Generating actual income, earning real money – it's the cornerstone of financial independence and a goal shared by many, regardless of their background or current financial standing. The feasibility of achieving this depends heavily on several factors, including your existing skills, resources, risk tolerance, and, perhaps most importantly, your willingness to learn and adapt. It's not a simple formula, but a multi-faceted approach involving careful assessment and strategic implementation.

One of the most fundamental ways to generate income is through employment. While a traditional 9-to-5 job may seem straightforward, consider exploring different avenues within your field or industry. Are there opportunities for freelancing, contract work, or remote positions? These can often provide greater flexibility and potentially higher earning potential than traditional employment. Building a strong professional network is crucial here. Attend industry events, connect with colleagues on platforms like LinkedIn, and actively seek out opportunities that align with your skills and career goals. Don't underestimate the power of referrals; a strong recommendation from a trusted contact can significantly boost your chances of securing a desirable position. Remember to continuously upskill. The job market is constantly evolving, so staying ahead of the curve by acquiring new knowledge and skills is essential for maintaining your competitive edge and increasing your earning capacity.

Beyond traditional employment, entrepreneurship presents a potentially lucrative, albeit riskier, path to generating income. Starting your own business, whether it's a small online store, a consulting service, or a tech startup, allows you to leverage your passions and expertise to create something of value. However, entrepreneurship requires significant dedication, perseverance, and a well-thought-out business plan. Before taking the plunge, thoroughly research your target market, analyze your competition, and develop a realistic financial projection. Seek mentorship from experienced entrepreneurs and be prepared to adapt your strategy as needed. Funding your venture can be a challenge, so explore various options such as bootstrapping, angel investors, venture capital, or small business loans.

