Day trading, the practice of buying and selling financial instruments within the same trading day, offers the tantalizing prospect of rapid profits. However, understanding the true profit potential requires a realistic assessment of its inherent risks, necessary skills, and the capital required to participate effectively. While stories of overnight fortunes abound, the reality is that consistent profitability in day trading is rare and demands significant dedication and expertise.

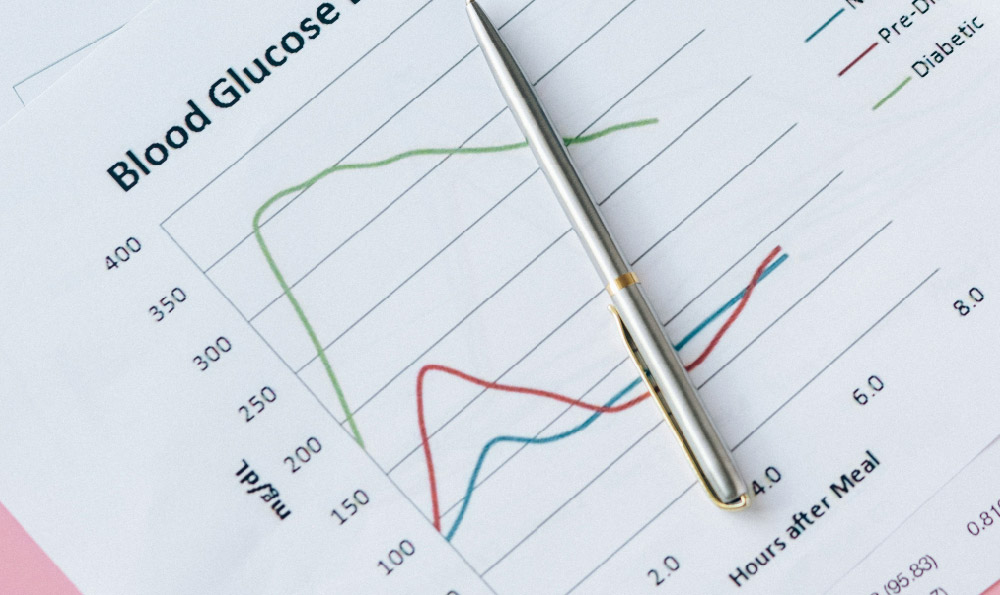

To even begin discussing profit potential, we must first acknowledge the diverse range of factors that influence a day trader's success. The market itself plays a crucial role. Volatile markets, characterized by significant price swings, present more opportunities for short-term gains. However, volatility also amplifies the risk of losses. Conversely, quiet, stable markets offer fewer opportunities and may require more sophisticated strategies to extract profits. The specific asset being traded also matters significantly. Highly liquid assets like major currency pairs (EUR/USD, GBP/USD), popular stocks, and widely traded commodities generally offer tighter spreads (the difference between the buying and selling price), making it easier to enter and exit positions quickly. Illiquid assets, on the other hand, can be difficult to trade efficiently due to wider spreads and potential slippage (the difference between the expected price and the actual price at which the trade is executed).

