Investing in a Health Savings Account (HSA) through Fidelity is often touted as a triple-tax-advantaged strategy, but like any investment decision, it requires careful consideration. Before diving into the specifics of how to invest your HSA funds with Fidelity, it's crucial to understand the fundamental benefits of an HSA and why it can be a cornerstone of a sound financial plan.

HSAs offer a unique combination of tax advantages not found in other retirement accounts. Contributions are tax-deductible, meaning they lower your taxable income in the year you make them. The funds grow tax-free, and withdrawals are also tax-free as long as they are used for qualified medical expenses. This trifecta of tax benefits makes HSAs a particularly attractive vehicle for long-term savings, especially for those anticipating significant healthcare costs in retirement.

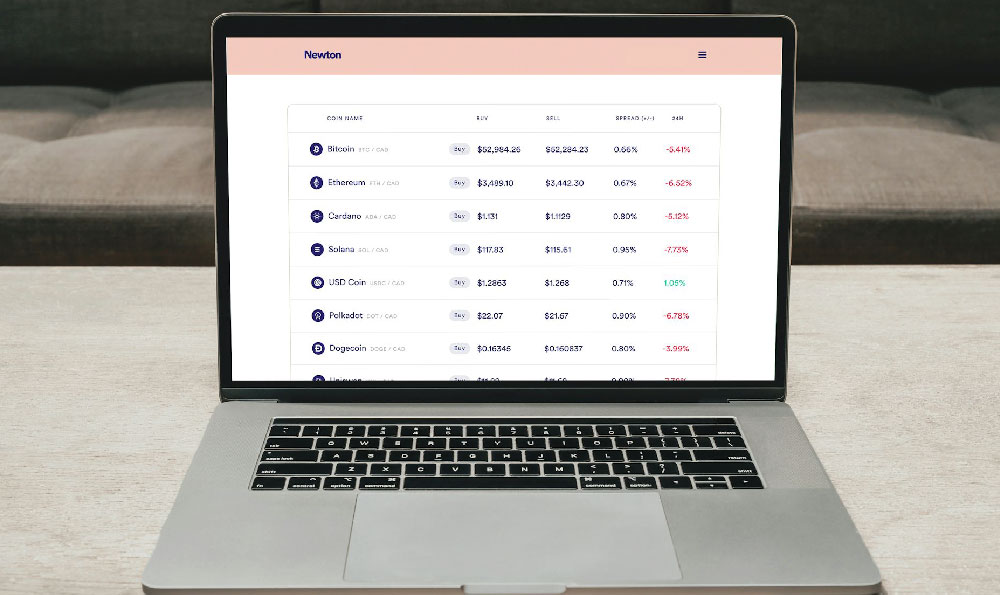

Fidelity, being a reputable and established brokerage firm, provides a robust platform for managing your HSA investments. They offer a wide array of investment options, including stocks, bonds, mutual funds, and ETFs (Exchange Traded Funds). This diversity allows you to tailor your investment strategy to your risk tolerance and time horizon. However, the sheer number of choices can be overwhelming for some, so it’s essential to understand the characteristics of each investment type before committing your funds.

The first step in investing your HSA with Fidelity is to determine your investment goals and risk tolerance. Are you primarily saving for healthcare expenses in the near term, or are you looking to build a long-term retirement nest egg? This will significantly influence your investment choices. If you anticipate needing the funds within the next few years, you might consider a more conservative approach, focusing on bonds or money market funds. These investments offer lower potential returns but also come with less risk.

