Investment bonds, often misunderstood as a monolithic asset class, encompass a broad range of fixed-income securities that can play a pivotal role in a well-diversified investment portfolio. Understanding their nuances, benefits, and potential risks is crucial for anyone looking to enhance their financial security and achieve long-term investment goals. Let's delve into the world of investment bonds, exploring what they are, how to invest in them, and the factors to consider before allocating your capital.

At their core, investment bonds represent a debt instrument where an investor loans money to an entity (be it a government, municipality, or corporation) for a defined period, in exchange for regular interest payments and the return of the principal amount at maturity. These payments, often referred to as coupon payments, provide a predictable income stream, making bonds an attractive option for income-seeking investors or those nearing retirement. The issuer, in turn, utilizes the borrowed funds for various purposes, such as funding infrastructure projects, managing government budgets, or expanding business operations.

The types of investment bonds available are diverse, each with its own risk-return profile. Government bonds, issued by national governments, are generally considered to be the safest due to the government's power to tax and print money. Examples include U.S. Treasury bonds, German Bunds, and Japanese Government Bonds (JGBs). These bonds often serve as a benchmark for other fixed-income securities and are favored by risk-averse investors. Municipal bonds, issued by state and local governments, are another type, often offering tax advantages, particularly for investors residing in the issuing state. This tax-exempt status can significantly enhance their after-tax yield, making them appealing to high-income earners. Corporate bonds, issued by companies, carry a higher degree of risk compared to government bonds, reflecting the possibility of the company defaulting on its debt obligations. To compensate for this increased risk, corporate bonds typically offer higher yields. The credit rating of a corporate bond, assigned by rating agencies like Moody's and Standard & Poor's, provides an assessment of its creditworthiness, with higher ratings indicating lower risk. Finally, there are specialized bonds like inflation-linked bonds, which provide protection against inflation by adjusting their principal value or interest payments based on changes in inflation indices.

Investing in bonds can be approached through several avenues. Direct purchase is one option, where investors buy individual bonds through a broker or directly from the issuer. This allows for greater control over the specific bonds held in the portfolio, enabling investors to tailor their investments to match their specific risk tolerance and investment goals. However, it requires a thorough understanding of bond valuation, credit analysis, and market dynamics. Another option is investing through bond mutual funds or exchange-traded funds (ETFs). These funds pool money from multiple investors to purchase a diversified portfolio of bonds, offering instant diversification and professional management. Bond funds come in various flavors, targeting different maturities, credit qualities, and sectors of the bond market. This makes them suitable for investors with varying risk appetites and investment objectives. For instance, a high-yield bond fund may offer higher returns but also carries greater risk due to its focus on lower-rated corporate bonds.

Before venturing into bond investments, several critical factors warrant careful consideration. Interest rate risk is paramount. Bond prices and interest rates have an inverse relationship: when interest rates rise, bond prices tend to fall, and vice versa. This is because newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. The longer the maturity of a bond, the greater its sensitivity to interest rate changes. Credit risk, as mentioned earlier, refers to the possibility of the issuer defaulting on its debt obligations. This risk is particularly relevant for corporate bonds, especially those with lower credit ratings. Investors should carefully assess the creditworthiness of the issuer before investing, taking into account factors such as its financial health, industry outlook, and management quality. Inflation risk erodes the purchasing power of fixed income streams. While inflation-linked bonds offer some protection, traditional bonds are vulnerable to this risk, especially during periods of high inflation. Investors should consider the potential impact of inflation on their bond investments and adjust their portfolios accordingly. Liquidity risk refers to the ease with which a bond can be bought or sold in the market. Some bonds, particularly those issued by smaller companies or those with lower trading volumes, may be difficult to sell quickly without incurring significant losses.

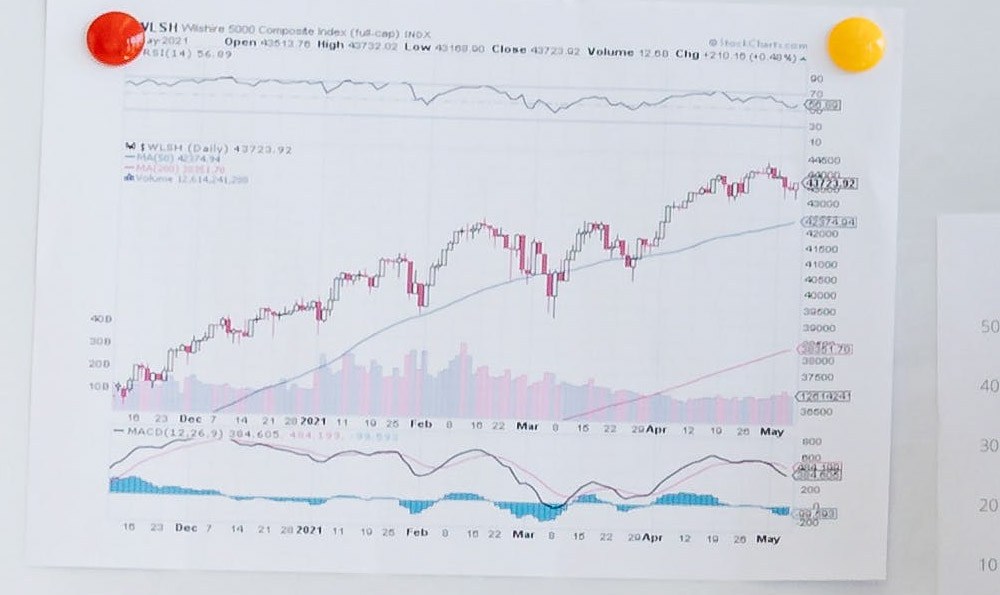

Building a bond portfolio involves strategic asset allocation, considering your investment goals, time horizon, and risk tolerance. If you are nearing retirement and seeking a stable income stream, a portfolio of high-quality government and corporate bonds with shorter maturities may be appropriate. If you have a longer time horizon and are willing to take on more risk, you may consider including a portion of higher-yielding corporate bonds or emerging market bonds in your portfolio. Diversification is key to mitigating risk. Diversifying across different types of bonds, maturities, and issuers can help to reduce the overall volatility of the portfolio. Regularly reviewing and rebalancing the portfolio is also essential to ensure that it remains aligned with your investment goals and risk tolerance. Market conditions change constantly, and adjustments may be necessary to maintain the desired asset allocation.

In conclusion, investment bonds represent a versatile asset class that can play a crucial role in achieving financial goals. By understanding the different types of bonds, the various ways to invest in them, and the key factors to consider, investors can make informed decisions and construct a well-diversified bond portfolio that aligns with their individual needs and circumstances. While not a guaranteed path to riches, a judiciously constructed bond allocation can provide stability, income, and a crucial buffer against the volatility of other asset classes, ultimately contributing to a more secure and prosperous financial future. Remember to consult with a qualified financial advisor before making any investment decisions.