Navigating the world of investment, particularly when aiming to track a broad market index like the S&P 500 using platforms like Robinhood, can present unique challenges and a variety of options. Many new investors find themselves drawn to Robinhood due to its commission-free trading structure and user-friendly interface, but knowing how to best approach S&P 500 exposure requires a deeper understanding of available instruments and strategies. The goal is to efficiently replicate the S&P 500's performance while minimizing costs, managing risk, and optimizing for long-term growth.

The most straightforward method for investing in the S&P 500 through Robinhood is to purchase shares of an Exchange-Traded Fund (ETF) that tracks the index. ETFs are investment funds that hold a basket of assets designed to mirror the performance of a specific index, sector, or commodity. Several ETFs are specifically designed to track the S&P 500, with the most popular and liquid being the SPDR S&P 500 ETF Trust (ticker symbol: SPY), the iShares Core S&P 500 ETF (ticker symbol: IVV), and the Vanguard S&P 500 ETF (ticker symbol: VOO).

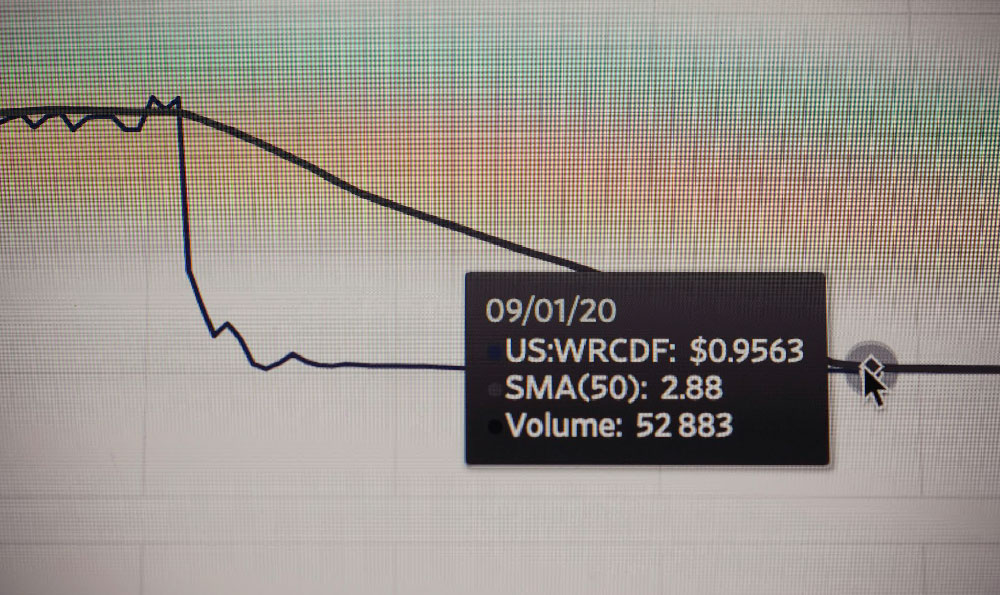

Choosing the right ETF involves considering several factors. Expense ratio, which represents the annual fee charged to manage the fund, is a crucial consideration. Lower expense ratios directly translate to higher returns over the long run. While all three ETFs mentioned above boast incredibly low expense ratios, generally in the range of 0.03% to 0.09%, even slight differences can accumulate significantly over decades. Liquidity, measured by the trading volume of the ETF, is also vital. High liquidity ensures that you can buy or sell shares quickly and at a price close to the net asset value (NAV) of the underlying assets. SPY generally has the highest trading volume, making it easier to execute large trades without significantly impacting the price. However, IVV and VOO offer comparable liquidity and often lower expense ratios, making them attractive alternatives.

Another factor to consider is the replication method used by the ETF. Most S&P 500 ETFs employ full replication, meaning they hold all the stocks in the index in the same proportions. This approach provides the most accurate tracking but may incur slightly higher costs. Some ETFs utilize sampling, holding only a representative sample of the S&P 500 stocks. This can reduce costs but may result in slightly less accurate tracking. The difference in tracking performance is usually negligible, so focusing on expense ratio and liquidity is often the most prudent approach.

Beyond directly purchasing ETF shares, Robinhood offers limited exposure to options trading, which can be used to create more complex strategies for investing in the S&P 500. For example, an investor could buy call options on SPY, IVV, or VOO, allowing them to control a larger amount of shares with a smaller initial investment. However, options trading carries significantly higher risk and requires a thorough understanding of options contracts, expiration dates, and potential profit and loss scenarios. It’s not generally advisable for beginners due to the potential for substantial losses if the market moves against the investor's position.

Fractional shares, another feature offered by Robinhood, enable investors to buy portions of a single share of an ETF. This is particularly beneficial for those with limited capital, as it allows them to participate in the S&P 500's growth even without enough funds to purchase a whole share. For instance, if SPY is trading at $450 per share, an investor could purchase $50 worth of SPY, owning a fraction of a share. This approach makes diversification more accessible and allows investors to allocate smaller amounts to different ETFs or stocks.

When establishing a long-term investment strategy focused on the S&P 500, consider employing a dollar-cost averaging approach. This involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy helps to mitigate the risk of investing a lump sum at the peak of the market and can lead to better average returns over time. By consistently investing a set amount, you purchase more shares when prices are low and fewer shares when prices are high, ultimately averaging out your cost basis.

Furthermore, it's crucial to consider the tax implications of your investments. S&P 500 ETFs are generally tax-efficient, as they have relatively low turnover rates. However, dividends paid by the underlying companies within the ETF are taxable as ordinary income or qualified dividends, depending on the holding period. Capital gains realized from selling ETF shares held for more than one year are taxed at lower long-term capital gains rates. To maximize tax efficiency, consider holding S&P 500 ETFs within tax-advantaged accounts such as a Roth IRA or a traditional IRA.

Finally, remember that investing in the S&P 500 is a long-term strategy. While the market may experience short-term fluctuations and volatility, the S&P 500 has historically provided strong returns over extended periods. Avoid making impulsive decisions based on short-term market movements. Stick to your investment plan, rebalance your portfolio periodically to maintain your desired asset allocation, and focus on compounding returns over the long haul. Before making any investment decisions, conduct thorough research, consult with a financial advisor if necessary, and understand your own risk tolerance and financial goals. Investing in the S&P 500 through platforms like Robinhood can be a powerful tool for building wealth, but it requires a disciplined and informed approach.