In the intricate world of finance, the pursuit of profitable investments is a constant endeavor. Individuals and institutions alike are perpetually seeking avenues to grow their capital, secure their financial future, and potentially achieve financial independence. However, the landscape of investment opportunities is vast and often complex, demanding a nuanced understanding of market dynamics, risk tolerance, and long-term financial goals. To navigate this terrain effectively, it is crucial to identify asset classes that historically demonstrate profit-generating potential and to understand the specific factors influencing their performance. Furthermore, discerning the optimal investment platforms and strategies for maximizing returns while mitigating risk is paramount.

Identifying Potential Profit-Generating Investments

Numerous investment options can generate profit, each with its own risk-reward profile. The suitability of a particular investment hinges on individual circumstances and financial objectives. Here's an overview of some key asset classes:

-

Stocks: Investing in stocks, or equities, represents ownership in a company. Stocks have historically offered high returns over the long term, reflecting the growth and profitability of the underlying businesses. However, stock prices can be volatile, subject to market fluctuations, economic cycles, and company-specific news. Diversifying across different sectors and industries can help mitigate risk. Growth stocks offer the potential for high capital appreciation, while dividend-paying stocks provide a stream of income.

-

Bonds: Bonds are debt instruments issued by governments or corporations. They typically offer a fixed rate of return over a specified period. Bonds are generally considered less risky than stocks, as they represent a contractual obligation to repay the principal amount along with interest. However, bond yields are typically lower than stock returns. Government bonds are considered safer than corporate bonds, but corporate bonds offer higher yields to compensate for the increased risk of default. Interest rate fluctuations can also impact bond prices; rising interest rates can lead to a decline in bond values.

-

Real Estate: Real estate can provide both rental income and capital appreciation. Investing in residential or commercial properties can be a tangible asset that appreciates over time. Rental income provides a consistent cash flow, while property values can increase due to factors such as population growth, infrastructure development, and economic prosperity. However, real estate investments require significant capital and involve property management responsibilities. Market downturns can also impact property values and rental income. Real Estate Investment Trusts (REITs) offer an alternative way to invest in real estate without directly owning property.

-

Commodities: Commodities are raw materials such as oil, gold, and agricultural products. Commodity prices are influenced by supply and demand dynamics, geopolitical events, and global economic conditions. Investing in commodities can provide diversification and hedge against inflation. However, commodity prices can be highly volatile and require specialized knowledge to navigate effectively. Investors can gain exposure to commodities through futures contracts, exchange-traded funds (ETFs), or by investing in companies involved in commodity production.

