The allure of rapidly accumulating wealth is a powerful driving force for many. The question isn't simply whether it's possible, but rather, what avenues exist, what risks are involved, and what realistic expectations should be set. Achieving substantial wealth quickly isn't a common occurrence; it usually demands a convergence of opportunity, skill, hard work, and a degree of luck. Dismissing it as pure fantasy, however, ignores the numerous examples of individuals who have achieved significant financial success in a relatively short period.

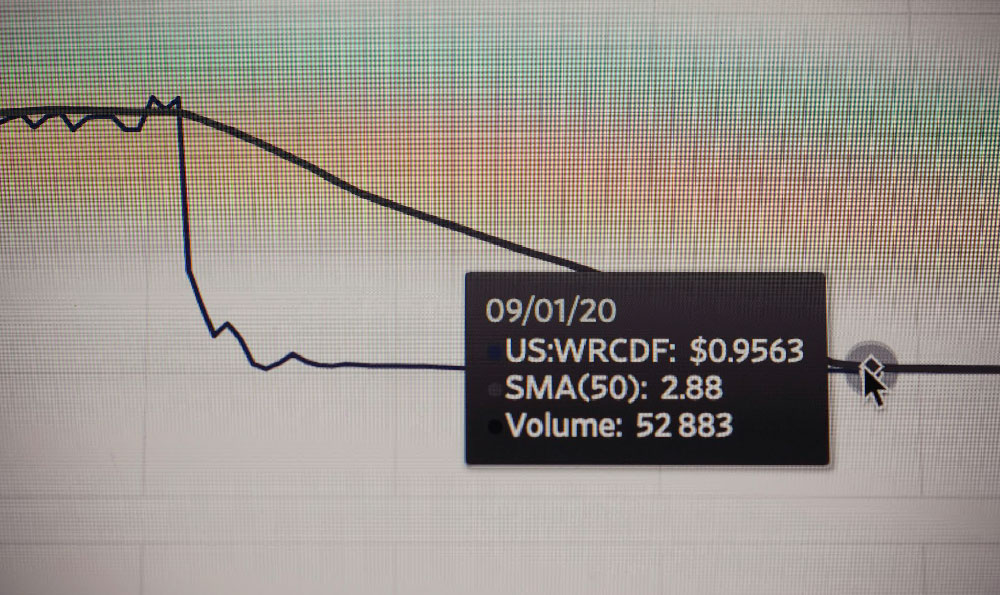

One pathway, often touted but fraught with risk, is high-growth investing. This typically involves allocating capital to assets that have the potential for exponential returns, such as early-stage startups, volatile technology stocks, or emerging market investments. While the upside can be substantial – imagine investing in Amazon or Tesla in their nascent stages – the downside is equally significant. Early-stage companies are inherently risky; most startups fail, and even those with promising ideas may struggle to navigate market challenges, competition, and funding hurdles. Investing in volatile stocks requires nerves of steel and a deep understanding of market dynamics. A sudden market correction or negative news can wipe out a significant portion of your investment in a matter of days. Emerging markets, while offering high growth potential, are often subject to political instability, currency fluctuations, and regulatory uncertainties, adding layers of complexity to the investment process. Successful high-growth investing requires rigorous due diligence, a strong risk tolerance, and the ability to accept potential losses. It's not a strategy for the faint of heart or those approaching retirement.

Another avenue, more entrepreneurial in nature, is starting and scaling a successful business. This path requires a unique blend of skills, including identifying a market need, developing a viable product or service, building a strong team, securing funding, and effectively marketing your offering. The initial stages of a business are often characterized by long hours, financial sacrifices, and a high degree of uncertainty. However, if you can successfully navigate these challenges and build a business that solves a real problem for a large enough market, the financial rewards can be substantial. Think of entrepreneurs who identified the need for ride-sharing services (Uber, Lyft), or online accommodation (Airbnb), or revolutionized e-commerce (Amazon). Their success wasn't accidental; it stemmed from a combination of vision, execution, and a willingness to take calculated risks. While not every business venture will become a multi-billion-dollar enterprise, building a profitable and scalable business can significantly accelerate your wealth accumulation. The key here is to focus on creating value for customers and building a sustainable competitive advantage.

Real estate offers another potential avenue for rapid wealth creation, though it often requires significant capital investment or access to financing. Strategies like flipping properties (buying, renovating, and reselling for a profit), investing in rental properties, or developing land can generate substantial returns, especially in rapidly growing markets. However, real estate investing comes with its own set of challenges, including market fluctuations, interest rate risks, property maintenance costs, and tenant management issues. Success in real estate requires a deep understanding of market trends, strong negotiation skills, and the ability to manage risks effectively. Timing is crucial; buying low and selling high is the golden rule, but accurately predicting market peaks and troughs is a skill that requires experience and expertise. Furthermore, real estate is often illiquid; selling a property can take time, and unexpected expenses can quickly erode your profits.

Beyond these specific avenues, several general principles can significantly influence your ability to accumulate wealth quickly. Increasing your income is paramount. This could involve pursuing higher education or training, developing in-demand skills, seeking promotions within your current company, or taking on side hustles or freelance work. The more you earn, the more you can save and invest, accelerating the compounding process. Living below your means is equally important. Avoid lifestyle inflation as your income increases; instead, focus on saving and investing a significant portion of your earnings. Budgeting, tracking your expenses, and making conscious spending choices are essential for controlling your finances and maximizing your savings.

Furthermore, continually seeking knowledge and staying informed about financial markets and investment opportunities is crucial. Read books, attend seminars, follow reputable financial news sources, and consider consulting with a financial advisor to gain a deeper understanding of investment strategies and risk management techniques. The more you know, the better equipped you'll be to make informed investment decisions and avoid costly mistakes.

Finally, a certain degree of luck and timing cannot be ignored. Being in the right place at the right time can play a significant role in your financial success. However, luck often favors those who are prepared and have positioned themselves to take advantage of opportunities when they arise. By developing the necessary skills, building a strong network, and consistently seeking out new opportunities, you can increase your chances of catching a lucky break.

In conclusion, while rapid wealth accumulation is possible, it is rarely easy or guaranteed. It requires a combination of strategic planning, hard work, risk tolerance, and a degree of luck. There is no magic formula or get-rich-quick scheme that will guarantee success. Instead, focus on developing valuable skills, building a strong financial foundation, making informed investment decisions, and continuously seeking out opportunities to increase your income and grow your wealth. The journey to financial independence is a marathon, not a sprint, but by consistently applying these principles, you can significantly increase your chances of achieving your financial goals. Remember, it's not just about getting rich quickly, but about building sustainable wealth that will provide you with financial security and freedom in the long term.