The allure of accumulating wealth, particularly the prospect of achieving riches with minimal initial investment, has captivated individuals across generations. While the notion of instant riches often proves elusive, a disciplined and strategic approach, combined with a keen understanding of financial markets, can pave the way for substantial wealth creation, even starting from a position of limited resources. Let’s delve into the possibilities and strategies for embarking on this challenging yet potentially rewarding journey, focusing specifically on the potential role of cryptocurrency.

The first step is fundamentally about acquiring knowledge. In today's digital age, access to information is readily available. Anyone can learn about investing in cryptocurrency through online courses, articles, and even by following reputable analysts and commentators. Understand the technology behind blockchain, the differences between various cryptocurrencies (Bitcoin, Ethereum, Altcoins), and the factors that influence their prices. This involves dedicating time to research, reading whitepapers, and staying abreast of the latest industry developments. Knowledge serves as the bedrock for informed decision-making, mitigating risk and maximizing opportunities.

One of the most effective strategies for building wealth from a small base is through diligent saving and strategic investment. Start by creating a budget that meticulously tracks income and expenses. Identify areas where spending can be reduced or eliminated to free up capital for investment. Even small amounts, when consistently saved and strategically deployed, can compound significantly over time. Consider setting up automated transfers to a separate investment account to ensure consistent savings. The power of compound interest is a cornerstone of long-term wealth creation. The earlier you start, the more pronounced the effect of compounding becomes.

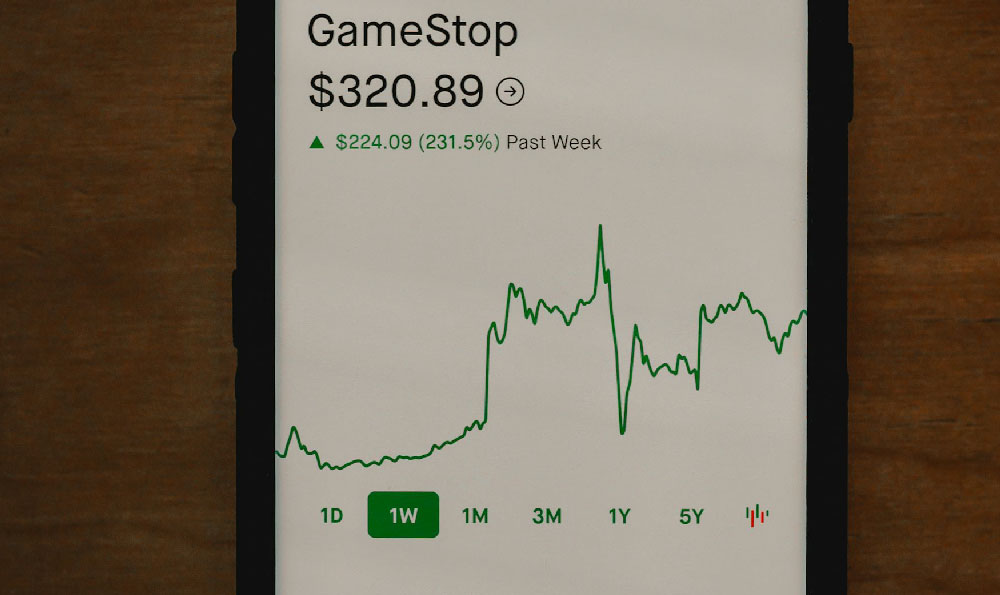

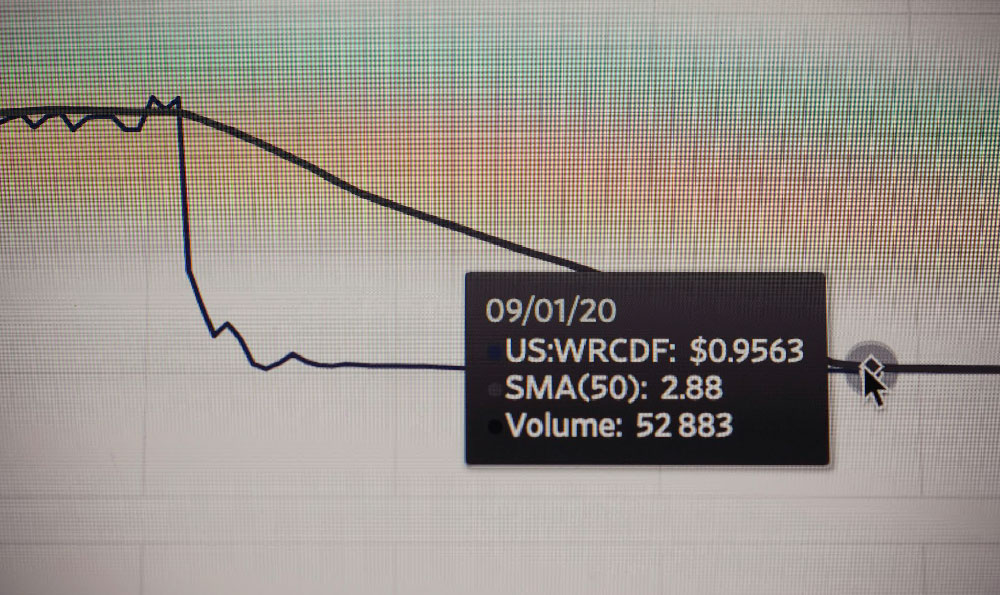

Within the realm of investment options, cryptocurrency presents both immense potential and considerable risk. The volatile nature of cryptocurrency markets requires a cautious and measured approach. Begin by allocating a small percentage of your investment portfolio to cryptocurrency, ensuring that you are comfortable with the potential for loss. Diversification is paramount. Spreading your investments across different asset classes and cryptocurrencies can help mitigate risk. Don't put all your eggs in one basket. Research various cryptocurrencies and identify those with strong fundamentals, innovative technology, and a dedicated development team.

