Investing in the realm of cryptocurrencies often evokes a feeling of walking a tightrope between immense potential gains and the very real possibility of significant losses. The question, “Investing: Risk or Reward?” isn’t a simple either/or proposition. It's a complex equation heavily influenced by individual circumstances, market dynamics, and the investor's understanding of the underlying technology and economic principles at play.

Understanding the Landscape: What Drives Crypto's Volatility?

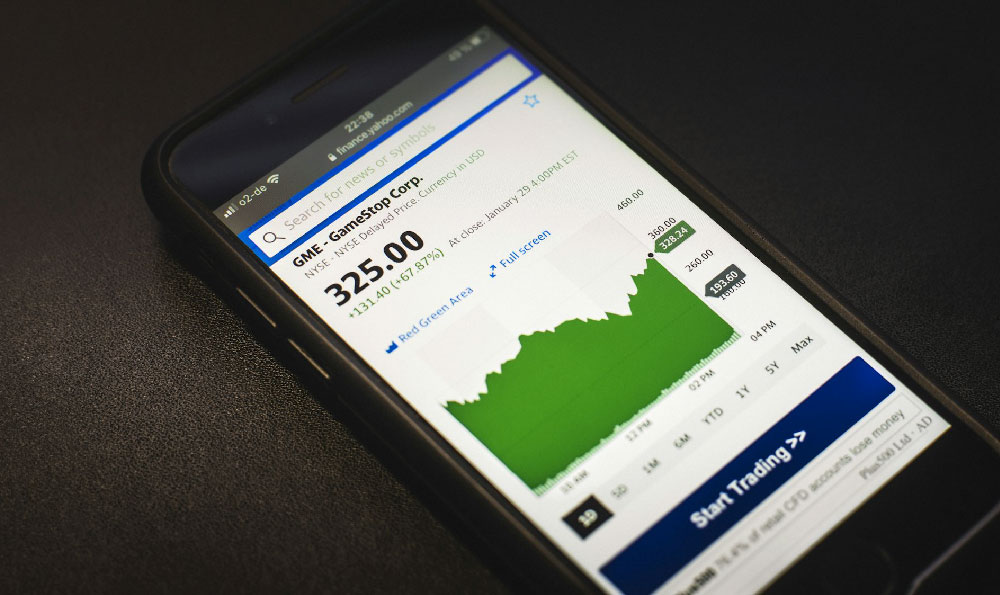

Cryptocurrencies, unlike traditional assets like stocks or bonds, operate in a relatively nascent and unregulated market. This inherent lack of oversight, while appealing to some due to its decentralized nature, contributes significantly to its volatility. Price swings can be dramatic and swift, driven by factors such as regulatory announcements, technological advancements (or failures), shifts in market sentiment, and even social media trends.

Another key element is the supply and demand dynamic. Many cryptocurrencies have a fixed or limited supply, designed to mimic the scarcity of precious metals like gold. When demand increases, the limited supply can lead to rapid price appreciation. Conversely, a decrease in demand can trigger a sharp decline. Speculation also plays a substantial role. The belief that a particular cryptocurrency will increase in value in the future can drive prices higher, regardless of its current utility or real-world adoption. This speculative element can create bubbles, which inevitably burst, leaving those who bought in at the peak with significant losses.

Furthermore, the technological complexities of blockchain technology and the underlying cryptography can be daunting for new investors. A lack of understanding of how these systems work can make it difficult to assess the true value of a cryptocurrency and identify potential risks.

Risk Mitigation Strategies: Protecting Your Investment

While the risks associated with cryptocurrency investing are undeniable, they can be mitigated through careful planning and execution. The following strategies are crucial for protecting your investment:

-

Due Diligence is Paramount: Never invest in a cryptocurrency without thoroughly researching its underlying technology, team, and use case. Read the whitepaper, analyze the project's roadmap, and assess the community's involvement. Look for evidence of real-world adoption and a clear value proposition. Understand who created the cryptocurrency, what problem it aims to solve, and how it plans to achieve its goals. Avoid cryptocurrencies with vague promises, unrealistic expectations, or a lack of transparency. Scrutinize the team behind the project. Are they experienced and reputable? Are they transparent about their identities and backgrounds?

-

Diversification is Key: Don't put all your eggs in one basket. Spreading your investments across multiple cryptocurrencies can reduce your overall risk. While one cryptocurrency may experience a decline, others may perform well, offsetting the losses. Consider diversifying across different types of cryptocurrencies, such as those focused on payments, decentralized finance (DeFi), or non-fungible tokens (NFTs).

-

Start Small and Scale Gradually: Begin with a small amount of capital that you are comfortable losing. As you gain experience and knowledge, you can gradually increase your investment. This approach allows you to learn the ropes without risking a significant portion of your savings. Avoid the temptation to invest a large sum of money upfront, especially when prices are surging.

-

Understand Your Risk Tolerance: Be honest with yourself about how much risk you are willing to take. If you are risk-averse, you may want to stick to more established cryptocurrencies with a longer track record. If you are more comfortable with risk, you may be willing to invest in newer, more speculative projects.

-

Use Stop-Loss Orders: A stop-loss order automatically sells your cryptocurrency when it reaches a certain price, limiting your potential losses. This is a crucial tool for managing risk, especially in a volatile market. Determine a price point at which you are willing to cut your losses and set a stop-loss order accordingly.

-

Secure Your Crypto Assets: Cryptocurrencies are vulnerable to theft and hacking. Store your crypto assets in a secure wallet, such as a hardware wallet or a reputable software wallet with strong security features. Enable two-factor authentication (2FA) on your accounts and be wary of phishing scams.

-

Stay Informed and Adapt: The cryptocurrency market is constantly evolving. Stay up-to-date on the latest news, trends, and regulations. Be prepared to adjust your investment strategy as needed. Follow reputable news sources, attend industry events, and engage with the cryptocurrency community.

The Allure of Reward: Understanding the Potential Upside

Despite the inherent risks, the potential rewards of cryptocurrency investing can be significant. Cryptocurrencies have the potential to generate substantial returns, far exceeding those of traditional investments. The early adopters of Bitcoin, for example, have seen their investments increase exponentially.

Furthermore, cryptocurrencies offer diversification benefits. They are often uncorrelated with traditional assets, meaning that their price movements are not necessarily tied to the stock market or the economy. This can make them a valuable addition to a diversified portfolio.

Beyond financial gains, cryptocurrencies have the potential to revolutionize various industries, from finance to healthcare to supply chain management. Investing in cryptocurrencies allows you to support these innovative technologies and participate in the future of the digital economy.

A Balanced Perspective: Risk Management and Opportunity

The decision of whether to invest in cryptocurrencies should be based on a careful assessment of your individual circumstances, risk tolerance, and investment goals. It's essential to approach this market with a balanced perspective, acknowledging the risks while recognizing the potential rewards. Through diligent research, prudent risk management, and a long-term investment horizon, you can navigate the complexities of the cryptocurrency market and potentially achieve significant financial gains. However, remember that past performance is not indicative of future results, and all investments carry risk. Consult with a qualified financial advisor before making any investment decisions. The key is to be informed, be prepared, and invest responsibly.