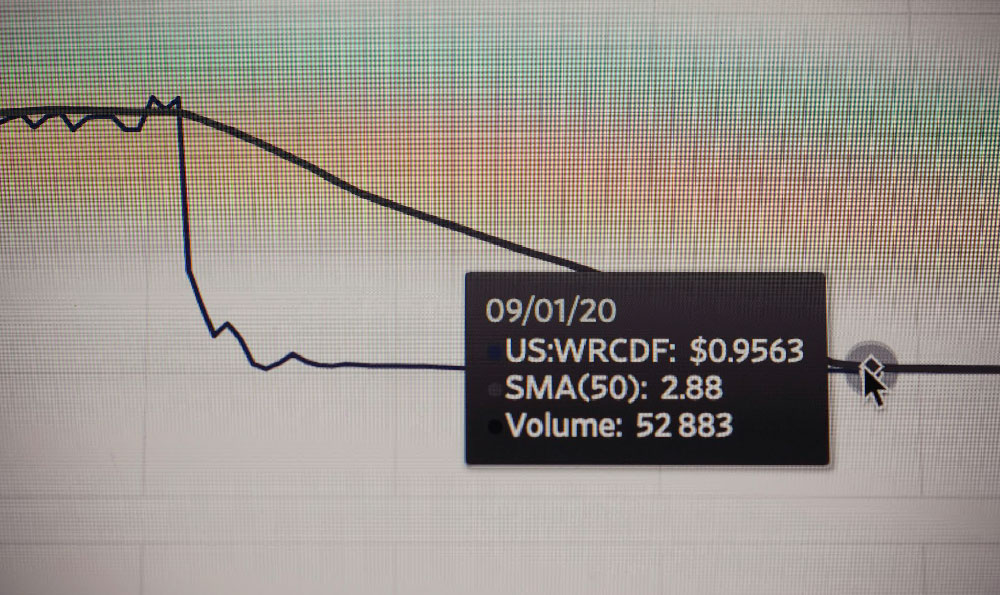

Beyond market conditions, the trader's skill and strategy are paramount. A successful day trader needs a deep understanding of technical analysis, which involves studying price charts and indicators to identify patterns and predict future price movements. This includes familiarity with various chart patterns (e.g., head and shoulders, double tops, triangles), candlestick patterns (e.g., doji, engulfing patterns), and technical indicators (e.g., moving averages, RSI, MACD). Mastering these tools allows a trader to identify potential entry and exit points for trades. However, technical analysis is not a foolproof method. It's essential to combine it with fundamental analysis, which involves understanding the underlying economic factors that influence asset prices. For stocks, this might involve analyzing company earnings reports, industry trends, and macroeconomic data. For currencies, it might involve monitoring interest rate decisions, inflation data, and political events.

Risk management is arguably the most critical skill for a day trader. The potential for rapid gains is matched by the potential for rapid losses. Without a robust risk management strategy, a single losing trade can wipe out days or even weeks of profits. Key risk management techniques include setting stop-loss orders, which automatically close a position if the price moves against the trader beyond a predetermined level. This limits potential losses on any given trade. Position sizing is also crucial. Traders should only risk a small percentage of their capital on each trade, typically 1-2%. This prevents any single trade from having a devastating impact on their overall account. Furthermore, traders should avoid over-leveraging their accounts. Leverage allows traders to control a larger position with a smaller amount of capital, but it also magnifies both profits and losses. While leverage can increase profit potential, it also significantly increases the risk of ruin.

Capital is another essential factor to consider. Day trading typically requires a larger amount of capital than longer-term investment strategies. This is because day traders need to be able to withstand intraday price fluctuations and maintain sufficient margin to cover potential losses. Furthermore, certain regulatory bodies, such as the Financial Industry Regulatory Authority (FINRA) in the United States, have minimum account requirements for day traders. Often referred to as the "pattern day trader" rule, it requires traders who execute four or more day trades within a five-business-day period to maintain a minimum equity balance of $25,000 in their account. Meeting this requirement is crucial for those who plan to day trade frequently.

So, what's the actual profit potential? It's difficult to provide a precise number, as it varies widely depending on the factors discussed above. Some experienced and skilled day traders can consistently generate profits of 1-5% per month on their capital. However, this requires significant dedication, discipline, and a deep understanding of the markets. Many aspiring day traders lose money, especially in the initial stages of their trading journey. Studies have shown that a significant percentage of day traders are unprofitable, and a small percentage account for the majority of the profits. The reality is that day trading is a challenging profession that requires ongoing learning and adaptation.

Furthermore, it's important to factor in transaction costs, such as commissions and spreads, which can eat into profits, especially for high-frequency traders. These costs can vary depending on the broker and the assets being traded. Finally, taxes can also significantly impact the profitability of day trading. Short-term capital gains, which are profits from assets held for less than a year, are typically taxed at a higher rate than long-term capital gains. Therefore, it's essential to understand the tax implications of day trading and to factor them into your profit calculations.

In conclusion, while day trading offers the potential for significant profits, it's not a get-rich-quick scheme. It requires a combination of skill, discipline, risk management, and sufficient capital. The profit potential is highly variable and depends on individual circumstances, market conditions, and trading strategies. Aspiring day traders should approach it with caution, invest time in learning the ropes, and be prepared to experience losses along the way. It’s prudent to start with a demo account to practice strategies and understand the market dynamics before risking real capital. Remember that consistent profitability in day trading is a marathon, not a sprint, and requires a long-term commitment to learning and improvement.