Okay, here's an article exploring life insurance as an investment vehicle, digging into its potential and pitfalls, and offering alternative strategies for wealth building.

Life insurance: a cornerstone of financial planning, or a cleverly disguised cost center? The answer, as with most things financial, lies in understanding its true purpose, the specific product in question, and your individual circumstances. For many, the term "life insurance" conjures up images of protecting loved ones from financial hardship in the event of premature death. This is, indeed, the primary and most crucial function of term life insurance. However, the allure of "making money" from life insurance often points to permanent life insurance policies, such as whole life or universal life, which incorporate a cash value component.

These permanent policies present themselves as a dual-purpose instrument: providing death benefit protection while simultaneously building a cash value that grows over time, often on a tax-deferred basis. The sales pitch frequently emphasizes the potential for using this cash value as a loan, a source of retirement income, or even a vehicle for arbitrage opportunities. This is where the "illusion" can creep in.

The core issue is the cost. Permanent life insurance policies carry significantly higher premiums than term life insurance. A substantial portion of those premiums goes towards covering the insurance company's expenses, commissions, and the underlying cost of providing the death benefit. While the cash value does grow, it often grows at a relatively slow rate, especially in the early years. This slow growth is further hampered by surrender charges, which can be quite substantial if you decide to cancel the policy within the first few years. These surrender charges effectively lock in your investment, making it difficult to access your money without incurring a significant penalty.

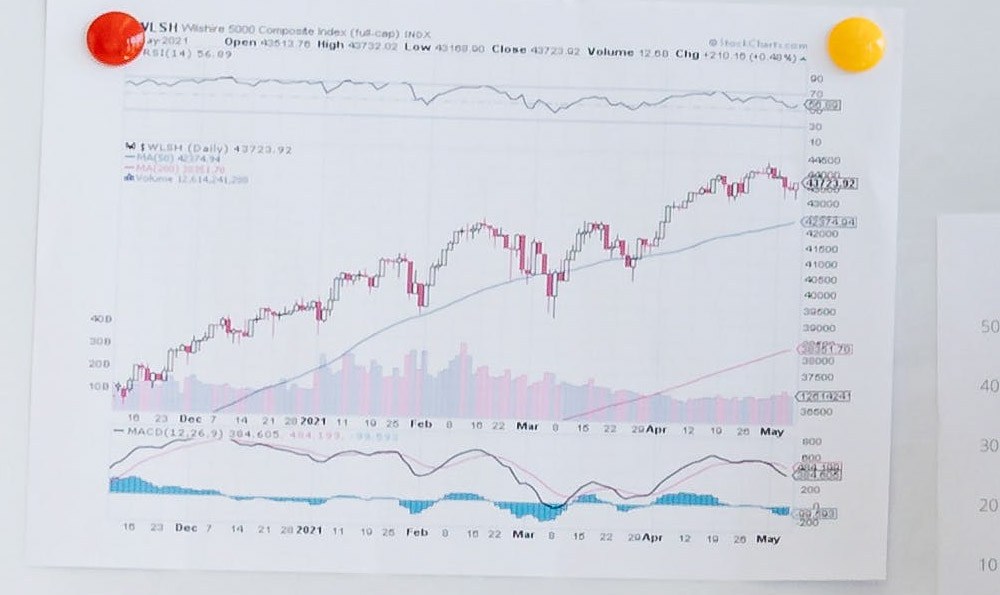

Comparing the returns on a permanent life insurance policy to alternative investment options, such as index funds or real estate, often reveals a stark difference. Over the long term, diversified investments in the stock market historically outperform the cash value growth of most life insurance policies. The "tax advantages" often touted are only advantageous if you hold the policy for a very long time and utilize the cash value through loans, which can be complex and have their own set of risks.

The complexity of permanent life insurance policies is another factor contributing to the "illusion." The policy documents can be dense and difficult to understand, making it challenging to assess the true costs and potential benefits. Sales agents often highlight the positive aspects while downplaying the drawbacks, making it crucial to conduct thorough research and seek independent financial advice.

So, how can you realistically make money in the realm of life insurance, or rather, how can you leverage its benefits without falling for the "illusion"? The key lies in separating the insurance aspect from the investment aspect.

Prioritize Term Life Insurance for Protection: If your primary goal is to protect your family from financial hardship in the event of your death, term life insurance is generally the most cost-effective solution. It provides a death benefit for a specified period (e.g., 10, 20, or 30 years) at a much lower premium than permanent life insurance. This allows you to allocate the money you save on premiums towards more lucrative investment opportunities.

Invest Separately and Strategically: Instead of relying on the cash value of a permanent life insurance policy, invest the difference in premiums between term and permanent life insurance in a diversified portfolio of stocks, bonds, and other assets. This approach offers the potential for significantly higher returns and greater flexibility in accessing your money. Consider utilizing tax-advantaged accounts like 401(k)s, Roth IRAs, or Health Savings Accounts (HSAs) to further enhance your investment returns.

Consider Whole Life as part of a broader Estate Planning strategy (for high net worth individuals): While not generally a good "investment" for the average individual, for high-net-worth individuals with complex estate planning needs, whole life insurance can sometimes play a specific role. Specifically, it can be used to cover estate taxes or to efficiently transfer wealth to future generations. However, this should be considered only after exhausting other tax-advantaged strategies and with the guidance of a qualified estate planning attorney and financial advisor.

Understand the Underlying Risks: Before investing in any life insurance policy, carefully review the policy documents, understand the fees and surrender charges, and compare the potential returns to alternative investment options. Seek independent advice from a fee-only financial advisor who can provide objective guidance based on your individual circumstances.

Arbitrage and Advanced Strategies (Proceed with Extreme Caution): The idea of using life insurance for arbitrage, such as borrowing against the cash value at a low interest rate and investing the borrowed funds in higher-yielding assets, is often promoted as a sophisticated wealth-building strategy. However, this approach is highly complex and carries significant risks, including interest rate risk, market risk, and the risk of losing your life insurance coverage if you are unable to repay the loan. This strategy is generally not suitable for novice investors.

In conclusion, life insurance is primarily a tool for risk management and financial protection. While permanent life insurance policies offer a cash value component, they are often not the most efficient or effective way to build wealth. By separating the insurance aspect from the investment aspect and focusing on a diversified investment strategy, you can maximize your returns and achieve your financial goals more effectively. The key is to approach life insurance with a clear understanding of its purpose and potential pitfalls, and to make informed decisions based on your individual needs and circumstances. Don't let the allure of "making money" cloud your judgment; instead, focus on building a solid financial foundation based on sound investment principles.