Okay, I understand. Here's the article, keeping in mind my role as a virtual currency and investment expert, tailored for a younger audience:

Earning money as a teenager is a pursuit brimming with possibilities, yet it also necessitates a thoughtful approach, especially when considering the desire to do so "fast." While the lure of quick riches is appealing, it's crucial to temper expectations and prioritize a foundation built on solid financial principles and realistic assessments of risk. Let’s explore options while emphasizing responsibility and long-term financial health.

Before diving into specific opportunities, it's essential to address the underlying mindset. The phrase "make money fast" often implies a shortcut, and shortcuts in finance frequently lead to increased risk. Instead, focus on leveraging your unique skills, interests, and the resources available to you to generate income effectively. Think about what you are good at. Are you a talented artist, a budding programmer, a social media whiz, or someone who enjoys helping others? Identifying your strengths is the first step towards finding income streams that align with your abilities and can grow over time.

Many traditional methods offer safe and reliable income, albeit not instantaneously. Part-time jobs, such as working in retail, food service, or tutoring, provide a consistent paycheck and valuable experience in the workforce. These jobs also teach crucial skills like time management, customer service, and teamwork, which are beneficial regardless of your future career path. While hourly wages may not seem glamorous, they offer a stable foundation upon which to build further financial goals.

Moving beyond traditional employment, consider the gig economy. Platforms like Fiverr, Upwork, and similar sites offer opportunities for freelancers with skills in writing, graphic design, web development, social media management, and more. The beauty of the gig economy lies in its flexibility. You can set your own hours, choose projects that interest you, and gradually increase your earning potential as you build a portfolio and reputation. To succeed in the gig economy, focus on building a strong profile, delivering high-quality work, and consistently communicating with clients. Remember to factor in platform fees and self-employment taxes when calculating your earnings.

Another avenue worth exploring is creating and selling products online. If you're artistically inclined, you could design and sell merchandise on platforms like Etsy or Redbubble. If you have a knack for crafting, you could create and sell handmade items. Or, if you're knowledgeable about a particular subject, you could create and sell educational resources or online courses. The key to success in this area is identifying a niche market, creating high-quality products, and effectively marketing your offerings.

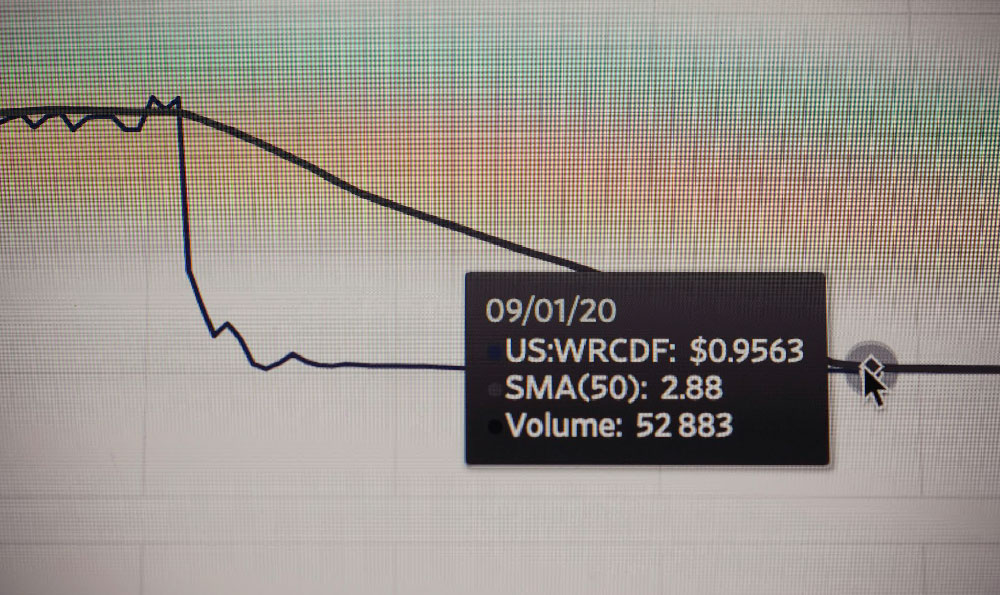

Now, let's address the topic of investments, particularly those related to virtual currencies. While the potential for high returns in the cryptocurrency market is undeniable, it's equally crucial to understand the inherent risks involved. Cryptocurrencies are notoriously volatile, meaning their prices can fluctuate dramatically in short periods. Investing in cryptocurrencies without proper knowledge and understanding is akin to gambling and can lead to significant financial losses.

If you're considering investing in cryptocurrencies, start with education. Research the different cryptocurrencies, understand blockchain technology, and learn about market trends and risk management strategies. Reputable resources like educational websites, books, and courses can provide a solid foundation of knowledge. Never invest more than you can afford to lose, and diversify your investments across different asset classes to mitigate risk.

Furthermore, be wary of get-rich-quick schemes and promises of guaranteed returns. These are often scams designed to exploit inexperienced investors. Always do your own research and seek advice from trusted sources before making any investment decisions. If something sounds too good to be true, it probably is.

Before investing in any virtual currency, consider your age and legal restrictions. Many cryptocurrency exchanges require users to be 18 years or older. If you're under 18, you may need to involve a parent or guardian in your investment activities. Be transparent about your intentions and ensure that you comply with all applicable laws and regulations.

Beyond virtual currencies, consider more traditional and lower-risk investment options. Investing in stocks, bonds, or mutual funds can provide a more stable and diversified approach to growing your wealth over time. These investments may not offer the same potential for rapid gains as cryptocurrencies, but they also carry significantly less risk.

In conclusion, while the desire to make money fast is understandable, it's crucial to prioritize a responsible and informed approach. Explore various income-generating opportunities that align with your skills and interests, and carefully consider the risks and rewards involved in any investment decision. Education, discipline, and patience are essential for building a solid financial foundation and achieving long-term financial success. Focus on developing valuable skills, saving diligently, and making informed investment choices. Remember, the journey to financial success is a marathon, not a sprint.