-

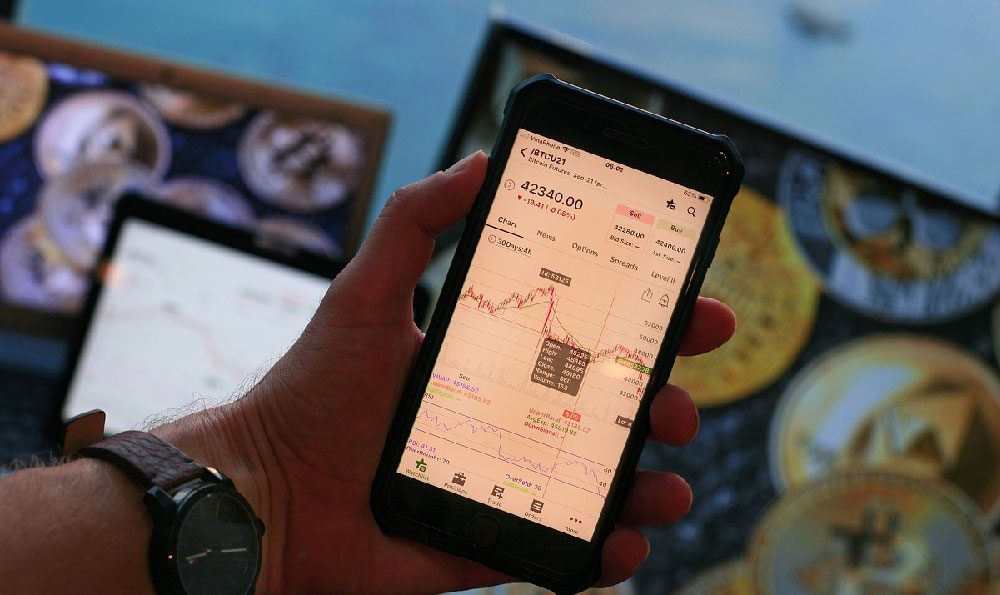

Cryptocurrencies: Cryptocurrencies, such as Bitcoin and Ethereum, have emerged as a new asset class with the potential for high returns. Cryptocurrencies are decentralized digital currencies that operate on blockchain technology. They offer the potential for rapid price appreciation but are also subject to extreme volatility and regulatory uncertainty. Investing in cryptocurrencies requires a high-risk tolerance and thorough understanding of the technology and market dynamics. It is crucial to invest only what you can afford to lose.

Strategic Avenues for Investment and Return Optimization

The selection of the appropriate investment platform is integral to achieving financial objectives. Here are some prevalent methods for investment:

-

Brokerage Accounts: Brokerage accounts offer access to a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Full-service brokerage firms provide investment advice and personalized financial planning services, while discount brokers offer lower commissions but less support. The choice depends on individual investment needs and expertise.

-

Retirement Accounts: Retirement accounts, such as 401(k)s and IRAs, offer tax advantages for long-term investing. Contributions to traditional retirement accounts are tax-deductible, while earnings grow tax-deferred. Roth retirement accounts offer tax-free withdrawals in retirement. These accounts are designed to encourage saving for retirement and provide a structured framework for long-term investment.

-

Robo-Advisors: Robo-advisors are automated investment platforms that provide portfolio management services based on individual risk profiles and financial goals. They use algorithms to construct and manage diversified portfolios, often at a lower cost than traditional financial advisors. Robo-advisors are suitable for investors who prefer a hands-off approach and are comfortable with technology.

-

Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers directly with lenders, bypassing traditional financial institutions. Investors can earn interest income by lending money to individuals or businesses. P2P lending can offer higher returns than traditional fixed-income investments, but it also involves the risk of borrower default. Thorough due diligence is essential before investing in P2P loans.

-

Alternative Investments: Alternative investments encompass a broad range of assets that are not typically traded on public markets, such as private equity, hedge funds, and venture capital. These investments can offer the potential for high returns but are also illiquid and require specialized knowledge. Alternative investments are generally suitable for sophisticated investors with a long-term investment horizon.

Mitigating Risks and Protecting Investments

Successful investment involves not only maximizing returns but also managing risk effectively. Here are some essential strategies for protecting your investments:

-

Diversification: Diversification is the cornerstone of risk management. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of any single investment on their overall portfolio. Diversification does not guarantee profits or prevent losses, but it can help to cushion the blow during market downturns.

-

Due Diligence: Thorough research is essential before investing in any asset. Understand the risks and potential rewards of each investment, and carefully evaluate the financial health and management team of the companies you invest in. Seek independent advice from qualified professionals when needed.

-

Risk Tolerance Assessment: Understand your own risk tolerance and invest accordingly. Risk tolerance is the degree of volatility you are willing to accept in your portfolio. Conservative investors should focus on lower-risk investments, while more aggressive investors may be comfortable with higher-risk investments.

-

Long-Term Perspective: Investing is a long-term endeavor. Avoid making impulsive decisions based on short-term market fluctuations. Stay focused on your long-term financial goals and resist the urge to time the market.

-

Stay Informed: Keep abreast of market trends, economic developments, and regulatory changes that may impact your investments. Regularly review your portfolio and adjust your investment strategy as needed.

-

Professional Advice: Seek advice from qualified financial advisors who can provide personalized guidance and help you develop a comprehensive financial plan. A financial advisor can help you assess your risk tolerance, set realistic financial goals, and create an investment strategy that aligns with your individual circumstances.

In conclusion, generating profit through investments requires a well-informed and strategic approach. By understanding the characteristics of different asset classes, selecting appropriate investment platforms, and mitigating risks effectively, individuals can enhance their prospects for financial growth and security. Always remember that investing involves risk, and there are no guarantees of profit. Thorough research, careful planning, and a long-term perspective are essential for success.