```

Unveiling the Depths of Aggregated BitMEX Data: A Trader's Guide

BitMEX, a pioneer in cryptocurrency derivatives trading, generates a wealth of data. Aggregated data, in particular, presents a compelling, albeit complex, opportunity for traders seeking an edge in the volatile crypto market. But what exactly is available, and more importantly, how useful is it? This exploration delves into the types of aggregated BitMEX data, its potential applications, and crucial considerations for effective utilization.

Understanding the Data Landscape: Types of Aggregated BitMEX Data

Aggregated BitMEX data refers to compiled and summarized information derived from the platform's trading activity. This data is typically presented in a format that allows for broader analysis and pattern identification, rather than individual trade tracking. Several key categories exist:

-

Order Book Data: This reflects a snapshot of all outstanding buy (bid) and sell (ask) orders at various price levels. Aggregated order book data often involves summarizing the depth (total quantity) of orders at certain price increments, providing insights into potential support and resistance levels. This can be seen in heatmaps, level 2 data feeds, or through charting tools.

-

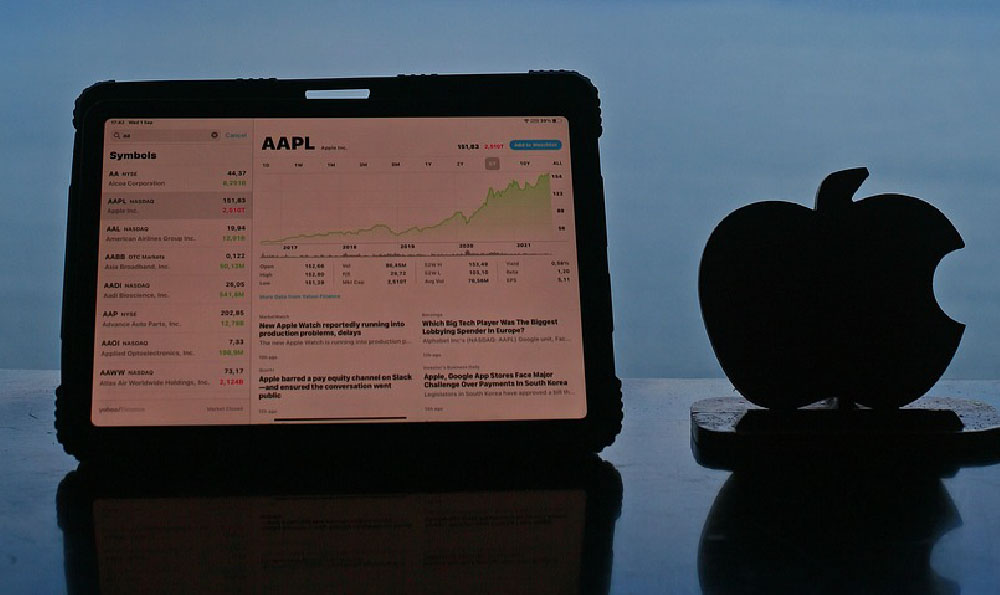

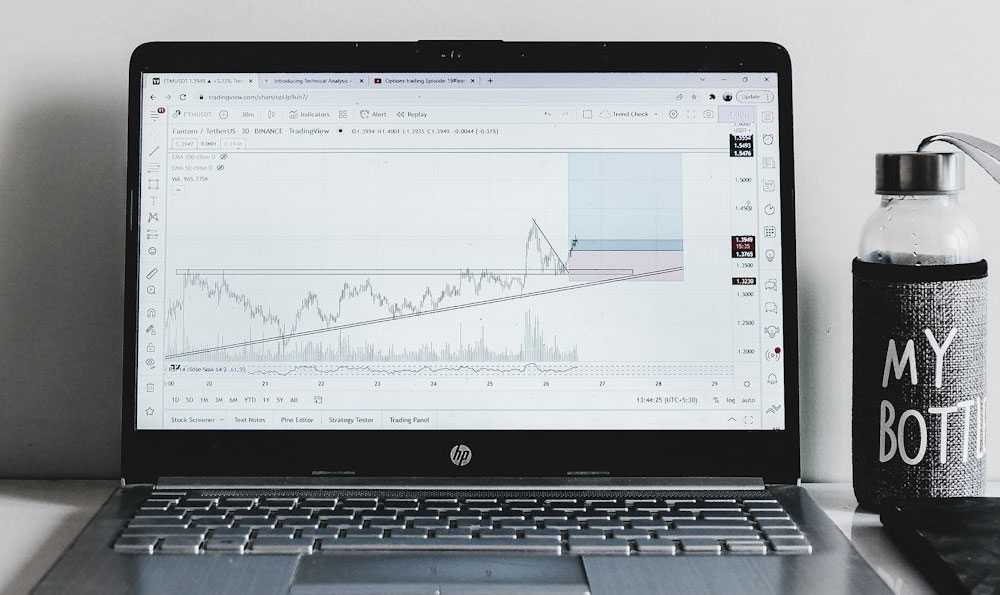

Trade Data: This encompasses information about executed trades, including the price, quantity, and timestamp. Aggregated trade data typically summarizes trading volume over specific time periods (e.g., hourly, daily), indicating market activity and potential price momentum. This often takes the form of candlestick charts and volume profiles.

