Investing in the financial markets has always been a balancing act between potential profits and inherent risks. For those seeking to maximize earnings, the key lies not just in identifying lucrative opportunities but in mastering the psychological, technical, and strategic elements that define successful trading. The most profitable trades often emerge from a combination of timing, market understanding, and disciplined execution, yet they remain elusive for many who chase quick wins without a solid framework. To navigate this landscape effectively, traders must first recognize that profitability isn’t solely about selecting the right assets but about cultivating a mindset that prioritizes patience, adaptability, and risk mitigation.

One of the defining characteristics of high-profit trades is their ability to leverage market volatility. While volatility is often viewed as a threat, it can also be a conduit for opportunity if analyzed correctly. For example, stocks of undervalued companies may experience sharp rebounds during economic downturns or sector corrections, but these gains are contingent on timing the entry and exit strategically. Similarly, forex markets offer potential for profit through currency pairs that react to geopolitical events, interest rate differentials, or macroeconomic indicators. A trader with a keen eye for these dynamics might capitalize on sudden shifts in the market, such as the overnight reversal of a currency due to unexpected central bank announcements, by employing tight stop-loss orders and multi-timeframe analysis.

Another critical factor is the role of technical analysis in uncovering patterns that precede significant price movements. Many traders focus on candlestick formations, support and resistance levels, or momentum indicators to predict market behavior. For instance, a breakout from a long-established consolidation pattern often signals a shift in sentiment, which can be exploited by those who recognize the psychological pressures driving such moves. Moreover, identifying key Fibonacci retracement levels or volume spikes can provide insights into potential turning points in a trade. However, technical signals are not infallible, and their success depends on contextual awareness—understanding how broader market trends, such as a bull or bear phase, influence individual assets.

The profitability of a trade is also closely tied to the execution of risk management principles. Even the most promising opportunities can turn into losses if not approached with a clear plan. Traders who prioritize proper position sizing, diversification, and emotional control are more likely to sustain long-term profitability. For example, allocating no more than 2% of a portfolio to any single trade can protect against catastrophic losses, while a diversified portfolio across multiple asset classes reduces exposure to sector-specific risks. Additionally, using tools like trailing stops or hedging strategies can help lock in profits or limit downside risks, depending on the market conditions.

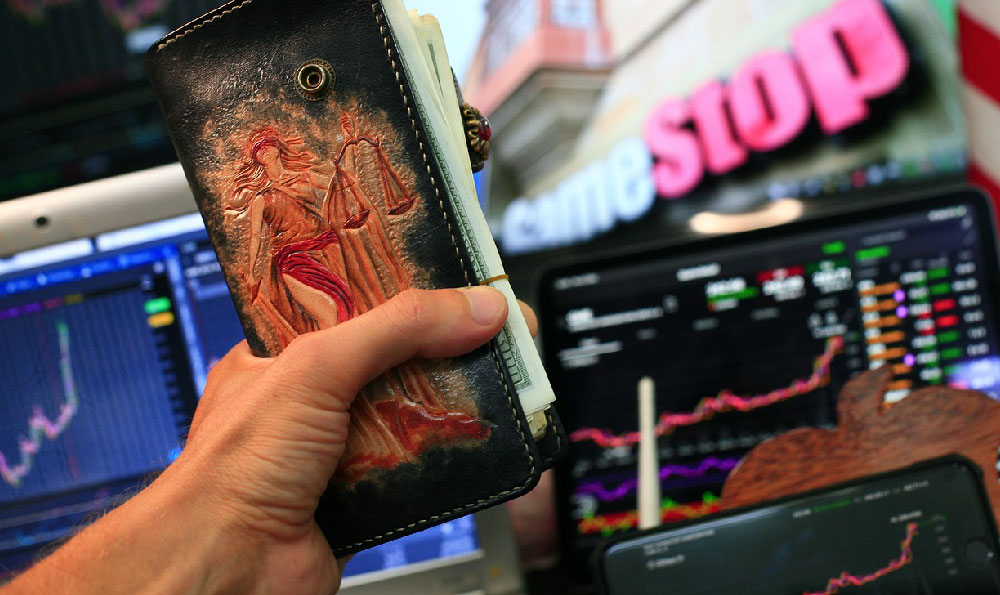

Market sentiment and behavioral economics play a crucial role in shaping profit potential. Understanding the psychology of investors—whether it’s fear during market declines or greed during bullish phases—can help identify mispricings that offer high returns. For instance, during a market crash, oversold assets like blue-chip stocks or ETFs may present opportunities for contrarian traders who recognize the imbalance between supply and demand. Conversely, retail investors often overreact to news, creating short-lived bubbles that can be exploited by those with the patience to wait for corrections. The ability to gauge sentiment through tools like social media analytics, retail trading volume, or retail investor behavior reports can provide a competitive edge.

Ultimately, the most profitable trades are not about luck but about systematically exploiting market inefficiencies. This requires continuous learning, adaptability, and a focus on edge-building strategies. For example, algorithmic trading models can capitalize on high-frequency market movements that are imperceptible to human traders, while fundamental analysis can uncover undervalued assets with strong growth potential. However, success in any strategy is contingent on execution—whether it’s adhering to a strict trading plan, maintaining emotional discipline, or staying informed about global economic shifts. Traders who approach the markets with a clear objective, whether to generate consistent income or achieve wealth accumulation, will find that profitability is a function of both knowledge and action.

In the pursuit of maximum earnings, it’s essential to recognize that no single strategy guarantees success. The most profitable trades often emerge from a unique blend of skills, including pattern recognition, risk assessment, and market timing. By focusing on high-probability setups—such as trending markets, news-driven events, or institutional activity traders can align their trades with the broader flow of capital. For instance, tracking the movement of large institutional investors in specific stocks or sectors can reveal potential entry points that are more likely to generate substantial returns. This approach blends quantitative data with qualitative insights, allowing traders to make more informed decisions.

The secret to profitable trading lies in the ability to adapt to changing conditions while maintaining a clear framework. Whether it’s adjusting strategies in response to a market shift, refining technical indicators, or re-evaluating risk management rules, flexibility is key. For example, a trader who shifts from long-term holding to short-term swing trading in response to a bear market may capitalize on market rebounds more effectively. Conversely, those who cling to a single approach may miss opportunities or suffer from overexposure to a declining market. The most profitable trades often require a blend of persistence and pragmatism, as well as the ability to evolve with the market’s rhythm.

While the allure of quick profits can be tempting, the most sustainable earnings often come from a long-term perspective. Building wealth through compounding requires a combination of high-yield opportunities and disciplined reinvestment. For instance, investors who focus on dividend-paying stocks or real estate investment trusts (REITs) may benefit from steady income streams that grow over time. Additionally, those who employ a buy-and-hold strategy while periodically rebalancing their portfolios can mitigate risks while maximizing returns from long-term appreciation. The path to maximum earnings is rarely straight, but it’s often more rewarding when approached with a strategic, goal-oriented mindset.