The question of how to make money without a job is a common one, particularly in an era where traditional employment models are being challenged by technological advancements and shifting economic landscapes. While the romantic notion of effortless wealth might seem appealing, the reality is that generating income without a job typically involves a combination of strategic planning, resourcefulness, and a willingness to embrace risk. It's absolutely possible, but it's crucial to approach it with realistic expectations and a well-thought-out plan.

One avenue to explore is investing, particularly in the realm of cryptocurrencies. Cryptocurrency, with its inherent volatility, presents both significant opportunities and substantial risks. Blindly diving in based on hype or fleeting trends is a recipe for disaster. Instead, a prudent approach involves thorough research and a deep understanding of the underlying technology, market dynamics, and individual asset profiles. Consider it analogous to venturing into a jungle; without a map and a knowledgeable guide, you're likely to get lost and possibly injured.

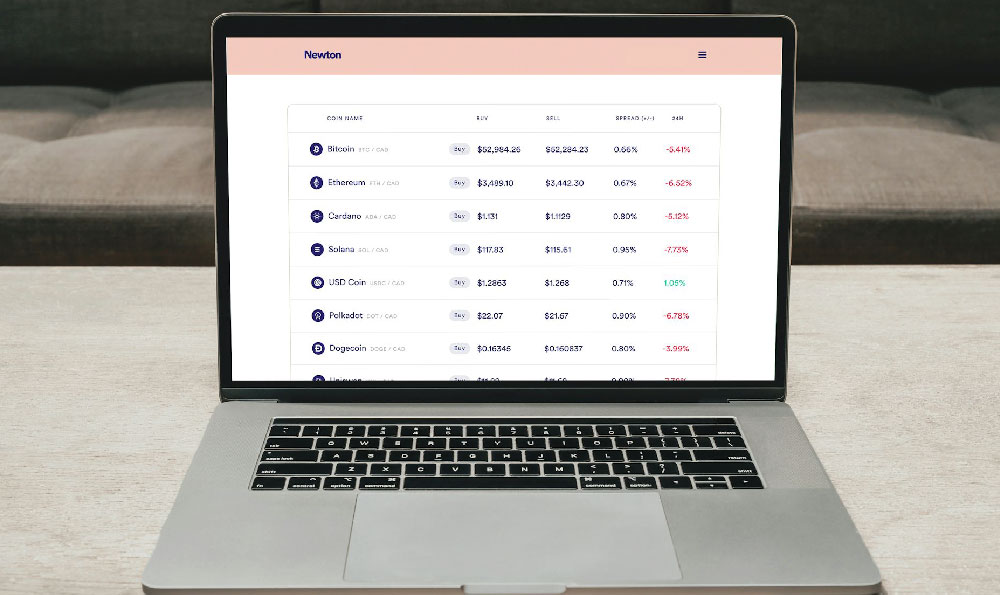

Therefore, before investing a single dollar, dedicate time to educating yourself. Explore the fundamental concepts of blockchain technology, the different types of cryptocurrencies (Bitcoin, Ethereum, altcoins), and the various factors that influence their price fluctuations. Understand the differences between proof-of-work and proof-of-stake consensus mechanisms, and the implications of tokenomics on long-term value. Numerous online resources, reputable books, and even some well-structured courses can provide a solid foundation of knowledge.

Once you have a grasp of the basics, delve into technical analysis. This involves studying historical price charts, identifying patterns, and utilizing various indicators to predict future price movements. Tools like moving averages, relative strength index (RSI), and Fibonacci retracements can provide valuable insights, but remember that technical analysis is not foolproof. It's a tool that enhances decision-making, not a crystal ball that guarantees profits.

Fundamental analysis is equally important. This involves evaluating the intrinsic value of a cryptocurrency based on factors such as its adoption rate, team credibility, technological innovation, and real-world applications. Projects with strong fundamentals are more likely to withstand market volatility and deliver long-term returns.

Furthermore, diversification is crucial. Don't put all your eggs in one basket. Spread your investments across a range of cryptocurrencies to mitigate risk. This could involve allocating a portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, while also exploring promising altcoins with innovative use cases.

Beyond direct investment, consider exploring alternative income streams within the cryptocurrency ecosystem. Staking, for instance, involves holding certain cryptocurrencies in a wallet to support the network and earn rewards. Lending platforms allow you to lend your cryptocurrencies to borrowers and earn interest. Yield farming involves providing liquidity to decentralized exchanges (DEXs) and earning transaction fees. However, these activities also carry risks, such as impermanent loss in yield farming and potential smart contract vulnerabilities.

Another option is engaging in cryptocurrency trading. This involves actively buying and selling cryptocurrencies to capitalize on short-term price fluctuations. Day trading, swing trading, and arbitrage are some of the common trading strategies. However, trading requires significant time, skill, and discipline. It's not for the faint of heart and should only be undertaken after thorough preparation and with a risk management plan in place.

Cryptocurrency mining, the process of verifying and adding new transactions to the blockchain, can also generate income. However, mining requires specialized hardware and significant energy consumption, making it less accessible to the average individual. Cloud mining, where you rent computing power from a third-party provider, is an alternative, but it also carries risks, such as potential scams and lower profitability.

Beyond cryptocurrency, numerous other avenues exist for generating income without a traditional job. The gig economy offers a plethora of opportunities for freelance work, such as writing, editing, graphic design, web development, and virtual assistance. Online platforms like Upwork, Fiverr, and Guru connect freelancers with clients seeking specific skills.

Creating and selling digital products, such as e-books, online courses, and software applications, can also be a lucrative option. Building an online audience through blogging, vlogging, or social media can generate income through advertising, sponsorships, and affiliate marketing.

Real estate investing, while requiring significant capital, can generate passive income through rental properties. Peer-to-peer lending platforms allow you to lend money to individuals and businesses and earn interest. Investing in dividend-paying stocks can provide a steady stream of income.

Regardless of the chosen path, a critical element of success is financial literacy. Understand your income and expenses, create a budget, and track your progress. Learn about taxes and other financial obligations. Develop a savings and investment strategy.

Crucially, be wary of scams and get-rich-quick schemes. The internet is rife with fraudulent opportunities that promise easy money but ultimately leave you with nothing. Always do your due diligence, research any investment opportunity thoroughly, and be skeptical of anything that sounds too good to be true. Never invest more than you can afford to lose.

Making money without a job is possible, but it requires dedication, discipline, and a willingness to learn and adapt. It's not a passive pursuit; it's an active endeavor that demands constant effort and attention. By combining sound financial principles, strategic investing, and a proactive approach, you can create a sustainable income stream and achieve financial independence. Remember to always prioritize risk management and protect your capital. Success in this arena is not about getting rich quick; it's about building wealth steadily and responsibly over the long term.