Navigating the intricate landscape of cryptocurrency investments demands a blend of astute analysis, a forward-thinking perspective, and a healthy dose of caution. The digital currency realm, with its volatility and rapid evolution, presents both tremendous opportunities for wealth creation and significant risks that must be carefully managed. This article delves into specific platforms and trends, drawing insights applicable to the broader crypto investment sphere, while emphasizing the critical importance of risk management and informed decision-making.

Deciphering the Signals: Market Analysis as a Cornerstone

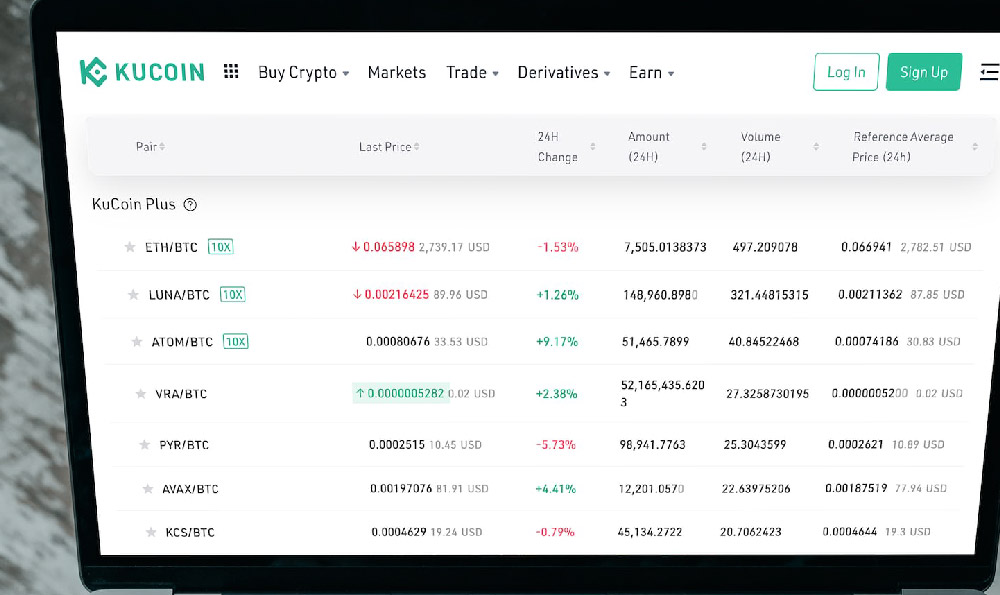

Before venturing into any cryptocurrency investment, a comprehensive market analysis is paramount. This involves scrutinizing market capitalization, trading volume, price trends, and the underlying technology driving a particular cryptocurrency. Tools such as CoinMarketCap and CoinGecko provide valuable data for tracking these metrics across various digital assets.

Technical analysis, another crucial component, utilizes chart patterns and technical indicators to identify potential entry and exit points. Moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) are commonly employed tools to assess momentum and potential reversals. While technical analysis can provide valuable insights, it's essential to remember that past performance is not necessarily indicative of future results.

Fundamental analysis delves deeper, examining the cryptocurrency's use case, the strength of its development team, its adoption rate, and its competitive landscape. Understanding the problem a cryptocurrency aims to solve and its potential for real-world application is crucial for long-term investment success. Whitepapers, project roadmaps, and community forums offer valuable information for conducting thorough fundamental research.

Reddit and Keepbit: Platforms for Insight and Caution

Platforms like Reddit, particularly subreddits dedicated to cryptocurrency, can be valuable sources of information and community sentiment. However, it's crucial to approach information gleaned from these platforms with a critical eye. While valuable insights and discussions can be found, these platforms are also susceptible to misinformation, hype, and coordinated pump-and-dump schemes. Look for established subreddits with active moderation and a focus on constructive discussion. Cross-reference information from multiple sources before making any investment decisions.

Keepbit, while not a widely recognized platform in the traditional sense, represents a growing trend of decentralized finance (DeFi) platforms offering innovative financial services using blockchain technology. These platforms often offer high yields on deposited cryptocurrencies through staking or lending, but they also carry significant risks, including smart contract vulnerabilities, impermanent loss, and rug pulls.

Before engaging with any DeFi platform, thoroughly audit the smart contract code, understand the associated risks, and only allocate funds that you can afford to lose. Diversification across multiple DeFi platforms can help mitigate some of the risks associated with a single platform. The evolving DeFi landscape necessitates staying informed about the latest security audits and best practices.

Strategic Investment Approaches

Once you have a solid understanding of market dynamics and potential investment opportunities, it's time to develop a strategic investment approach. Diversification is a cornerstone of risk management. Spreading your investments across different cryptocurrencies, asset classes, and geographic regions can help cushion the impact of potential losses in any single investment.

Dollar-cost averaging (DCA) is a popular strategy that involves investing a fixed amount of money at regular intervals, regardless of the current price. This approach can help mitigate the risk of buying at the top and can lead to better average returns over the long term.

Another crucial aspect of strategic investing is setting realistic goals and expectations. Cryptocurrency investments can be highly volatile, and it's important to avoid chasing quick riches or falling prey to get-rich-quick schemes. Develop a long-term investment horizon and focus on building wealth steadily over time.

Risk Mitigation: A Non-Negotiable Imperative

Risk mitigation is not just an afterthought; it's an integral part of a sound cryptocurrency investment strategy. Never invest more than you can afford to lose. Cryptocurrency investments are inherently risky, and it's crucial to have a clear understanding of your risk tolerance before allocating any funds.

Secure your cryptocurrency holdings by using strong passwords, enabling two-factor authentication, and storing your private keys in a secure hardware wallet. Hardware wallets provide an offline storage solution, protecting your private keys from online attacks.

Be wary of scams and phishing attempts. Cryptocurrency investors are often targeted by scammers who use various tactics to steal private keys or trick them into sending funds. Never share your private keys with anyone, and be skeptical of unsolicited offers or requests for funds.

Staying Informed: A Continuous Pursuit

The cryptocurrency market is constantly evolving, and staying informed about the latest trends, developments, and regulatory changes is essential for long-term investment success. Follow reputable news sources, industry experts, and research reports to stay abreast of the latest happenings.

Attend industry conferences and webinars to network with other investors and learn from experts in the field. Engage with online communities to share insights and learn from the experiences of others. The more knowledge you accumulate, the better equipped you will be to make informed investment decisions.

Conclusion: Embracing Diligence and Discipline

Navigating the world of cryptocurrency investments requires a disciplined approach, diligent research, and a healthy dose of skepticism. Platforms like Reddit and emerging DeFi platforms offer both opportunities and risks. By carefully analyzing market trends, implementing sound risk management strategies, and staying informed about the latest developments, you can increase your chances of achieving your financial goals while protecting your capital. Remember that cryptocurrency investing is a long-term game, and patience, discipline, and continuous learning are key to success. The allure of rapid gains should never overshadow the fundamental principles of prudent investing and risk mitigation.