Investing in emerging technologies like DeepSeek, a name increasingly associated with advancements in AI and potentially blockchain-related projects (depending on its specific application), demands a measured and informed approach. Before diving into any specific investment strategy, it's crucial to understand the landscape of opportunities presented by companies operating in these fields, and to rigorously assess your own risk tolerance and investment goals.

The initial step involves understanding the nature of DeepSeek, which for the purpose of this response, we will assume is a hypothetical or newly emergent entity operating in the intersection of artificial intelligence and potentially blockchain technologies. Is it a publicly traded company? Is it a pre-IPO startup seeking funding through venture capital? Or is it a cryptocurrency or token associated with a specific project? The answer to these questions will drastically alter the available investment avenues and the associated risks.

If DeepSeek is a publicly traded company, traditional investment strategies apply. Thoroughly analyze the company's financial statements (if available). Look at revenue growth, profitability, debt levels, and cash flow. Compare these metrics to its competitors in the AI and/or blockchain space. Analyze its management team and their track record. Read industry reports and analyst opinions to gauge the company's potential for future growth. Use discounted cash flow analysis or other valuation methods to determine a fair price for the stock. Remember, even seemingly promising companies can be overvalued by the market. Diversification is your friend here. Don't put all your eggs in one basket, even if you believe strongly in DeepSeek's potential.

If DeepSeek is a pre-IPO startup seeking funding, the investment landscape becomes significantly more complex and riskier. Access to such investments is typically limited to accredited investors or venture capital funds. If you qualify, due diligence is paramount. Investigate the company's business model, its competitive landscape, its management team, and its potential market size. Understand the terms of the investment, including valuation, liquidation preferences, and voting rights. Be prepared to tie up your capital for several years, as it can take a long time for a startup to go public or be acquired. The vast majority of startups fail, so allocate only a small percentage of your portfolio to such high-risk, high-reward ventures. Understand that liquidity will be extremely limited or nonexistent during this period.

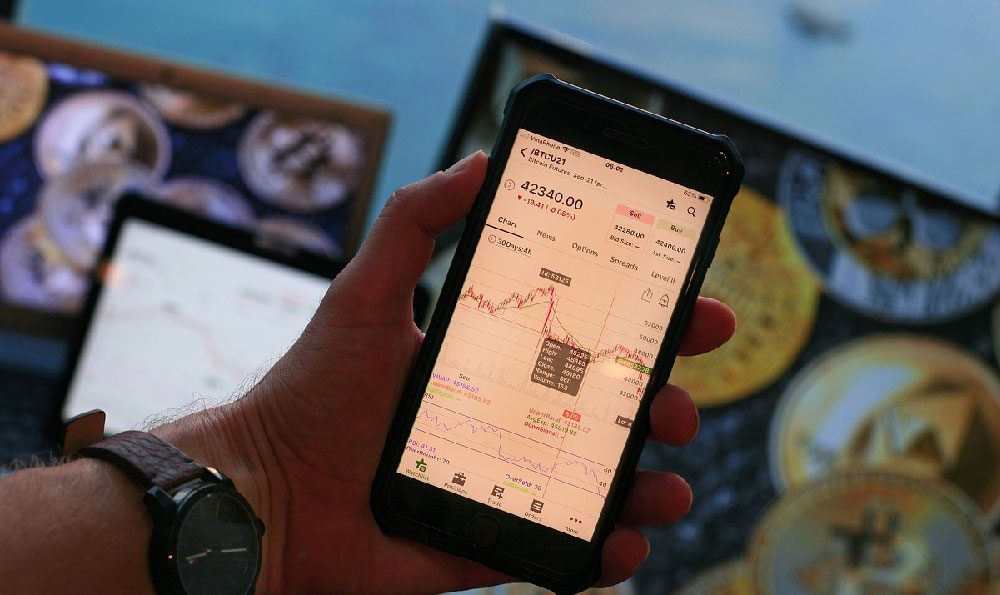

If DeepSeek is a cryptocurrency or token, a completely different set of considerations apply. The cryptocurrency market is notoriously volatile and speculative. The intrinsic value of many cryptocurrencies is difficult to assess, and prices can be driven by hype and speculation rather than fundamental factors. Understand the technology underlying the cryptocurrency or token. What problem does it solve? Is there a clear use case? How does it compare to other cryptocurrencies in the same space? Scrutinize the project's whitepaper and team. Are the claims realistic? Are the team members experienced and credible? Be wary of projects that promise unrealistic returns or lack transparency. Given the risk of scams and fraud in the cryptocurrency market, it is imperative to exercise extreme caution. Only invest what you can afford to lose, and be prepared for the possibility of a total loss of your investment. Secure your cryptocurrency holdings with strong passwords and two-factor authentication, and consider using a hardware wallet for added security. Also, be keenly aware of tax implications related to cryptocurrency investments, as regulations vary by jurisdiction.

Regardless of the specific investment vehicle, it's crucial to understand the risks involved. The AI and blockchain sectors are rapidly evolving, and technological advancements can quickly render existing technologies obsolete. Regulatory uncertainty is another significant risk factor. Governments around the world are still grappling with how to regulate these technologies, and new regulations could have a significant impact on the value of investments. Competition is fierce, and even companies with promising technologies can struggle to gain market share. Market sentiment can also play a significant role in investment performance. Even well-funded and well-managed companies can see their stock prices decline due to broader market downturns or changes in investor sentiment.

So, is investing in DeepSeek right for you? This depends entirely on your individual circumstances, risk tolerance, and investment goals. If you are a conservative investor with a low risk tolerance, investing in a pre-IPO startup or a speculative cryptocurrency is probably not a good idea. If you are a more aggressive investor with a higher risk tolerance, you may be willing to allocate a small percentage of your portfolio to such investments, but only after conducting thorough due diligence and understanding the risks involved.

In conclusion, approaching investments in companies like DeepSeek, especially in nascent technologies like AI and blockchain, requires a multi-faceted strategy that prioritizes knowledge, risk assessment, and diversification. Understand the underlying technology, rigorously analyze the investment vehicle, and align your investment with your financial goals. Above all, exercise caution and avoid making emotional decisions. The key is to approach the opportunity with a clear understanding of the potential rewards and, more importantly, the inherent risks. A calculated and informed approach is the best way to navigate the complexities of investing in this dynamic field.