In the ever-evolving digital landscape of 2023, the intersection of technology and finance has opened unprecedented opportunities for individuals seeking to generate income online efficiently. While traditional avenues remain viable, the rise of cryptocurrency and blockchain-based platforms has introduced innovative methods that blend speed, accessibility, and strategic potential. To navigate this complex terrain successfully, investors must adopt a mindset that combines technical acumen with a deep understanding of market dynamics. The key lies not in chasing quick wins but in identifying sustainable opportunities that align with long-term trends and personal financial goals.

The cryptocurrency market has experienced a transformative shift in recent years, driven by institutional adoption, technological advancements, and the maturation of decentralized finance (DeFi) ecosystems. In 2023, the integration of blockchain technology into mainstream financial services has created new avenues for profit, particularly for those willing to explore the nuances of this space. Platforms such as DeFi protocols, NFT marketplaces, and yield farming applications have emerged as critical tools for generating passive income. However, the volatility of these markets demands a disciplined approach, where investors balance the pursuit of returns with the necessity of risk mitigation.

One of the most impactful strategies in 2023 involves leveraging decentralized finance through yield farming and liquidity pools. By providing liquidity to decentralized exchanges (DEXs), investors can earn rewards in the form of governance tokens or transaction fees. This method requires a careful evaluation of the underlying projects, their token economics, and the terms of the farming contracts. For instance, the rise of protocols like Uniswap and SushiSwap has enabled users to participate in automated market makers (AMMs), which operate without centralized intermediaries. Success in these platforms hinges on understanding the mechanisms of automated liquidity provision and choosing projects with a track record of security and community engagement.

Another lucrative avenue for generating income quickly is the trading of cryptocurrencies and derivatives. In 2023, the proliferation of algorithmic trading tools and high-frequency trading (HFT) platforms has allowed individuals to capitalize on market fluctuations with precision. Technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume analysis play a pivotal role in this strategy. Investors should focus on mastering these indicators to anticipate market trends and execute trades at optimal times. For example, a trader might use the RSI to identify overbought or oversold conditions, while combining MACD with volume data to confirm market sentiment. This requires not only analytical skills but also the discipline to adhere to a well-defined trading plan.

The emergence of non-fungible tokens (NFTs) has further expanded the scope of online income generation. NFT marketplaces such as OpenSea and Rarible offer opportunities to profit from digital art, virtual real estate, and collectibles. In 2023, the growth of NFTs has been fueled by their integration into gaming, social media, and intellectual property sectors. Investors should approach this space with caution, prioritizing projects that demonstrate real-world utility and sustainable value. The ability to analyze blockchain-based royalties and understand the dynamics of secondary market trading is crucial for maximizing returns while minimizing exposure to speculative risks.

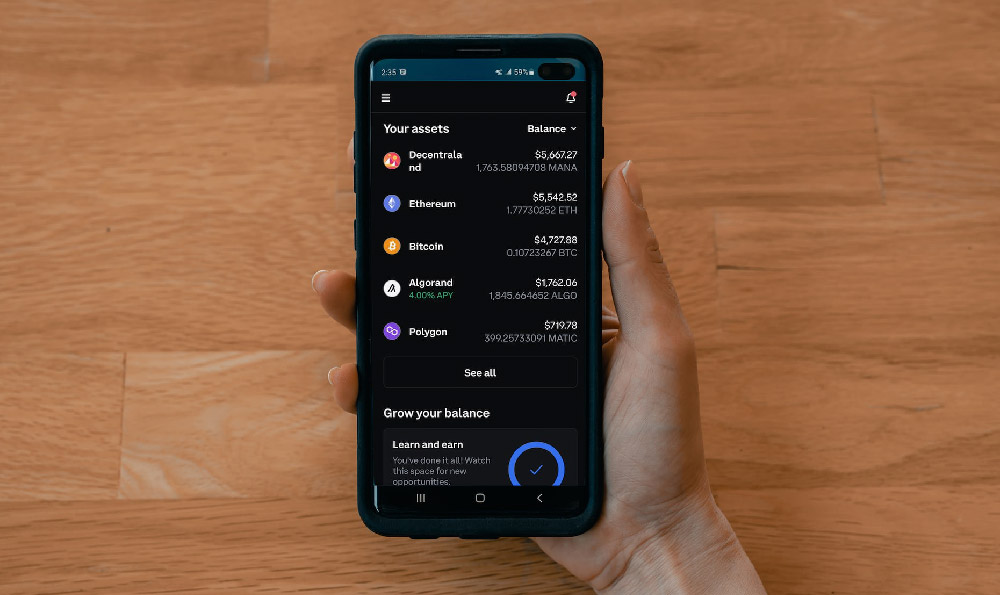

For those interested in passive income, staking and yield generation on blockchain networks have proven to be effective methods. By staking cryptocurrencies such as Ethereum or Cosmos, investors can earn interest on their holdings, with returns varying based on the network's design and market conditions. In 2023, the growth of staking-as-a-service platforms has made this process more accessible, but choosing the right platform requires evaluating factors such as security, interoperability, and the project's long-term vision. Investors should also consider the energy efficiency of staking mechanisms, as environmental concerns have become a significant factor in the valuation of blockchain projects.

The development of tokenized assets and smart contracts has introduced new dimensions to online income generation. By investing in tokenized real estate or equity, individuals can participate in fractional ownership models that offer liquidity and returns in a manner distinct from traditional markets. In 2023, the integration of these assets into decentralized platforms has created opportunities for diversifying investment portfolios. However, success in this arena depends on understanding the legal frameworks, liquidity mechanisms, and risks associated with tokenization. Investors should conduct thorough due diligence, including evaluating the credibility of the issuing platforms and the scalability of the underlying blockchain.

The rise of decentralized autonomous organizations (DAOs) has also created new avenues for income generation through governance participation. By holding governance tokens, investors can influence the direction of projects and earn rewards from voting rights or delegated staking. In 2023, the growing adoption of DAOs in various industries has highlighted their potential as investment vehicles, with returns tied to the project's performance and community decisions. However, the complexity of these governance models requires a deep understanding of blockchain fundamentals and the ability to analyze voting patterns and community sentiment.

To thrive in the fast-paced world of online income generation in 2023, investors must cultivate a holistic approach that integrates technical analysis with strategic decision-making. This includes monitoring macroeconomic trends, regulatory developments, and technological breakthroughs that shape the market. For example, the anticipated launch of Bitcoin ETFs in 2023 has created excitement among investors, but the potential impact of these developments requires careful analysis of market sentiment, institutional behavior, and regulatory timelines.

The success of any investment strategy in the digital realm ultimately depends on the investor's ability to adapt to changing conditions while maintaining a long-term perspective. In 2023, the convergence of technological innovation and financial mechanisms has created opportunities for profit that are both dynamic and diverse. By combining a deep understanding of market trends with disciplined risk management, investors can navigate this complex landscape with confidence and achieve sustainable growth.

The digital age has reshaped the way individuals approach financial opportunities, offering a blend of speed, accessibility, and innovation. For those willing to explore the nuances of this space, the methods outlined above provide a framework for generating income quickly while maintaining a balance between risk and reward. The key to success lies in staying informed, adopting a strategic mindset, and continuously refining one's approach to adapt to the ever-changing digital economy.