The Roaring Kitty saga, the moniker under which Keith Gill operated, is a fascinating intersection of internet culture, retail investing, and the complexities of market dynamics. Understanding how he initially made money and the strategy he employed requires delving into his background, investment philosophy, and the specific context of the GameStop phenomenon.

Gill's journey wasn't an overnight success. Prior to his viral fame, he was a chartered financial analyst (CFA) and worked for MassMutual as a financial wellness education director. This background is crucial. It provided him with a deep understanding of financial markets, valuation techniques, and risk management – knowledge that far surpassed the average retail investor. He wasn’t simply throwing darts at a stock ticker; his investment decisions were rooted in fundamental analysis.

His initial wealth generation wasn't directly tied to GameStop. He had been investing in the stock market for years, employing a value investing approach. This meant he sought out companies that he believed were undervalued by the market. He meticulously analyzed financial statements, assessed competitive landscapes, and considered macroeconomic factors to identify stocks trading below their intrinsic worth. While specific details of his early portfolio are less documented, it's safe to assume that he applied the same rigorous analysis that later defined his GameStop investment. His initial strategy revolved around finding these undervalued opportunities and holding them for the long term, allowing the market to eventually recognize their true potential. He publicly documented some of his early investments, providing insights into his analytical process and demonstrating his commitment to transparency, which would later prove pivotal in building his online following.

The GameStop situation became unique. Gill’s initial interest in GameStop stemmed from the same value investing principles. He saw a company, battered by the rise of digital downloads and facing skepticism from Wall Street, that he believed possessed inherent value. He recognized that GameStop still held a significant market share in the physical video game retail space, had a recognizable brand, and possessed valuable real estate assets. He also noted that the company was undergoing a transformation, attempting to adapt to the changing landscape by expanding into e-commerce and other related ventures.

However, what distinguished Gill’s investment in GameStop from his previous investments was the added layer of a potential short squeeze. He observed that the stock was heavily shorted by institutional investors, meaning a large percentage of the outstanding shares were being borrowed and sold with the expectation that the price would decline. He reasoned that if positive news or increased buying pressure were to emerge, these short sellers would be forced to cover their positions by buying back the shares, driving the price even higher. This potential for a short squeeze became a critical element of his investment thesis.

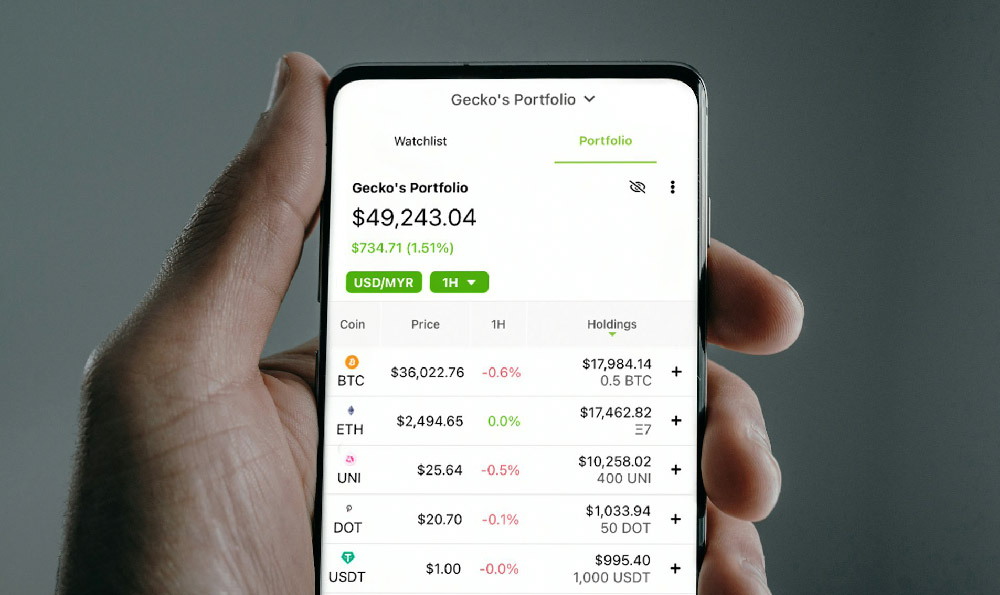

His strategy then morphed from pure value investing into a blend of value and speculative trading, fueled by the possibility of exploiting the heavily shorted position of the stock. He began sharing his research and investment thesis on Reddit forum r/wallstreetbets, posting screenshots of his positions and providing detailed explanations of his analysis. This is where the “Roaring Kitty” persona truly took flight. His genuine enthusiasm, coupled with his meticulous research and transparent approach, resonated with other retail investors. He wasn't presenting himself as a guru; he was sharing his personal investment journey, warts and all.

His consistent updates, including both gains and losses (though primarily gains, naturally attracting attention), built trust and a sense of camaraderie within the online community. He used humor and relatable language, further amplifying his message and attracting a wider audience. He streamed live on YouTube, where he provided further analysis and answered questions from viewers. This direct engagement was unprecedented and fostered a strong sense of community among his followers.

It's important to note that while the potential short squeeze played a significant role in the GameStop saga, Gill consistently emphasized that he believed in the long-term potential of the company. He argued that even without the short squeeze, GameStop's intrinsic value justified a higher stock price. This nuanced perspective helped to differentiate him from those who were simply chasing a quick profit. He repeatedly stated that he was not advising anyone to buy the stock, but simply sharing his own investment journey.

His strategy, therefore, involved a combination of deep fundamental research, recognizing the potential for a short squeeze, transparently sharing his investment journey online, and fostering a sense of community. He used his financial expertise to identify an undervalued stock, understood the dynamics of short selling, and leveraged the power of social media to build a following and amplify his message. The financial gains he realized stemmed from a combination of shrewd analysis, fortuitous timing, and the collective action of retail investors who rallied behind his vision. While the Roaring Kitty phenomenon became synonymous with the GameStop short squeeze, understanding his initial strategy reveals a more complex and nuanced approach to investing than simple meme stock hype. It was a confluence of financial knowledge, strategic execution, and the harnessing of the power of online communities.