Apple (AAPL) remains a subject of fervent debate among investors. Is it a reliable, long-term bet, or are its glory days fading? The answer, as with most investments, isn't a simple yes or no, but rather a nuanced exploration of its strengths, weaknesses, and the broader market context. Let's delve into a comprehensive analysis to determine whether Apple currently represents a sound investment opportunity.

One undeniable argument for investing in Apple lies in its unparalleled brand loyalty. Apple has cultivated an almost cult-like following, with customers consistently willing to pay a premium for its products and services. This isn't merely about the technology; it's about the ecosystem. Once someone invests in the Apple universe – iPhones, iPads, MacBooks, Apple Watch, AirPods – they become deeply integrated and less likely to switch to competitors. This sticky customer base translates into predictable recurring revenue, a crucial element for sustained growth and stability. The strength of this brand allows Apple to introduce new products and services with a high degree of confidence, knowing there's already a receptive market waiting. The subscription services, such as Apple Music, Apple TV+, and iCloud, are increasingly significant contributors to Apple's revenue stream, further solidifying this recurring revenue model. This diversification beyond hardware sales is a strategically important move, making Apple less reliant on the cyclical nature of product releases.

Furthermore, Apple boasts a massive cash hoard. This substantial financial cushion provides the company with incredible flexibility. It allows them to weather economic downturns, invest heavily in research and development, acquire promising startups, and return capital to shareholders through dividends and share buybacks. This financial strength is a major competitive advantage, enabling Apple to pursue ambitious projects and quickly adapt to changing market conditions. For instance, the vast sums dedicated to developing new chips and integrating them across their product line are a testament to this power. This in-house chip development strategy not only reduces reliance on external suppliers but also gives Apple greater control over performance and energy efficiency, leading to a superior user experience and a distinct competitive edge.

However, it's crucial to acknowledge the challenges and potential downsides. Apple's reliance on a small number of key products is a significant risk. The iPhone, while still a massive revenue generator, contributes a substantial portion of Apple's overall earnings. A significant decline in iPhone sales, whether due to increased competition, technological disruption, or changing consumer preferences, would have a profound impact on the company's financial performance. While Apple has been actively diversifying into services, this transition takes time, and it's unclear whether these new revenue streams will fully compensate for any potential downturn in hardware sales. The company needs to constantly innovate and release compelling new products to maintain its market dominance and avoid becoming complacent.

The increasing regulatory scrutiny surrounding Big Tech companies also presents a potential headwind. Apple faces antitrust investigations in multiple jurisdictions, particularly regarding the App Store's policies and its control over the mobile ecosystem. These investigations could lead to regulatory changes that impact Apple's business model and profitability. Fines, forced divestitures, or changes in App Store policies could all negatively affect Apple's bottom line. It's a risk that investors need to factor into their assessment.

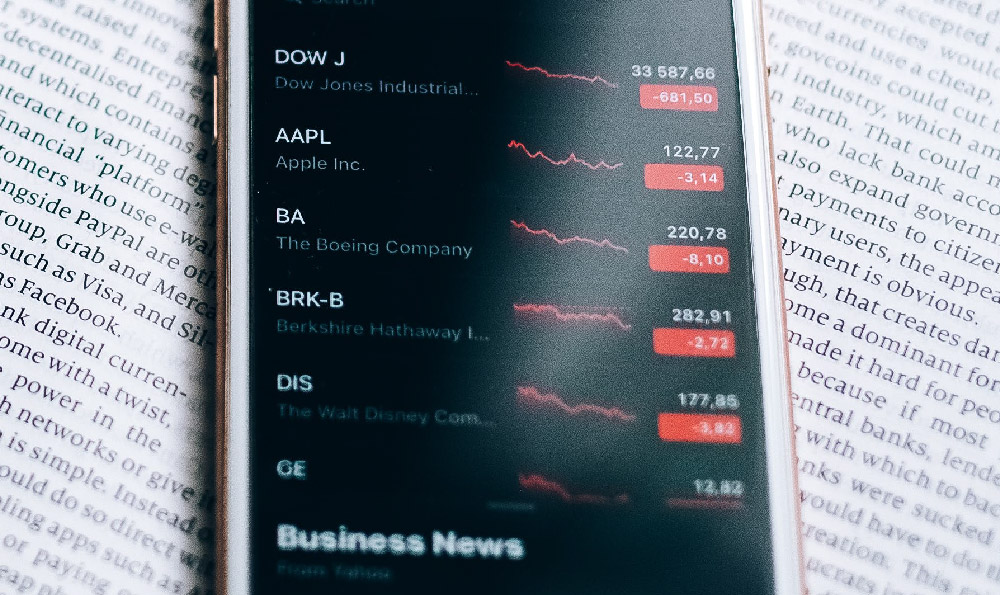

Moreover, Apple's valuation is a point of contention. The stock trades at a premium compared to some of its competitors, reflecting the market's confidence in its long-term prospects. However, this premium valuation also means that expectations are high, and any missteps could lead to a significant correction in the stock price. Investors need to carefully consider whether the current valuation adequately reflects the risks and opportunities facing the company. A period of slower growth or disappointing product launches could expose the vulnerability of this high valuation.

Looking ahead, the success of Apple's foray into new product categories, such as augmented reality (AR) and the automotive industry, will be crucial for its long-term growth. The development of compelling AR applications and the potential launch of an Apple Car could significantly expand the company's addressable market and drive future revenue growth. However, these ventures are also highly competitive and involve significant technological and execution risks. There is no guarantee that Apple will be successful in these new markets.

Therefore, deciding whether Apple is a sound investment requires careful consideration of individual investment goals, risk tolerance, and time horizon. For long-term investors seeking a relatively stable and reliable investment with a strong track record, Apple likely remains a worthwhile addition to a diversified portfolio. Its strong brand, loyal customer base, and massive cash reserves provide a solid foundation for future growth. However, investors should be aware of the risks associated with the company's reliance on a small number of key products, regulatory scrutiny, and its premium valuation. A measured approach, focusing on the long-term prospects and understanding the potential downsides, is essential when investing in any stock, including Apple. Before investing, it’s wise to consult a financial advisor.