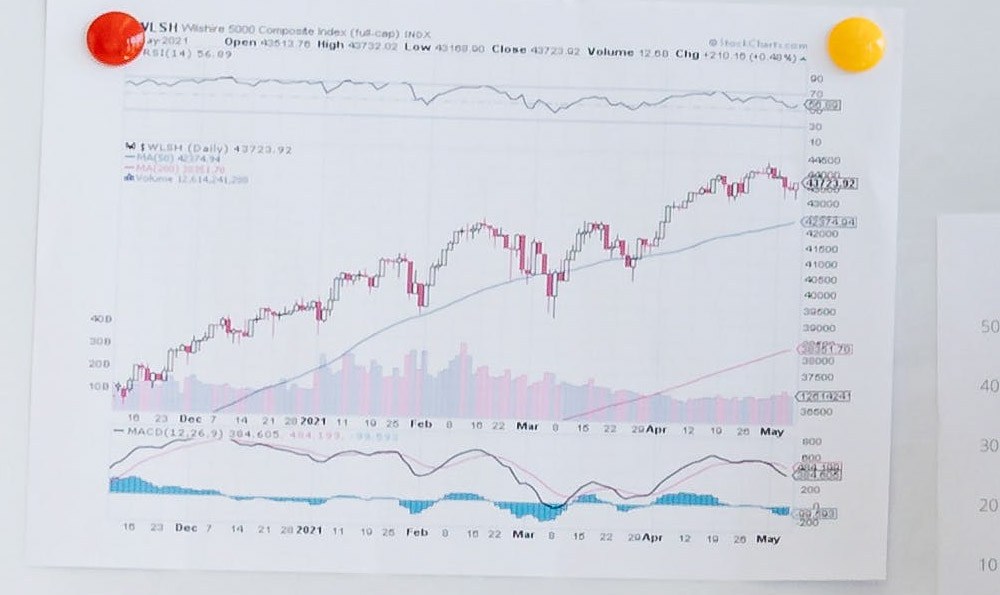

For long-term growth, you might consider investing in a diversified portfolio of stocks and bonds through mutual funds or ETFs. Fidelity offers a variety of index funds and actively managed funds that cater to different investment styles and risk profiles. Index funds, which track a specific market index like the S&P 500, typically have lower expense ratios than actively managed funds. This can translate into higher returns over the long run, as you're not paying for a fund manager's expertise that may or may not outperform the market.

When selecting mutual funds or ETFs, pay close attention to the expense ratio, which is the annual fee charged to manage the fund. A lower expense ratio means more of your investment returns go directly into your pocket. Also, consider the fund's historical performance, but remember that past performance is not necessarily indicative of future results. Look for funds with a consistent track record of solid performance relative to their benchmark index.

Another factor to consider is asset allocation. This refers to the mix of stocks, bonds, and other asset classes in your portfolio. A well-diversified portfolio can help to mitigate risk and improve returns over the long term. Fidelity provides tools and resources to help you determine an appropriate asset allocation based on your risk tolerance and time horizon. For example, they may offer model portfolios that automatically adjust your asset allocation as you approach retirement.

Once you've chosen your investments, you can place your trades through Fidelity's online platform. The platform is user-friendly and provides access to real-time market data and research tools. You can also set up automatic investments to regularly contribute to your HSA and dollar-cost average your investments over time. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price. This can help to reduce the risk of buying high and selling low.

Beyond simply choosing investments, it's essential to actively manage your HSA portfolio. This means regularly reviewing your investment performance and making adjustments as needed. Market conditions change, and your investment goals may evolve over time. It’s prudent to rebalance your portfolio periodically to maintain your desired asset allocation. Rebalancing involves selling some of your winning investments and buying more of your losing investments to bring your portfolio back into alignment.

Fidelity also offers access to financial advisors who can provide personalized investment advice and guidance. If you're unsure about how to invest your HSA or need help developing a financial plan, consider consulting with a financial advisor. They can help you assess your financial situation, identify your goals, and create a customized investment strategy. While there may be fees associated with financial advisory services, the potential benefits of professional guidance can outweigh the costs.

Finally, remember that investing in an HSA is a long-term strategy. Avoid the temptation to make emotional investment decisions based on short-term market fluctuations. Stay disciplined and stick to your investment plan. By carefully considering your investment goals, risk tolerance, and asset allocation, you can maximize the benefits of your HSA and achieve your financial objectives. The triple tax advantage, combined with the robust investment platform offered by Fidelity, makes investing your HSA a potentially smart choice for those seeking to secure their financial future and manage healthcare costs effectively. While it is a smart choice in many instances, the "smartness" ultimately hinges on your own individual financial situation, risk tolerance, and your ability to understand the complexities of the investment options available to you. Seek professional advice if needed, and always do your own thorough research before making any investment decisions.