As a student, navigating the digital landscape for income opportunities requires strategic thinking, a clear understanding of market dynamics, and a cautious approach to risks. While traditional sources like part-time jobs or internships remain viable, the evolving world of online earning also offers unique pathways that blend financial acumen with technological innovation. One of the most promising areas for students seeking growth is cryptocurrency investment, but it must be approached with the same rigor as any other financial venture. This analysis explores how students can generate income online by leveraging their existing skills and exploring alternative avenues, while emphasizing the importance of education, discipline, and risk mitigation.

For students with technical or creative expertise, the internet opens doors to lucrative opportunities. If you're proficient in coding, freelance platforms like Upwork or Fiverr provide a marketplace to monetize your abilities. Similarly, those with graphic design or video editing skills can offer their services on sites such as 99designs or YouTube. The key here is to focus on projects that align with your strengths and interests, as passion often drives consistency and quality. A student who develops a website or creates tutorials on niche topics can not only earn income but also build a personal brand that attracts future clients. However, success in this realm requires more than just talent—it demands efficient time management, a clear pricing strategy, and the ability to adapt to market demands. For instance, understanding the value of your skills in the current labor market can help you set competitive rates, while mastering tools like Canva or Adobe Premiere can enhance your productivity.

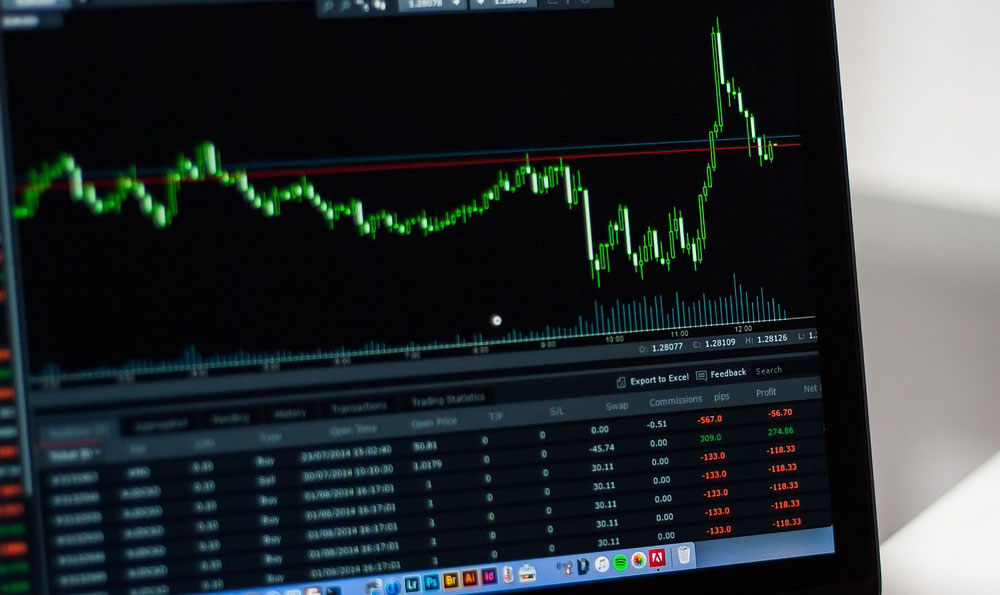

Investing in the cryptocurrency market presents another avenue for financial growth, though it carries inherent risks. Beginners should start by educating themselves on blockchain technology, market trends, and fundamental analysis. Platforms like CoinMarketCap or CoinGecko offer valuable insights into asset performance, while tools like MetaMask enable secure transactions. As a student, diversifying your portfolio by allocating a small percentage of savings to multiple crypto assets can reduce exposure to market volatility. However, it's crucial to recognize that novice investors should avoid overleveraging or speculative trading, as these practices can lead to significant financial losses. Instead, focusing on long-term value investing by researching projects with strong fundamentals and real-world applications can yield more sustainable returns. For example, investing in stablecoins or well-established cryptocurrencies like Bitcoin or Ethereum might provide a safer entry point compared to volatile altcoins.

Another aspect to consider is the growing trend of online content creation. Platforms such as YouTube, TikTok, or Medium allow students to monetize their creativity through advertising, sponsorships, or affiliate marketing. The success of this route hinges on identifying a niche audience, producing high-quality content consistently, and understanding the algorithms that govern visibility. For instance, a student who streams gaming content or creates educational videos can build a following over time, which in turn opens opportunities for monetization. However, this requires patience and dedication, as building a substantial audience takes months of effort. Additionally, students should be wary of scams that promise quick wealth through dubious affiliations or clickbait strategies, which often result in financial exploitation.

The rise of the gig economy has also created opportunities for students to earn income through microtasks and online services. Platforms like Amazon Mechanical Turk or Swappa allow users to complete small tasks for payment, while freelance writing or virtual assistance roles offer more substantial earnings. The advantage here is the flexibility, as students can manage their time around academic responsibilities. However, the income from these methods is often low and inconsistent, requiring a significant time commitment for meaningful returns. Students should assess their availability and allocate time strategically to avoid burnout, as balancing studies and part-time work demands discipline and prioritization.

For those interested in cryptocurrency, diversification is a critical strategy. Allocating income to different asset classes such as stocks, bonds, and crypto can create a balanced portfolio that withstands market fluctuations. A student who invests in a mix of traditional assets and crypto can benefit from the stability of the former while capitalizing on the potential growth of the latter. However, it's essential to understand that diversification does not eliminate risk entirely—it reduces the probability of catastrophic losses. Conducting thorough research on each asset's market position, historical performance, and fundamentals is a prerequisite for informed decisions.

Security and privacy are also paramount when engaging in online earning. Whether it's protecting digital assets in crypto or safeguarding personal data while working online, students must adopt best practices to minimize risks. Using strong passwords, enabling two-factor authentication, and storing assets securely in hardware wallets can prevent unauthorized access. Similarly, being cautious of scams that often target students—such as fake investment opportunities or phishing attempts—requires a critical mindset and verification process. Cross-checking the legitimacy of any opportunity through community reviews, official channels, or trusted platforms can save students from financial traps.

In conclusion, earning money online as a student requires a combination of skills, strategy, and foresight. Whether through leveraging technical abilities, exploring investment opportunities, or participating in the gig economy, students must approach these methods with a well-defined plan. The key to success lies in continuous learning, disciplined execution, and a strong awareness of risks. By aligning their efforts with their goals and maintaining a balanced perspective, students can navigate the digital landscape effectively and achieve financial growth without compromising their academic priorities.