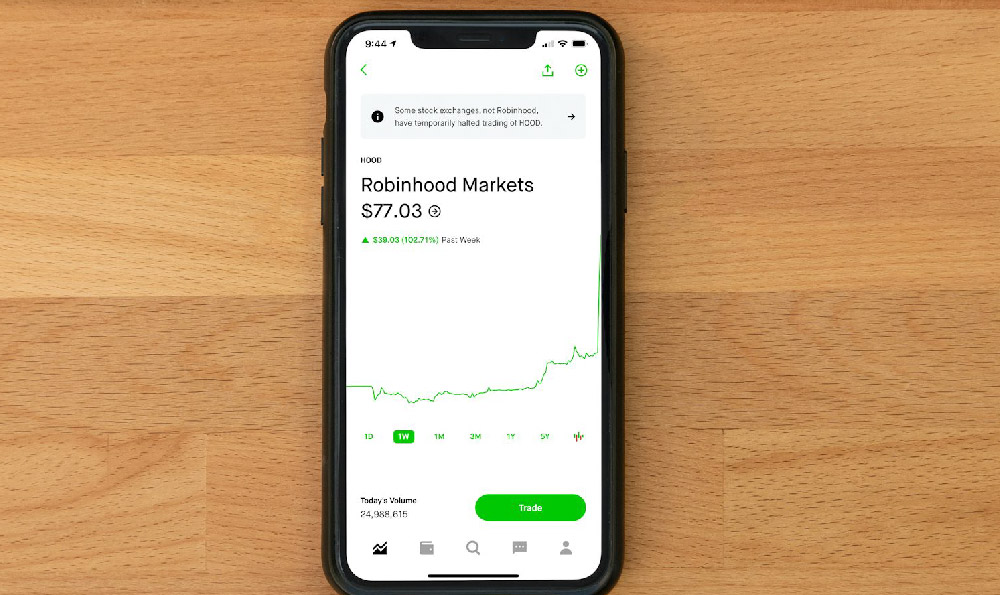

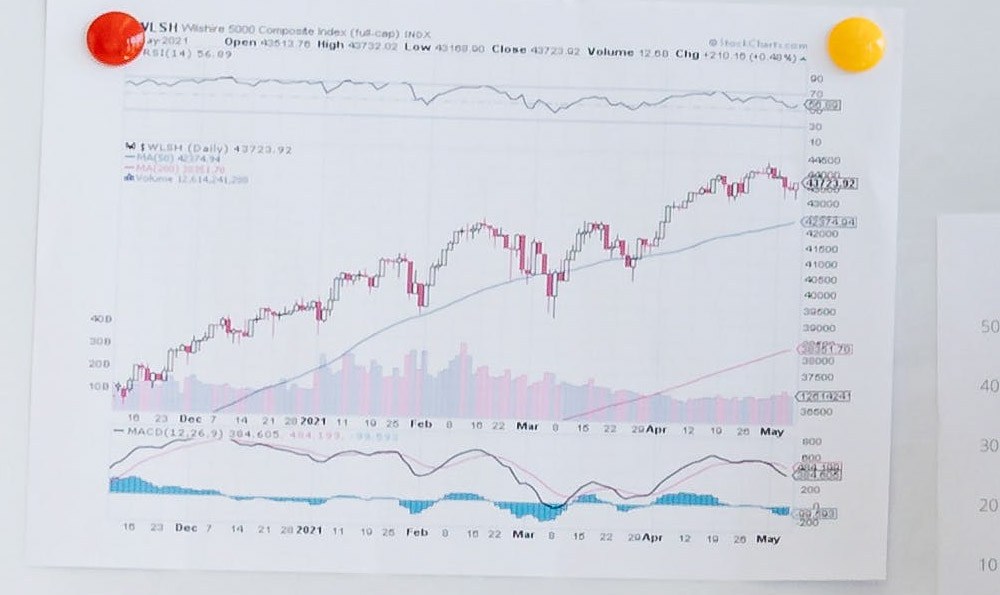

Another powerful way to generate income is through investing. The stock market, while volatile, offers the potential for significant returns over the long term. Diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate, is crucial for mitigating risk. Thoroughly research individual companies and industries before investing, and consider consulting with a financial advisor to develop a personalized investment strategy. Real estate investing can be a source of both rental income and capital appreciation. Consider purchasing a rental property in a desirable location and managing it effectively to maximize your returns. Alternatively, you can invest in real estate investment trusts (REITs), which allow you to participate in the real estate market without the complexities of direct ownership. Remember that all investments carry risk, and it's important to understand your risk tolerance and invest accordingly.

Creating digital content can also lead to income generation. If you have a passion for writing, consider starting a blog or offering freelance writing services. If you're skilled in video editing, create tutorials on YouTube or offer your services to businesses. If you have expertise in a particular subject, create and sell online courses. The key is to create high-quality content that provides value to your audience and attracts a loyal following. Monetizing your content can be achieved through advertising, affiliate marketing, selling digital products, or offering paid subscriptions. Building a strong online presence through social media and search engine optimization (SEO) is crucial for reaching a wider audience and increasing your income potential.

Furthermore, consider leveraging existing assets. Do you have a spare room that you could rent out on Airbnb? Do you have a car that you could use for ride-sharing services? Do you have unused skills or knowledge that you could offer as a consultant or tutor? Monetizing these assets can provide a steady stream of income without requiring significant additional effort. Evaluate your resources and identify opportunities to turn them into income-generating assets.

Developing in-demand skills is also a critical component of earning more money. The tech industry, for instance, is constantly seeking skilled professionals in areas such as software development, data science, and cybersecurity. Investing in training and education to acquire these skills can significantly increase your earning potential. Consider taking online courses, attending workshops, or pursuing a degree in a high-demand field. Networking with professionals in your desired industry can also provide valuable insights and opportunities.

Ultimately, generating actual income is feasible, but it requires a proactive and strategic approach. Evaluate your skills, resources, and risk tolerance, and explore various income-generating opportunities that align with your goals. Continuously learn and adapt to the changing market conditions, and be persistent in your efforts. Building a solid financial foundation takes time and effort, but with dedication and the right strategies, you can achieve your financial goals and build a more secure future. Remember to track your income and expenses, create a budget, and save regularly to maximize your financial well-being.