Alright, let's delve into an analysis of Alex's investments. To effectively interpret the data and uncover its hidden narratives, we need a systematic approach. This involves scrutinizing the portfolio composition, performance metrics, risk profile, and prevailing market conditions. A single snapshot is rarely enough; a historical perspective is crucial to identify trends and assess the sustainability of any gains or losses.

Portfolio Composition: A Foundation for Understanding

The first step is to understand what constitutes Alex's investments. Are they primarily concentrated in Bitcoin, Ethereum, or a diversified basket of altcoins? Does the portfolio include stablecoins, and if so, what percentage? A heavy reliance on highly volatile assets suggests a higher risk tolerance, while a larger allocation to stablecoins indicates a more conservative approach. Furthermore, examine the diversification strategy. Is Alex spreading investments across different blockchain sectors, such as DeFi, NFTs, or gaming? Proper diversification can mitigate the impact of sector-specific downturns.

The specific tokens held are also important. Consider the market capitalization and liquidity of each token. Investing heavily in low-cap coins, while potentially lucrative, carries significant risks due to price manipulation and limited trading volume. Conversely, a portfolio dominated by established coins like Bitcoin and Ethereum provides greater stability but potentially lower growth potential.

Performance Metrics: Beyond the Headlines

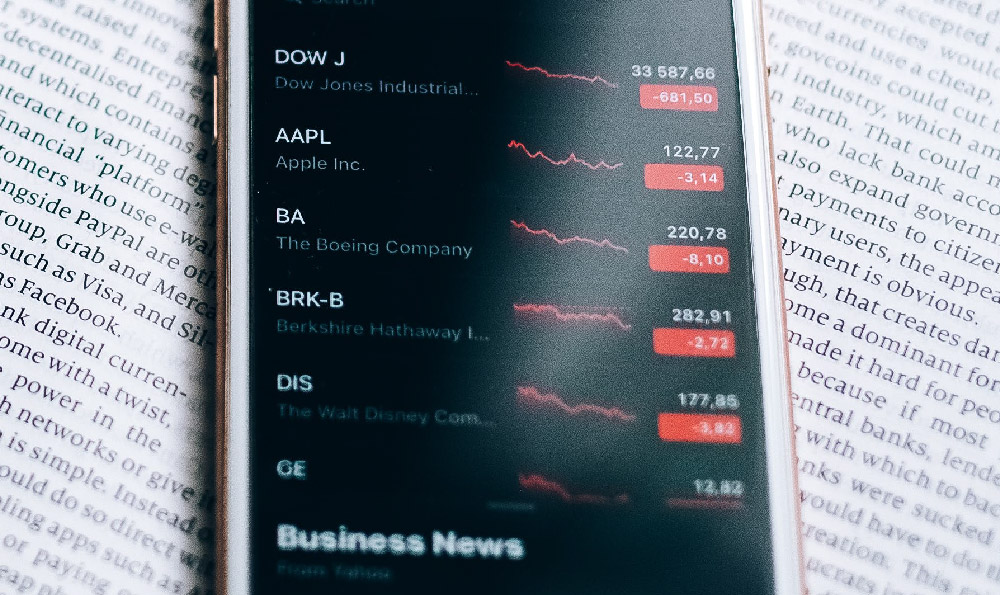

While overall gains or losses are important, a deeper dive into performance metrics is essential. Calculate the return on investment (ROI) for each asset and the portfolio as a whole. Compare these returns to benchmark indices, such as the Crypto Market Index or DeFi Pulse Index, to assess whether Alex is outperforming or underperforming the market.

Consider the Sharpe ratio, which measures risk-adjusted return. A higher Sharpe ratio indicates better returns for a given level of risk. Volatility, measured by standard deviation, provides insight into the price fluctuations Alex's investments have experienced. High volatility can be emotionally taxing and may require a more robust risk management strategy.

Also, analyze the performance during different market cycles – bull runs, bear markets, and periods of consolidation. How did the portfolio perform during significant market events, such as the collapse of FTX or the Ethereum merge? This analysis can reveal strengths and weaknesses in Alex's investment strategy.

Risk Profile: Assessing Tolerance and Exposure

Understanding Alex's risk tolerance is paramount. This involves evaluating their investment horizon, financial goals, and emotional capacity to handle market fluctuations. A young investor with a long investment horizon can typically afford to take on more risk than someone nearing retirement.

Assess the portfolio's exposure to different risks, including market risk, liquidity risk, regulatory risk, and security risk. Market risk refers to the general fluctuations in the cryptocurrency market. Liquidity risk arises from the difficulty of buying or selling an asset quickly at a fair price. Regulatory risk stems from changes in government policies that could impact the cryptocurrency industry. Security risk encompasses the potential for theft or loss of funds due to hacking or fraud.

Specifically, evaluate the use of leverage. Has Alex been using margin trading or leveraged tokens? Leverage can amplify both gains and losses, making it a high-risk strategy that requires careful management. The liquidation price of leveraged positions should be closely monitored to avoid forced selling during market downturns.

Market Conditions: A Broader Perspective

Alex's investment performance cannot be evaluated in isolation. It is crucial to consider the prevailing market conditions. Were the gains achieved during a broad market rally, or were they the result of skillful stock picking? Similarly, were the losses due to a general market downturn, or were they specific to the assets Alex held?

Analyze macroeconomic factors, such as interest rates, inflation, and economic growth. These factors can influence investor sentiment and capital flows into or out of the cryptocurrency market. Keep abreast of regulatory developments and technological advancements that could impact the industry. For example, the approval of a Bitcoin ETF could significantly increase institutional investment, while the emergence of new Layer-2 scaling solutions could improve the efficiency of blockchain networks.

Revealing the Story: Interpreting the Data

Once we have gathered and analyzed the data, we can begin to piece together the story of Alex's investments.

- Is the portfolio aligned with Alex's risk tolerance and financial goals? If Alex is a conservative investor, a portfolio heavily weighted towards volatile altcoins may be unsuitable.

- Is the portfolio properly diversified? A lack of diversification can expose Alex to undue risk.

- Is Alex taking on excessive leverage? Leverage can magnify losses and should be used cautiously.

- Is Alex adequately protecting their assets from security risks? Using strong passwords, enabling two-factor authentication, and storing cryptocurrencies in cold wallets are essential security measures.

- Is Alex making informed investment decisions based on thorough research, or are they chasing hype and FOMO? Investing based on emotions can lead to poor decisions.

- Does Alex have a clear investment strategy, or are they simply reacting to market fluctuations? A well-defined strategy can provide a framework for making rational investment decisions.

Based on the answers to these questions, we can provide Alex with tailored recommendations to improve their investment strategy and mitigate risks. This may involve rebalancing the portfolio, reducing leverage, strengthening security measures, or developing a more disciplined investment approach. It's crucial to remember that the cryptocurrency market is constantly evolving, so continuous monitoring and adaptation are essential for long-term success. Ultimately, the goal is to empower Alex with the knowledge and tools necessary to make informed investment decisions and achieve their financial objectives. By taking a holistic and data-driven approach, we can provide valuable insights that help Alex navigate the complexities of the cryptocurrency market and build a more secure financial future.