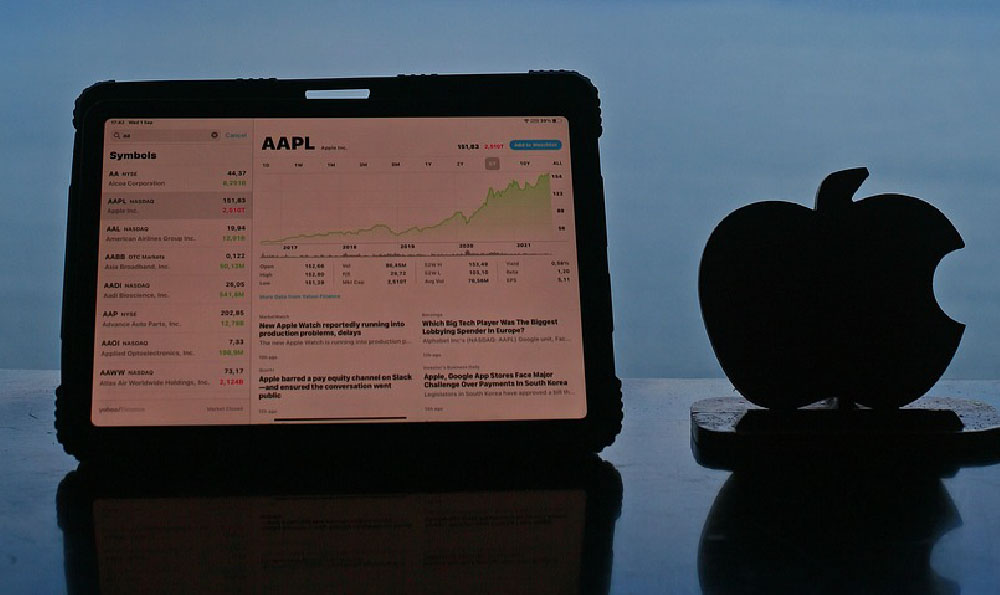

Now, let's talk about the ingredients, the actual investments. Stocks, or equities, represent ownership in a company. They offer the potential for high returns but also come with higher volatility. Bonds are essentially loans to governments or corporations. They are generally considered less risky than stocks and provide a fixed income stream. Real estate involves investing in physical properties, which can generate rental income and appreciate in value. However, it's less liquid than stocks and bonds and requires significant capital. Alternative investments, such as private equity, hedge funds, or commodities, can provide diversification and potentially higher returns, but they are often illiquid, complex, and require specialized knowledge.

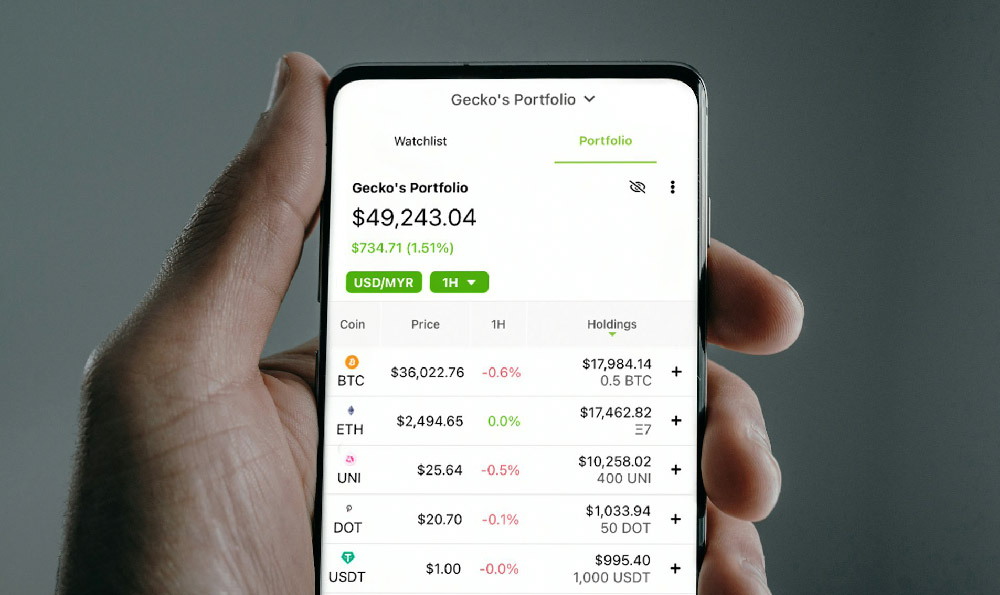

The crucial element in crafting your "money pizza" is asset allocation. This refers to the distribution of your investments across different asset classes. A common starting point is a diversified portfolio of stocks and bonds. The specific allocation will depend on your risk tolerance and time horizon. For example, a young investor with a long time horizon might allocate a larger portion of their portfolio to stocks, while a retiree might favor bonds for stability and income.

Beyond stocks and bonds, consider adding other ingredients to diversify your portfolio further. Real estate can provide a hedge against inflation and generate rental income. International stocks offer exposure to different economies and growth opportunities. Commodities, like gold and silver, can act as a safe haven during times of economic uncertainty.

Rebalancing your portfolio is like ensuring your pizza is perfectly cooked. Over time, your asset allocation will drift away from your target due to market fluctuations. Rebalancing involves selling some of the overperforming assets and buying more of the underperforming ones to bring your portfolio back to its original allocation. This helps maintain your desired risk profile and potentially enhance returns.

Just as a pizza chef carefully selects the freshest ingredients, you should conduct thorough research before investing in any asset. Understand the risks and potential returns of each investment. Don't rely solely on recommendations from friends or family. Consult with a qualified financial advisor who can help you develop a personalized investment strategy tailored to your specific needs and goals.

Beware of "gimmick" investments that promise unusually high returns with little risk. These are often too good to be true and can lead to significant losses. Just like a pizza with bizarre or untested toppings, these investments can leave a bad taste in your mouth. Stick to well-established asset classes and reputable investment firms.

Finally, remember that investing is a long-term game. There will be ups and downs along the way. Don't get discouraged by short-term market fluctuations. Stay focused on your long-term goals and stick to your investment plan. By carefully crafting your "money pizza" with a diversified portfolio, regular rebalancing, and a long-term perspective, you can increase your chances of achieving financial success. The key is to be patient, disciplined, and informed. A well-crafted investment strategy, like a perfectly made pizza, can be both satisfying and rewarding. And while the concept of a "money pizza" might seem like a gimmick, the underlying principles of diversification and asset allocation are essential for building a strong financial foundation. It's not just about the ingredients, but how they are combined and managed over time that truly matters. So, choose your toppings wisely, and enjoy the delicious journey to financial well-being!