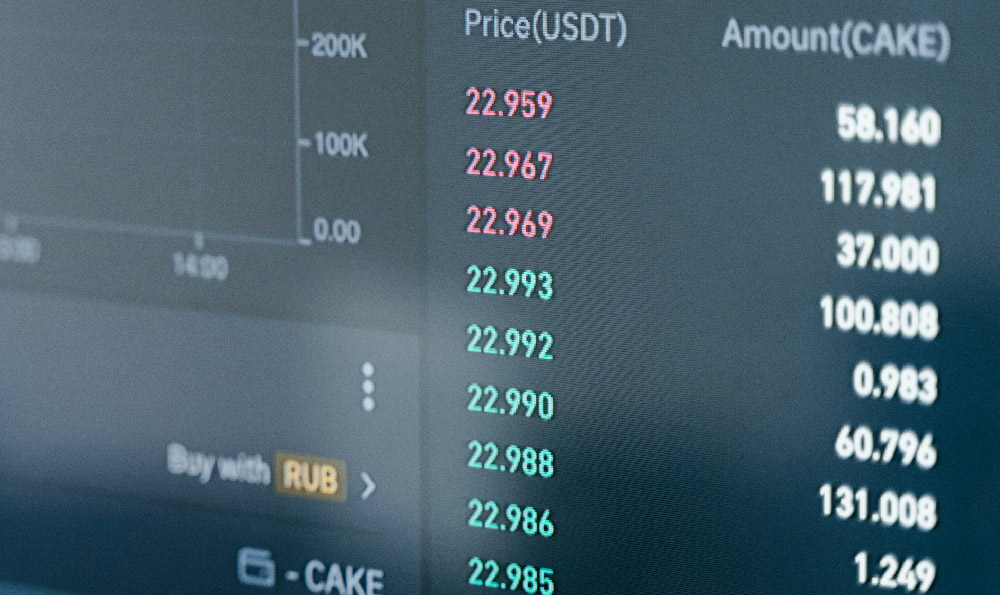

Several strategies can be employed within the cryptocurrency market to generate returns, even with limited initial capital. Dollar-Cost Averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the current price. This strategy helps to smooth out price fluctuations and reduces the risk of buying high and selling low. Another strategy involves actively trading cryptocurrencies, capitalizing on short-term price movements. However, this approach requires a significant investment of time and expertise, as well as a tolerance for risk. Consider engaging in staking, where you hold certain cryptocurrencies in a wallet to support the network and earn rewards. Lending cryptocurrency on platforms offering interest rates can also generate passive income. However, it's important to be aware of the risks associated with these platforms, including security breaches and platform failures.

Venturing into the cryptocurrency market necessitates a firm grasp of risk management principles. Never invest more than you can afford to lose. The cryptocurrency market is inherently volatile, and prices can fluctuate dramatically. Set realistic profit targets and stop-loss orders to protect your capital. Employ stop-loss orders to automatically sell your cryptocurrency holdings if the price falls below a certain level. This can help to limit potential losses. Develop a trading plan that outlines your investment goals, risk tolerance, and trading strategies. Stick to your plan and avoid making impulsive decisions based on emotion.

In addition to direct investment in cryptocurrencies, exploring other avenues within the blockchain ecosystem can also be fruitful. Consider learning a valuable skill in the blockchain space, such as coding, marketing, or content creation, and offering your services to blockchain projects. The demand for skilled professionals in the blockchain industry is high, and this can provide a steady stream of income that can be reinvested. Look into participating in bounty programs offered by blockchain projects. These programs reward individuals for completing tasks such as testing software, creating content, or promoting the project on social media.

Avoiding common pitfalls is crucial for success in cryptocurrency investing. Beware of get-rich-quick schemes and promises of guaranteed returns. These are often scams designed to take advantage of unsuspecting investors. Conduct thorough research before investing in any cryptocurrency or project. Don't rely solely on information from biased sources. Be wary of pump-and-dump schemes, where groups of individuals artificially inflate the price of a cryptocurrency and then sell their holdings for a profit, leaving other investors with losses. Secure your cryptocurrency holdings by using strong passwords and enabling two-factor authentication. Store your cryptocurrency in a secure wallet, preferably a hardware wallet that is not connected to the internet. Stay informed about security threats and phishing scams.

Building wealth takes time, discipline, and a long-term perspective. There are no shortcuts to success. Remain patient and persistent, even when faced with setbacks. Continuously learn and adapt to the ever-changing landscape of the cryptocurrency market. Maintain a positive attitude and focus on your long-term goals. While the path to riches is not guaranteed, a strategic and informed approach, combined with perseverance, can significantly increase your chances of achieving financial independence and building lasting wealth, even when starting with limited resources. Remember, responsible investing is not just about chasing high returns, but also about protecting your capital and making informed decisions that align with your risk tolerance and financial goals.