-

Open Interest Data: Open interest represents the total number of outstanding derivative contracts (e.g., perpetual swaps) for a particular asset. Aggregated open interest data tracks the overall volume of these contracts, providing a gauge of market participation and sentiment. A rising open interest generally suggests increasing interest and capital flowing into the market, while a decreasing open interest may indicate waning enthusiasm.

-

Funding Rate Data: BitMEX's perpetual swaps utilize a funding rate mechanism to keep the contract price close to the underlying asset's spot price. Aggregated funding rate data tracks these rates over time, revealing whether long or short positions are paying a premium to maintain their positions. Extreme funding rates can signal potential overbought or oversold conditions.

-

Liquidation Data: This data outlines the volume of leveraged positions that have been forcibly closed due to insufficient margin. Aggregated liquidation data highlights price levels where significant liquidations occurred, providing clues about potential stop-loss clusters and areas of vulnerability.

The Allure of Aggregated Data: Potential Applications for Traders

The appeal of aggregated BitMEX data lies in its ability to uncover patterns and trends that might be difficult to discern from raw, granular data. Here are some potential applications:

-

Identifying Support and Resistance Levels: Analyzing aggregated order book data can help identify price levels with significant buy or sell interest, acting as potential support or resistance zones. Large clusters of bids can suggest a price floor, while substantial ask orders may indicate a price ceiling.

-

Gauging Market Sentiment: Monitoring aggregated open interest and funding rate data can provide insights into overall market sentiment. For example, a rapidly increasing open interest coupled with positive funding rates suggests a bullish market bias. Conversely, decreasing open interest and negative funding rates may indicate bearish sentiment.

-

Predicting Price Movements: By analyzing aggregated trade data and liquidation data, traders can identify potential breakout levels or areas where price reversals are likely to occur. A surge in trading volume near a particular price level, especially when coupled with significant liquidations, can signal a strong directional move.

-

Developing Algorithmic Trading Strategies: Aggregated BitMEX data can be used to develop and backtest automated trading strategies. Algorithms can be designed to react to changes in order book depth, open interest, funding rates, or liquidation levels, allowing for efficient execution of trading decisions.

-

Risk Management: Understanding where liquidations are clustered can allow for better placement of stop-loss orders and better sizing of positions.

Navigating the Pitfalls: Considerations for Effective Use

While aggregated BitMEX data offers valuable insights, it's crucial to approach it with a critical and informed perspective. Several factors can influence the accuracy and reliability of the data:

-

Data Quality and Accuracy: Ensure that the data source is reputable and provides accurate and up-to-date information. Some data providers may have errors or delays in their feeds, which can lead to misleading analysis.

-

Market Manipulation: Be aware that market participants can attempt to manipulate the order book or trade data to influence prices. "Spoofing" or "layering" techniques, where large orders are placed and then quickly cancelled, can create false signals.

-

Overfitting and Backtesting Bias: Avoid overfitting trading strategies to historical data. Backtesting results may not accurately reflect future performance due to changing market conditions.

-

Correlation vs. Causation: Recognize that correlations between aggregated data and price movements do not necessarily imply causation. Other factors, such as news events or macroeconomic trends, can also influence market behavior.

-

Liquidity Considerations: Data from BitMEX alone might not provide a full picture, especially when liquidity shifts to other exchanges or platforms.

Maximizing the Value: Best Practices for Analyzing Aggregated Data

To effectively utilize aggregated BitMEX data, consider the following best practices:

-

Combine with Other Data Sources: Integrate aggregated BitMEX data with other market data, such as spot prices, on-chain analytics, and news feeds, to gain a more comprehensive view of the market.

-

Use Visualization Tools: Employ charting software or other visualization tools to effectively analyze and interpret the data. Visual representations can help identify patterns and trends that might be difficult to discern from raw numbers.

-

Develop a Trading Plan: Create a well-defined trading plan that outlines your risk management strategy, entry and exit criteria, and position sizing rules. Avoid making impulsive decisions based solely on aggregated data.

-

Continuously Monitor and Adapt: Regularly monitor the performance of your trading strategies and adapt them as market conditions change. The cryptocurrency market is dynamic, and what works today may not work tomorrow.

-

Stay Informed: Keep abreast of the latest news and developments in the cryptocurrency market. Understand the factors that can influence price movements and how they might impact your trading decisions.

Conclusion: A Powerful Tool, But Not a Magic Bullet

Aggregated BitMEX data provides a powerful tool for traders seeking to gain an edge in the cryptocurrency market. By understanding the types of data available, its potential applications, and the associated risks, traders can leverage this information to make more informed trading decisions. However, it's crucial to remember that aggregated data is not a magic bullet. It should be used in conjunction with other data sources, a well-defined trading plan, and a disciplined approach to risk management. When used effectively, aggregated BitMEX data can be a valuable asset in navigating the complexities of the crypto derivatives market. ```