Okay, I understand. Here's an article based on the title "Cash App Riches: Can You Really Make Money & How?", written from the perspective of a seasoned investment and financial expert, aiming for a minimum of 800 words and avoiding a point-by-point structure and numbered lists.

Cash App has undeniably revolutionized the way we handle everyday transactions. From splitting dinner bills to sending birthday gifts, its user-friendly interface and instant transfer capabilities have made it a ubiquitous presence in the digital finance landscape. However, the question arises: can this convenient app truly be a vehicle for wealth creation, a path towards "Cash App Riches"? The answer, as with most financial endeavors, is nuanced.

While Cash App wasn't primarily designed as an investment platform, it does offer features that can be leveraged for financial gain. Understanding these features and employing them strategically is key to determining if "Cash App Riches" is a realistic goal. Let’s delve deeper into the app's capabilities and explore the potential, and the limitations, they present.

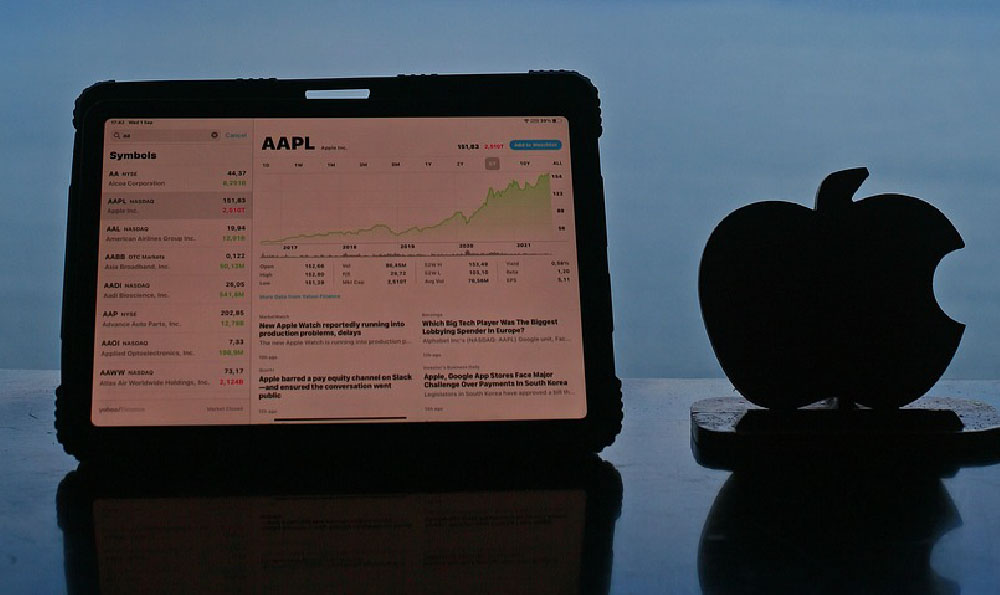

One of the most direct ways Cash App can contribute to wealth accumulation is through its built-in investment features. Users can purchase fractional shares of stocks and invest in Bitcoin directly within the app. This democratizes access to the stock market, allowing individuals with even limited capital to participate in the potential growth of publicly traded companies. Furthermore, exposure to Bitcoin, while inherently volatile, provides an avenue for participating in the cryptocurrency market, known for its rapid fluctuations and potential for significant returns.

However, it's crucial to approach these investment options with a clear understanding of risk. The stock market, while historically a reliable source of long-term growth, is subject to market corrections and economic downturns. Investing without proper research and a well-defined strategy is akin to gambling. Similarly, Bitcoin's volatility means that losses can be substantial and rapid. Diversification, a cornerstone of sound investment practices, is difficult to achieve with limited capital and the relatively restricted investment options available within Cash App. Building a truly diversified portfolio requires exploring a broader range of assets, including bonds, real estate, and potentially alternative investments.

Beyond direct investment, Cash App can facilitate other income-generating activities. For example, individuals can use the app to receive payments for freelance work, side hustles, or small business ventures. The ease of receiving funds through Cash App streamlines the payment process, allowing entrepreneurs to focus on their core business operations rather than chasing invoices. Furthermore, the ability to instantly transfer funds to a bank account provides immediate access to earned income, enabling quick reinvestment into the business or personal savings.

However, it’s important to remember that relying solely on Cash App for business transactions can create vulnerabilities. Cash App is primarily intended for personal use, and while it accommodates small business transactions, it may lack the sophisticated accounting and reporting features offered by dedicated business banking solutions. Furthermore, relying on Cash App's payment processing may expose businesses to potential disruptions if the platform experiences technical issues or changes its terms of service.

Another potential, albeit less direct, path to "Cash App Riches" lies in its use as a budgeting and savings tool. By meticulously tracking income and expenses through Cash App, users can gain a clearer understanding of their financial habits and identify areas where they can cut spending and increase savings. The app's instant transfer capabilities can also be leveraged to automate savings contributions, diverting a portion of each paycheck or windfall directly into a separate savings account. Over time, even small, consistent savings contributions can accumulate into a substantial sum, providing a foundation for future investments and financial security.

The "Cash App Card" is another interesting component. By using the debit card linked to your Cash App balance wisely, you can potentially benefit from rewards or discounts offered by participating merchants. While the rewards are unlikely to be substantial, every penny saved contributes to overall financial well-being. However, it's crucial to avoid overspending or racking up unnecessary debt simply to earn rewards. The allure of "Cash App Riches" shouldn't tempt you into making impulsive purchases that undermine your financial goals.

Furthermore, one must be wary of scams and fraudulent schemes that often target Cash App users. These scams range from fake giveaways to requests for "urgent" payments, often exploiting users' desire for quick financial gain. Protecting oneself from these scams requires vigilance, skepticism, and a refusal to engage with unsolicited requests for money. Always verify the identity of individuals requesting payments and never share sensitive information such as your PIN or password.

In conclusion, while Cash App offers tools and features that can contribute to wealth creation, it's not a magic bullet for achieving "Cash App Riches." The app's investment options are limited, and relying on it as a primary business platform can create vulnerabilities. The true potential of Cash App lies in its ability to facilitate budgeting, savings, and efficient payment processing. When used responsibly and strategically, Cash App can be a valuable tool for managing finances and building a solid foundation for future financial success. However, achieving true "Cash App Riches" requires a broader understanding of investment principles, a diversified approach to wealth building, and a healthy dose of skepticism. The app is a tool, not a shortcut, and its effectiveness is ultimately determined by the user's financial knowledge and discipline. Focusing on long-term financial literacy and responsible decision-making will always be a more sustainable and reliable path to wealth creation than chasing after fleeting promises of "Cash App Riches." The real riches lie in informed decisions and consistent effort.