Leveraging debt for profit in the realm of cryptocurrency investments is a high-stakes game that demands a profound understanding of financial principles, risk management, and the inherently volatile nature of the crypto market. It's not simply about borrowing money to buy more coins; it's about strategically employing debt to amplify potential gains while meticulously mitigating the amplified risks. Approaching this with a cavalier attitude is a surefire path to financial ruin.

The fundamental concept is simple: borrow money at a certain interest rate and invest it in an asset that is expected to yield a higher return. The difference between the return on investment and the cost of borrowing constitutes the profit. However, applying this principle to cryptocurrencies injects layers of complexity and danger that are absent in more traditional investment avenues.

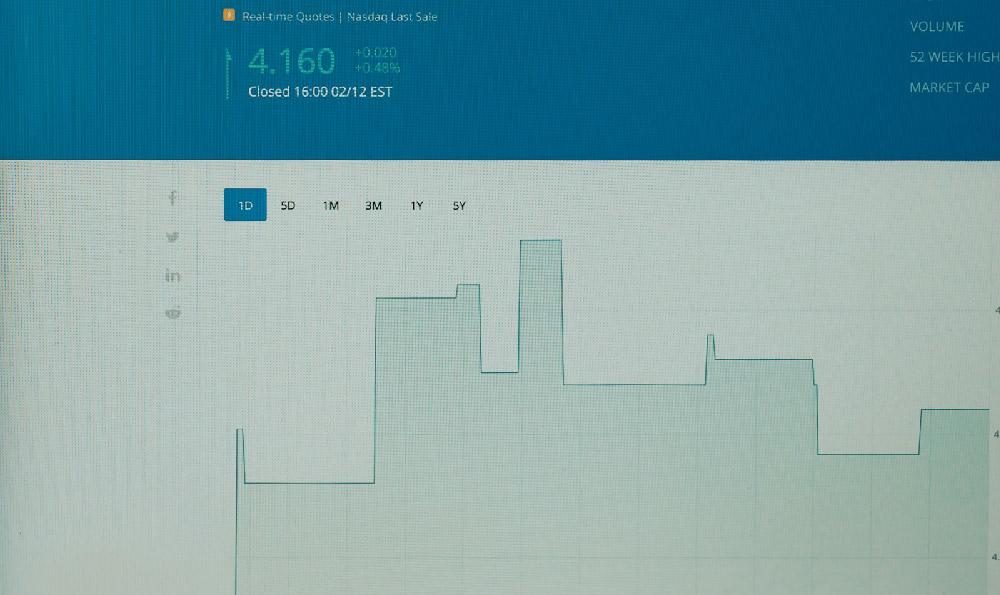

One primary area where debt can be used in the crypto space is margin trading on cryptocurrency exchanges. Margin trading allows investors to borrow funds from the exchange to increase their trading positions. For instance, with 10x leverage, an investor with $1,000 can control $10,000 worth of Bitcoin. If the price of Bitcoin increases by 10%, the investor makes a $1,000 profit (before fees and interest), effectively doubling their initial investment. The allure of such magnified returns is undeniable.

However, the flip side is equally compelling. If the price of Bitcoin drops by 10%, the investor loses their entire $1,000 initial investment. What’s worse, they are still liable for the borrowed amount and the associated interest. This phenomenon, known as liquidation, can happen extremely quickly in the volatile crypto market, often triggered by sudden market corrections or "flash crashes."

Furthermore, margin calls can further exacerbate the risk. If the market moves against the leveraged position, the exchange can issue a margin call, requiring the investor to deposit more funds to maintain the position. Failure to meet the margin call results in automatic liquidation, locking in losses and potentially leaving the investor with substantial debt. The speed at which these events can unfold in the 24/7 crypto market leaves little room for error or reaction.

Another way debt manifests in the crypto space is through crypto lending platforms. These platforms allow users to borrow cryptocurrency or fiat currency by using their existing crypto holdings as collateral. This can be useful for investors who want to access capital without selling their crypto assets, perhaps to pursue other investment opportunities or cover short-term expenses. However, the interest rates on these loans can be substantial, particularly for less established platforms or less liquid cryptocurrencies. Defaulting on these loans can lead to the loss of the collateralized crypto assets, negating any potential benefits of holding onto them.

Decentralized finance (DeFi) protocols also offer opportunities for leveraging debt, often through strategies like yield farming and liquidity provision. Investors can borrow stablecoins against their crypto assets and then use those stablecoins to participate in DeFi protocols that offer attractive yields. Again, while the potential rewards can be tempting, the risks are equally high. DeFi protocols are often complex and vulnerable to exploits, hacks, and "rug pulls," where the project developers suddenly abandon the project and abscond with user funds. Moreover, the regulatory landscape surrounding DeFi is still evolving, and there is a risk that regulatory actions could negatively impact the value of DeFi assets and protocols.

Before even considering leveraging debt in crypto, it's crucial to have a deep understanding of technical analysis, fundamental analysis, and market sentiment. Technical analysis involves studying price charts and technical indicators to identify potential trading opportunities. Fundamental analysis involves evaluating the underlying value of a cryptocurrency based on factors like its technology, adoption rate, and team. Market sentiment involves gauging the overall mood of the market, which can be influenced by news events, social media trends, and other factors.

Crucially, one must acknowledge that past performance is not indicative of future results. Just because a cryptocurrency has performed well in the past does not guarantee that it will continue to do so in the future. The crypto market is characterized by rapid innovation, evolving regulatory landscapes, and unpredictable events, all of which can significantly impact the value of cryptocurrencies.

Effective risk management is paramount when using debt for profit. This includes setting strict stop-loss orders to limit potential losses, diversifying investments across multiple cryptocurrencies, and avoiding over-leveraging. A general rule of thumb is never to risk more than you can afford to lose. Additionally, regularly re-evaluating your investment strategy and risk tolerance is critical, particularly in a rapidly changing market.

Beyond the financial risks, there are also psychological risks to consider. Leveraging debt can amplify emotions, leading to impulsive decisions and emotional trading. The fear of losing money can be overwhelming, and the temptation to chase profits can be equally dangerous. It's important to maintain a rational and disciplined approach to investing, even when faced with market volatility and emotional pressure.

Therefore, is debt a smart investment strategy in the volatile crypto market? The answer is a resounding "it depends." It can be a potentially lucrative tool for sophisticated investors with a deep understanding of the market, robust risk management strategies, and a disciplined approach. However, for inexperienced investors, or those who are easily swayed by emotions, leveraging debt in crypto is a recipe for disaster. It is akin to handing a loaded weapon to someone without proper training; the potential for harm far outweighs the potential for good. Always conduct thorough research, understand the risks involved, and never invest more than you can afford to lose. If unsure, seek advice from a qualified financial advisor.