The concept of money as a medium to achieve happiness has sparked endless debate across cultures and disciplines. While financial resources undeniably shape quality of life, their impact on lasting fulfillment is far more complex than a simple equation. From the materialistic allure of wealth accumulation to the psychological effects of financial autonomy, the relationship between wealth and well-being reflects a spectrum of human motivations and societal influences.

Economic stability often acts as a cornerstone for life satisfaction. Research from the World Happiness Report consistently highlights that access to basic necessities—such as healthcare, education, and shelter—creates a foundation for contentment. When individuals are free from financial stress, they gain the ability to pursue passions, maintain relationships, and invest in personal growth. A study published in the Journal of Happiness Studies found that individuals in the top quartile of income were more likely to report feeling in control of their lives, a crucial factor in psychological well-being. However, this correlation begins to plateau after a certain threshold, suggesting that beyond meeting fundamental needs, additional wealth may not significantly elevate happiness levels.

The psychological dimension of money extends beyond mere survival. Financial security can reduce anxiety about the future, allowing people to focus on present joys. Yet, this dynamic is often overshadowed by the paradox of wealth accumulation. Many affluent individuals report feeling more stressed and isolated than their less financially stable counterparts, a phenomenon attributed to the increased expectations and pressures associated with higher net worth. The pressure to maintain wealth, outperform peers in financial markets, or meet societal benchmarks can create a cycle of constant comparison, detracting from intrinsic satisfaction.

Social comparison plays a pivotal role in shaping perceptions of wealth and happiness. In a culture that glorifies material success, individuals may equate financial status with self-worth. This mindset often leads to the "hedonic treadmill" effect, where increased wealth temporarily boosts happiness but the gains diminish over time as new desires emerge. A longitudinal study by the University of California found that participants who prioritized wealth over personal relationships experienced declining life satisfaction after five years. Conversely, those who focused on community and experiences reported sustained happiness, highlighting the importance of aligning financial goals with core values.

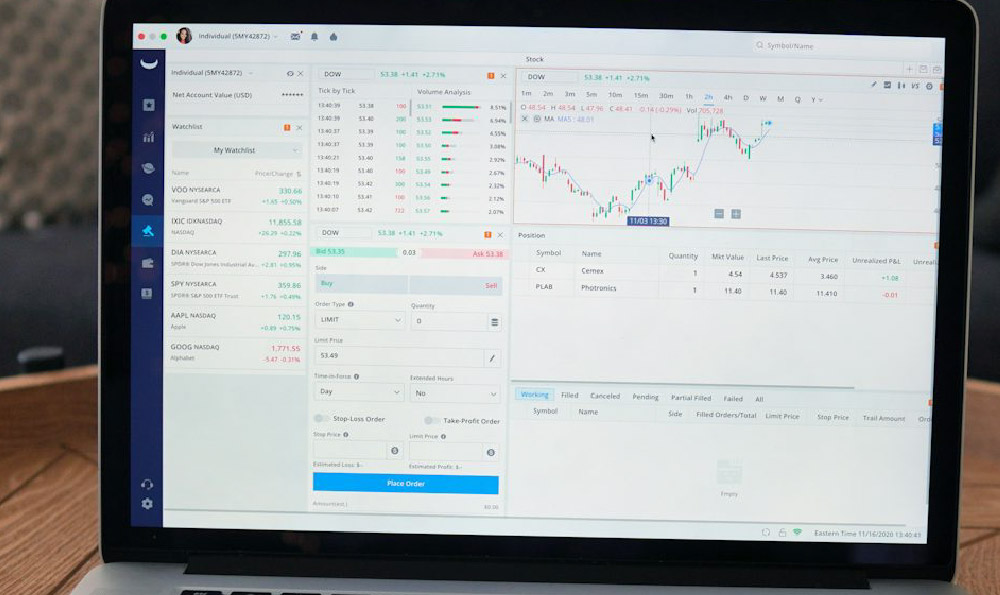

The long-term impact of wealth on happiness is closely tied to financial literacy and future planning. Compound interest, tax optimization, and strategic investments are tools that allow individuals to create lasting wealth without compromising present well-being. A Harvard Business Review analysis revealed that individuals who actively managed their finances to achieve retirement security were more likely to experience peace of mind in their later years. This suggests that the quality of wealth management, rather than the quantity of money, is a key determinant in long-term happiness.

The psychological effects of wealth also depend on how it is acquired and used. Ethical investment practices, such as socially responsible investing or impact investing, have been linked to greater personal fulfillment. When individuals align their financial decisions with ethical values, they create a sense of purpose that transcends mere monetary gain. A study by the University of Cambridge found that investors who prioritized sustainability in their portfolios reported higher levels of satisfaction, even when their returns were slightly lower than traditional investments.

The role of money in happiness is further complicated by cultural attitudes toward wealth. In individualistic societies, financial independence is often seen as a measure of success, while in collectivist cultures, communal wealth sharing is valued more highly. These differences illustrate that happiness is not solely defined by economic indicators but is deeply influenced by social norms and personal values. A comparative study of happiness metrics in various countries showed that while wealth correlated with higher scores in more affluent nations, it had less impact in societies with strong social safety nets.

Ultimately, the pursuit of happiness through wealth requires a balanced approach. Financial resources are necessary for accessing opportunities, but they are not sufficient for achieving lasting well-being. The key lies in understanding how money interacts with other aspects of life, such as relationships, health, and personal fulfillment. By cultivating financial literacy, practicing mindful spending, and prioritizing values that align with happiness, individuals can create a sustainable path to contentment. This perspective emphasizes that while money can be a tool for happiness, its true value lies in how it is used to enhance, rather than replace, the non-material aspects of life.