The allure of quick riches often surrounds the crypto market, and the question of whether it’s possible to make money, and whether that pursuit is actually worthwhile, is a complex one that demands a nuanced understanding. The simple answer is yes, it’s absolutely possible, but the reality is far more intricate than the hype suggests.

Let's first address the "is it possible?" aspect. Historically, cryptocurrency has created significant wealth for some investors. Early adopters of Bitcoin, Ethereum, and other now-established projects have seen astronomical returns on their investments. The emergence of DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and the ever-evolving metaverse continue to present new avenues for potential profit. Trading cryptocurrencies, participating in staking programs, lending out crypto assets, and actively engaging in DeFi protocols are all potential routes to generating income.

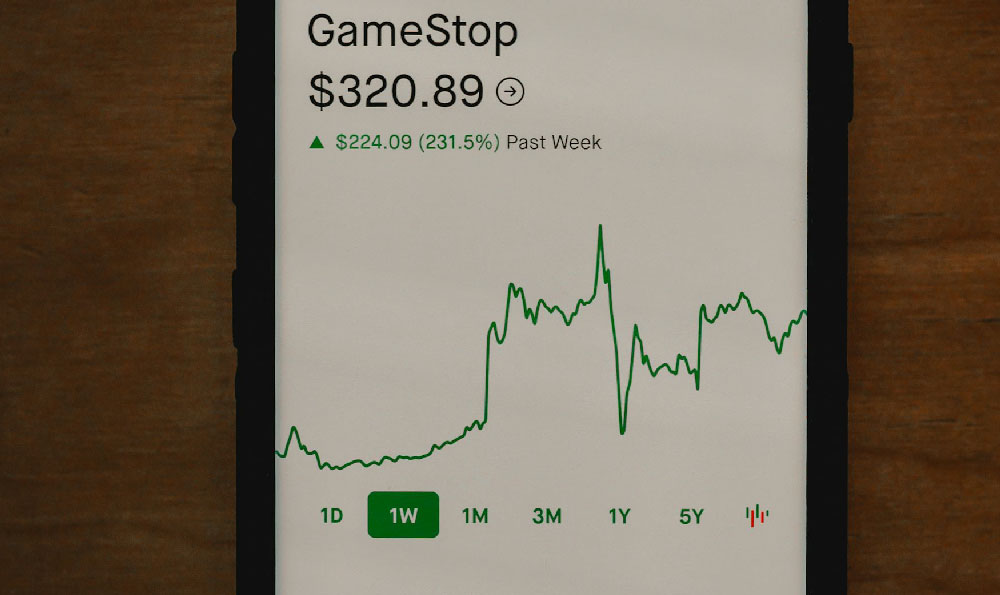

However, the key word is "potential." The crypto market is notoriously volatile. Prices can swing dramatically in short periods, and what appears to be a promising investment can quickly turn sour. The inherent risks are amplified by the prevalence of scams, rug pulls (where developers abandon a project after raising funds), and market manipulation. News events, regulatory announcements, and even influential tweets can trigger massive price fluctuations, leaving inexperienced investors vulnerable to significant losses.

The "is it worth it?" question delves into a more personal evaluation. Worth is subjective and depends heavily on individual risk tolerance, financial goals, and time commitment. Investing in crypto is not a passive activity. It requires constant monitoring, research, and a willingness to adapt to rapidly changing market conditions.

For some, the potential rewards outweigh the risks. They are willing to dedicate the time and effort necessary to understand the underlying technology, analyze market trends, and develop a well-defined investment strategy. They recognize the inherent volatility and are prepared to weather the storms. For others, the high stress and uncertainty associated with crypto investing may not be worth the potential gains. They may prefer more stable and predictable investment options, even if the returns are lower.

A crucial element in determining whether crypto investing is worthwhile is understanding the principles of risk management. Never invest more than you can afford to lose. Diversification is essential; spreading your investments across different cryptocurrencies and asset classes can help mitigate losses. Thoroughly research any project before investing, paying close attention to the team behind it, the technology, the tokenomics (how the token is distributed and used), and the community support. Avoid falling prey to hype and FOMO (fear of missing out). A sustainable investment strategy is built on rational analysis and a long-term perspective, not emotional impulses.

Beyond the financial risks, consider the ethical implications. Some cryptocurrencies are energy-intensive to mine, contributing to environmental concerns. Others may be used for illicit activities, raising questions about the social responsibility of investing in them. Being aware of these issues and making informed choices that align with your values is a critical aspect of responsible crypto investing.

Furthermore, the learning curve can be steep. Understanding blockchain technology, cryptography, and the intricacies of various crypto projects requires a significant investment of time and effort. There are numerous resources available online, but navigating the information landscape and discerning credible sources from misleading ones can be challenging. Joining reputable online communities and seeking guidance from experienced investors can be helpful, but always maintain a healthy dose of skepticism and do your own due diligence.

Ultimately, making money in crypto is possible, but it’s not a guarantee. It demands a calculated approach, a deep understanding of the risks involved, and a willingness to learn and adapt. It’s not a get-rich-quick scheme, but a potentially rewarding avenue for financial growth for those who are prepared to put in the necessary work. Whether it's worth it is a deeply personal question that requires honest self-assessment and a clear understanding of your own financial goals and risk tolerance. Before venturing into the crypto market, it's wise to consult with a qualified financial advisor who can help you assess your situation and develop a sound investment strategy that aligns with your individual needs and circumstances. Remember, knowledge, discipline, and a long-term perspective are the keys to navigating the complexities of the crypto world and potentially achieving financial success.