Unlocking Financial Potential: Creative and Educational Paths for Children to Earn Money

Many children start by developing a strong foundation in financial management, which serves as a stepping stone to future wealth-building opportunities. Encouraging a habit of saving from an early age is one of the most effective strategies. Parents can guide their kids to open a savings account and teach them the importance of budgeting, even with small amounts. By setting aside a portion of their allowance or gifts, children learn discipline and appreciation for the value of money. Over time, these early savings can grow through compound interest, laying the groundwork for long-term financial growth.

Another effective approach is to engage in activities that require minimal financial investment but offer significant returns. For example, children can create and sell handmade crafts, such as bracelets or drawings, using materials they already have at home. This not only teaches them about entrepreneurship but also helps them understand the value of their creativity. Similarly, offering services like pet sitting, tutoring, or helping neighbors with small errands can be a practical way to earn income. These tasks often don’t require special skills, but they teach responsibility and the importance of contributing to others’ needs.

Exploring digital platforms can also open new avenues for children to earn money without traditional employment. Many online communities and marketplaces provide opportunities for young individuals to monetize their hobbies or talents. For instance, kids can start a YouTube channel to share educational videos, vlogs, or art, and earn revenue through ads, sponsorships, or affiliate marketing. While these ventures may seem complex, many successful creators began with simple ideas and gradually expanded their reach. It’s essential to emphasize safety and moderation, ensuring children understand the risks involved while enjoying the creative process.

Investing in education is a powerful way to build long-term financial potential. Parents can help their children set aside money for books, online courses, or workshops that align with their interests. For example, learning coding or graphic design through free platforms like Khan Academy or Coursera can equip young individuals with valuable skills for future careers. Even a modest monthly contribution to these resources can lead to significant personal growth and increased earning capacity down the line. By associating money with learning, children develop a mindset that sees financial resources as tools for self-improvement.

Parental involvement plays a crucial role in shaping a child’s approach to financial independence. Instead of treating money-making as a quick fix, parents can encourage a balanced perspective that values both earning and saving. For example, setting up a family budgeting game where children track their expenses and savings can make the concept more engaging. Additionally, assigning responsibilities like managing a small allowance or planning a budget for a school project helps children understand the practical aspects of handling money. These experiences not only teach financial skills but also foster a sense of accountability and independence.

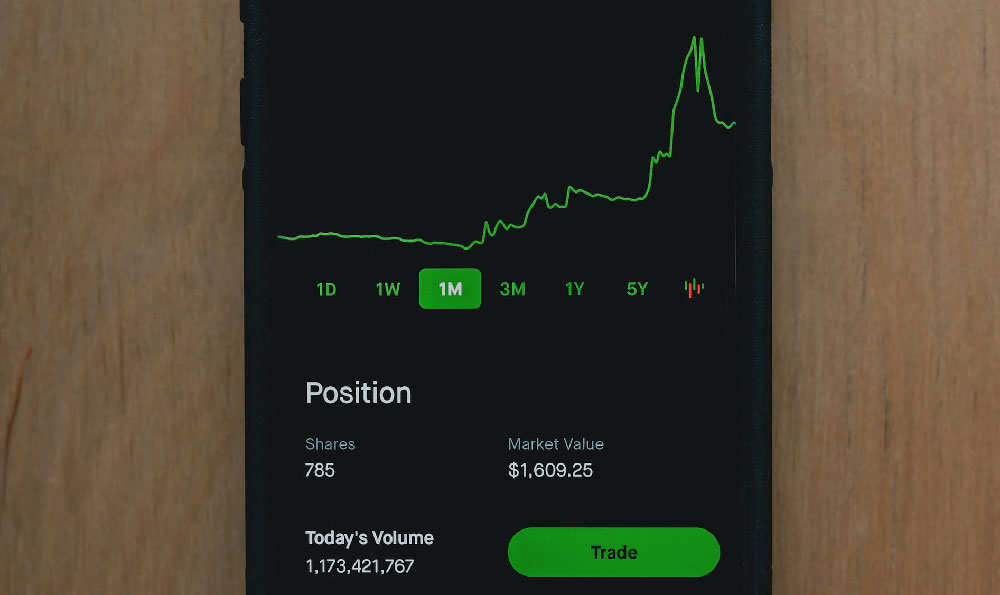

Technology can be a bridge between childhood money-making and future financial opportunities. Tools like mobile banking apps or budgeting calculators enable children to track their money in real time, making the process more interactive and educational. Parents can also use platforms like Robinhood or educational investment accounts to introduce children to the stock market in a safe environment. By guiding them to research companies and understand market trends, children gain insights into how capital can grow over time. This early exposure to financial instruments creates a mindset that sees money as a tool for growth rather than a goal in itself.

Ultimately, the key to successful money-making for children lies in combining education, creativity, and informed decision-making. By fostering a curiosity about personal finance, parents can help their children develop a lifelong habit of making wise financial choices. Whether through small savings projects, creative endeavors, or early exposure to investment concepts, these approaches prepare young individuals to navigate the complexities of financial independence. The most valuable lessons children learn are not about how to make money immediately, but about how to build a sustainable and responsible relationship with money throughout their lives.