Okay, I understand. Here's an article responding to the query "How did Jasmine Crockett make money, and what strategies did she use?", written from an investment/financial perspective and aiming for comprehensive coverage without using bullet points or numbered lists, nor the title directly. The output is in English.

Jasmine Crockett's rise from civil rights attorney to U.S. Representative for Texas's 30th congressional district is a compelling story of public service, but beyond her political career, questions naturally arise about her financial background. Understanding how individuals, particularly those in the public eye, accumulate wealth provides valuable insights into potential opportunities and strategies, although it's crucial to remember that everyone's financial situation is unique and what works for one person may not work for another.

While readily available information regarding the minute details of Crockett's personal finances might be limited due to privacy and disclosure regulations for public officials, we can analyze the common pathways individuals in similar positions often leverage to build wealth. Generally, income streams for individuals in fields like law and politics come from a combination of sources.

Before entering politics, Crockett was a practicing attorney. Lawyers, depending on their specialization and firm affiliation, can earn substantial incomes. Civil rights law, while deeply rewarding, might not be the most lucrative area in the legal field. However, building a successful practice, attracting clients, and winning cases can certainly generate a comfortable income and contribute to long-term wealth accumulation. Success in law often hinges on a combination of factors: exceptional legal skills, strong networking abilities, and a reputation for integrity and successful outcomes. The profits from a law practice, if managed effectively, can be channeled into various investment vehicles.

Transitioning to politics, the primary source of income shifts to a government salary. While Congressional salaries are publicly available, they are often just one piece of the financial puzzle. Many politicians have pre-existing assets or continue to engage in activities that generate income outside of their official duties. These could include book deals, speaking engagements, or investments in real estate or the stock market.

Investment is a cornerstone of wealth building for many professionals. Real estate, in particular, has historically been a popular choice. Owning property, whether for personal use or as a rental income source, can offer both appreciation in value and consistent cash flow. The savvy investor diversifies their real estate portfolio, considering factors like location, property type, and market conditions. Leveraging mortgages strategically can further amplify returns, although it also introduces an element of risk.

The stock market presents another avenue for wealth creation. Investing in stocks, bonds, and mutual funds allows individuals to participate in the growth of companies and the overall economy. A diversified portfolio, spread across different asset classes and sectors, is generally considered a prudent approach to mitigate risk. Understanding fundamental investment principles, such as the importance of long-term investing and the benefits of dollar-cost averaging, is crucial for success in the stock market. Seeking advice from qualified financial advisors can also be beneficial, especially for those who are new to investing or who have complex financial situations.

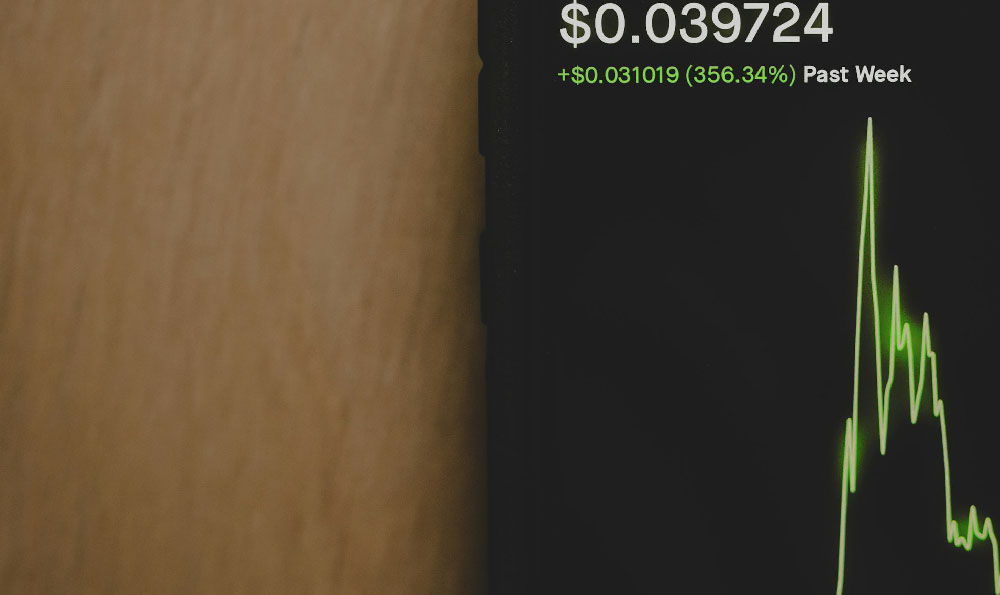

Beyond traditional investments, some individuals explore alternative asset classes, such as private equity, venture capital, or even cryptocurrency. These investments often carry higher risks but also offer the potential for higher returns. However, thorough due diligence and a strong understanding of the underlying asset are essential before investing in these areas.

Financial discipline is paramount, regardless of income level or investment strategy. Creating a budget, tracking expenses, and avoiding unnecessary debt are crucial for building a solid financial foundation. Saving a portion of income regularly, even a small amount, can accumulate significantly over time. The power of compound interest allows investments to grow exponentially, accelerating the wealth-building process. Tax planning is another important aspect of financial management. Understanding tax laws and utilizing tax-advantaged investment accounts, such as 401(k)s or IRAs, can significantly reduce tax liabilities and increase overall wealth.

In the context of someone in public service, it's important to remember that transparency and ethical conduct are paramount. Public officials are often subject to strict disclosure requirements regarding their financial holdings and potential conflicts of interest. Adhering to these regulations is essential for maintaining public trust and ensuring that decisions are made in the best interests of the constituents they serve.

Ultimately, building wealth is a multifaceted process that requires a combination of factors: earning potential, investment savvy, financial discipline, and a bit of luck. While the specifics of anyone's financial journey are unique, understanding the fundamental principles of wealth creation can empower individuals to make informed decisions and pursue their financial goals. While information specific to the individual mentioned at the start is limited and should be gathered from reputable, verified sources, these general principles offer a framework for understanding potential pathways to financial success for people in similar positions. It is vital to remember that this is not financial advice and seeking personalized guidance from a qualified professional is always recommended.