Investing an inheritance presents a unique opportunity to secure your financial future and potentially grow the wealth you've received. However, it also comes with a significant responsibility to make informed decisions. Approaching this task strategically is crucial to maximizing the benefits and minimizing potential risks.

Understanding Your Financial Landscape Before Investing

Before diving into specific investment options, take a comprehensive look at your overall financial situation. This involves assessing your current financial goals, risk tolerance, existing debts, and time horizon.

-

Define Your Financial Goals: What do you hope to achieve with this inheritance? Are you aiming for long-term growth, generating income, paying off debt, or a combination of these? Clear goals will guide your investment strategy. For example, if your goal is retirement savings, you'll likely opt for a different approach than if you're saving for a down payment on a house in the next few years.

-

Determine Your Risk Tolerance: How comfortable are you with the possibility of losing some of your investment in exchange for potentially higher returns? Risk tolerance is a personal factor influenced by your age, financial stability, and psychological makeup. A younger investor with a longer time horizon might be more comfortable with higher-risk investments, while someone nearing retirement might prefer more conservative options.

-

Assess Existing Debts: High-interest debt, such as credit card debt, can significantly hinder your financial progress. Consider using a portion of your inheritance to pay off these debts before investing, as the interest savings can often outweigh potential investment returns.

-

Consider Your Time Horizon: This refers to the length of time you plan to keep your money invested. A longer time horizon allows you to weather market fluctuations and potentially benefit from long-term growth. Shorter time horizons require more conservative investments to minimize the risk of losses.

Crafting an Investment Strategy Tailored to Your Needs

Once you have a clear understanding of your financial situation, you can begin to develop an investment strategy. This involves deciding how to allocate your assets across different investment classes, such as stocks, bonds, real estate, and alternative investments.

-

Diversification is Key: Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help reduce risk. When one investment performs poorly, others may perform well, offsetting the losses.

-

Consider Tax Implications: Investments are subject to different tax rules. Understanding the tax implications of your investment choices is essential to maximizing your after-tax returns. Consider consulting with a tax advisor to develop a tax-efficient investment strategy.

-

Start Small and Gradually Increase Exposure: If you're new to investing, consider starting with smaller investments and gradually increasing your exposure as you become more comfortable. This allows you to learn the ropes without risking a significant portion of your inheritance.

-

Rebalance Your Portfolio Regularly: Over time, your asset allocation may drift away from your target allocation due to market fluctuations. Rebalancing involves buying and selling assets to bring your portfolio back into alignment with your desired asset allocation.

Exploring Different Investment Options

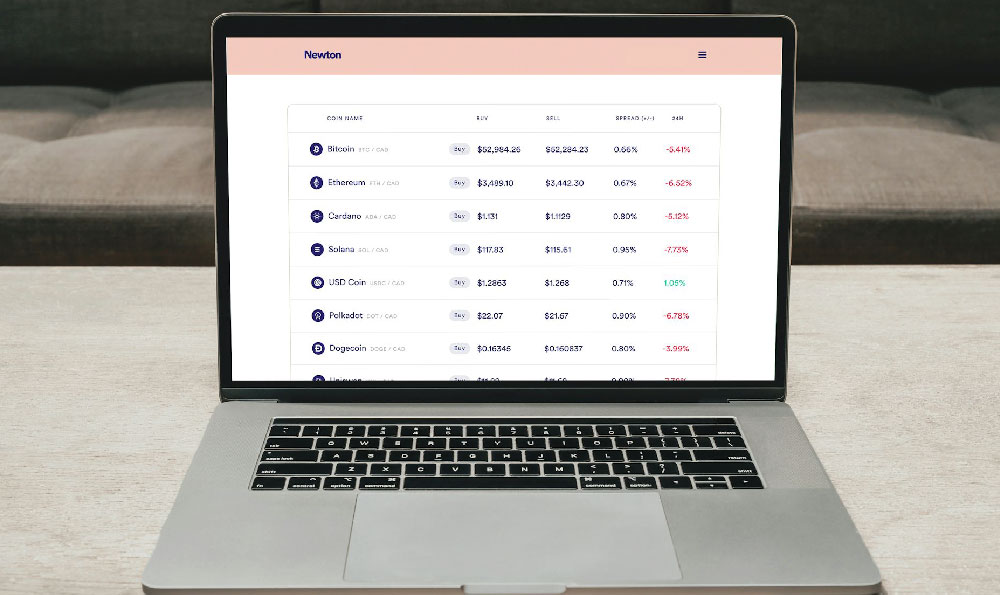

The specific investment options available to you will depend on your individual circumstances and risk tolerance. However, some common options to consider include:

- Stocks: Represent ownership in a company. They offer the potential for high returns but also come with higher risk.

- Bonds: Represent loans to a government or corporation. They typically offer lower returns than stocks but are also less risky.

- Mutual Funds: Pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but trade on stock exchanges like individual stocks.

- Real Estate: Can provide rental income and potential appreciation but requires significant capital and ongoing management.

- Retirement Accounts (401(k)s, IRAs): Offer tax advantages for retirement savings.

- High-Yield Savings Accounts and Certificates of Deposit (CDs): Provide a safe and liquid place to store cash while earning interest.

Seeking Professional Guidance

Investing an inheritance can be complex, and it's often wise to seek professional guidance from a qualified financial advisor. A financial advisor can help you:

- Develop a personalized financial plan: Tailored to your specific goals and circumstances.

- Assess your risk tolerance: And recommend suitable investment options.

- Manage your investments: And rebalance your portfolio regularly.

- Provide ongoing support: And answer your questions.

Avoiding Common Pitfalls

- Making Hasty Decisions: Don't feel pressured to invest immediately. Take your time to research your options and develop a well-thought-out strategy.

- Investing in Things You Don't Understand: Avoid investing in complex or unfamiliar investments that you don't fully understand.

- Chasing High Returns: Be wary of investments that promise unrealistically high returns, as they often come with higher risks.

- Ignoring Fees: Pay attention to the fees associated with different investment options, as they can eat into your returns over time.

- Letting Emotions Guide Your Decisions: Avoid making investment decisions based on fear or greed. Stick to your plan and stay disciplined.

The Importance of Long-Term Perspective

Investing is a long-term game. Don't get discouraged by short-term market fluctuations. Focus on your long-term goals and stick to your investment strategy. Remember that patience and discipline are key to successful investing.

By taking a thoughtful and strategic approach to investing your inheritance, you can make it work for you and secure your financial future. Remember to seek professional guidance when needed and always prioritize your financial well-being.