Investing in stocks can be a powerful way to grow your wealth, but it's crucial to approach it with a clear understanding of the risks and potential rewards. The stock market, while offering the possibility of significant gains, is also subject to volatility and can lead to losses if not navigated carefully. Whether you can truly profit from stocks depends on a multitude of factors, including your investment strategy, risk tolerance, market conditions, and the time horizon you're willing to commit.

Let's start with the basics. A stock represents ownership in a company. When you buy shares of stock, you are essentially buying a small piece of that company. As the company grows and becomes more profitable, the value of its stock generally increases. This increase in value is known as capital appreciation. In addition to capital appreciation, some stocks pay dividends, which are a portion of the company's profits distributed to shareholders. Dividends can provide a steady stream of income, especially for long-term investors.

However, it's important to acknowledge the inherent risks involved. Stock prices can fluctuate dramatically due to a variety of factors, including economic conditions, industry trends, company-specific news, and even investor sentiment. A company might report disappointing earnings, face legal challenges, or simply fall out of favor with investors, all of which can cause its stock price to decline. In extreme cases, a company can go bankrupt, rendering its stock worthless.

So, how can you increase your chances of profiting from stocks? The key lies in adopting a well-thought-out investment strategy. There is no one-size-fits-all approach, and the best strategy for you will depend on your individual circumstances and goals.

One popular strategy is long-term investing. This involves buying stocks of companies you believe will perform well over the long run and holding onto them for many years, if not decades. The idea is to ride out the inevitable ups and downs of the market and benefit from the compounding effect of returns over time. Long-term investing often involves a "buy and hold" approach, where you resist the urge to sell during market downturns and instead focus on the long-term potential of your investments. This strategy requires patience and discipline, but it can be particularly effective for building wealth over time.

Another strategy is value investing. Value investors seek out stocks that are trading below their intrinsic value. They believe that the market is sometimes inefficient and that undervalued stocks will eventually be recognized and appreciate in price. Identifying undervalued stocks requires careful analysis of a company's financial statements, its competitive position, and its growth prospects. Value investing can be a rewarding strategy, but it requires a significant amount of research and analytical skills.

Growth investing, on the other hand, focuses on companies that are expected to grow their earnings at a faster rate than the overall market. Growth investors are willing to pay a premium for these stocks, as they believe that the potential for future growth outweighs the current valuation. Growth investing can be highly profitable, but it also comes with higher risk, as growth stocks tend to be more volatile than value stocks.

Beyond these general strategies, there are also more specific approaches, such as dividend investing, which focuses on stocks that pay high dividends, and index investing, which involves tracking a specific market index, such as the S&P 500. Index investing is a low-cost and diversified way to participate in the stock market. Exchange-Traded Funds (ETFs) are commonly used for index investing, providing instant diversification across a basket of stocks.

No matter which strategy you choose, it's essential to diversify your portfolio. Diversification means spreading your investments across different stocks, industries, and even asset classes. By diversifying, you reduce the risk of losing a significant portion of your investment if one particular stock or industry performs poorly. A well-diversified portfolio can help you weather market volatility and achieve more consistent returns over time.

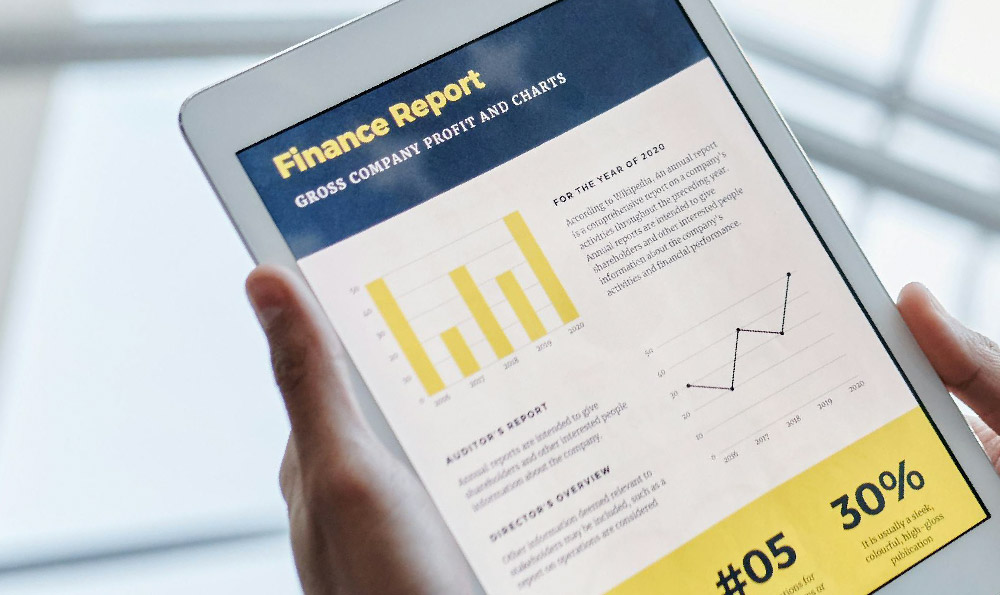

It's also crucial to conduct thorough research before investing in any stock. Don't rely solely on recommendations from friends or family, or on hyped-up news articles. Instead, take the time to understand the company's business model, its financial performance, its competitive landscape, and its management team. Read the company's annual reports, listen to its earnings calls, and consult with financial professionals if needed.

Furthermore, understanding your risk tolerance is paramount. Are you comfortable with the possibility of losing a significant portion of your investment in exchange for the potential for higher returns? Or are you more risk-averse and prefer to invest in more stable, low-risk assets? Your risk tolerance should guide your investment decisions and help you choose stocks that are appropriate for your comfort level.

Timing the market is notoriously difficult, if not impossible. Trying to predict when the market will go up or down is a fool's errand. Instead of trying to time the market, focus on investing consistently over time. Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the market conditions. This can help you avoid the pitfalls of trying to time the market and can potentially lead to better returns over the long run.

Finally, remember that investing in stocks is a long-term game. Don't expect to get rich overnight. It takes time, patience, and discipline to build wealth through stocks. Be prepared to ride out the inevitable ups and downs of the market and to stay focused on your long-term goals. Regular monitoring and periodic adjustments to your portfolio are necessary to ensure that your investments remain aligned with your risk tolerance and financial objectives. Seek professional financial advice if you feel overwhelmed or need assistance with developing and implementing your investment strategy. With careful planning, diligent research, and a long-term perspective, you can increase your chances of profiting from stocks and achieving your financial goals.