Coinbase and Bitstamp, both established players in the cryptocurrency exchange arena, offer platforms for buying, selling, and trading digital assets. Choosing between the two depends heavily on your individual needs, trading style, and risk tolerance. Let's delve into a comprehensive comparison to help you make an informed decision.

A Head-to-Head Comparison: Fees, Security, and User Experience

One of the most crucial aspects for any trader or investor is the fee structure. Coinbase operates with a tiered fee system that can be somewhat complex, particularly for smaller transactions. The fees are based on factors like your location, payment method, and the size of your trade. Coinbase Pro, a more advanced trading platform offered by Coinbase, boasts significantly lower fees than the standard Coinbase platform. If you plan on actively trading, utilizing Coinbase Pro is almost essential to minimize costs.

Bitstamp, on the other hand, employs a volume-based fee structure. This means the fees decrease as your trading volume increases over a 30-day period. While this can be advantageous for high-volume traders, those making infrequent or small trades might find the fees slightly higher compared to Coinbase Pro, depending on the specific transaction.

Security is paramount in the cryptocurrency world. Both Coinbase and Bitstamp have robust security measures in place to protect user funds. Coinbase stores a significant portion of its digital assets offline in cold storage, mitigating the risk of online hacks. They also offer two-factor authentication (2FA) and insurance coverage for certain types of losses.

Bitstamp also prioritizes security, employing cold storage, 2FA, and multi-signature technology to safeguard user assets. They undergo regular security audits and have a long track record of security. Both platforms demonstrate a commitment to protecting user funds.

User experience plays a vital role in making trading accessible and enjoyable. Coinbase is renowned for its user-friendly interface, making it an excellent choice for beginners. The platform is intuitive and easy to navigate, simplifying the process of buying and selling cryptocurrencies.

Bitstamp's interface is generally considered to be more geared towards experienced traders. While it offers a functional trading platform, it might not be as immediately intuitive for newcomers as Coinbase. However, for those familiar with trading platforms, Bitstamp provides a solid and efficient experience.

Cryptocurrency Selection and Trading Tools: Meeting Your Investment Needs

Coinbase offers a curated selection of popular cryptocurrencies, focusing on well-established and vetted digital assets. This can be beneficial for beginners who might be overwhelmed by the vast array of cryptocurrencies available.

Bitstamp provides a more limited selection of cryptocurrencies compared to Coinbase. However, they focus on offering major cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple (XRP), along with some other altcoins.

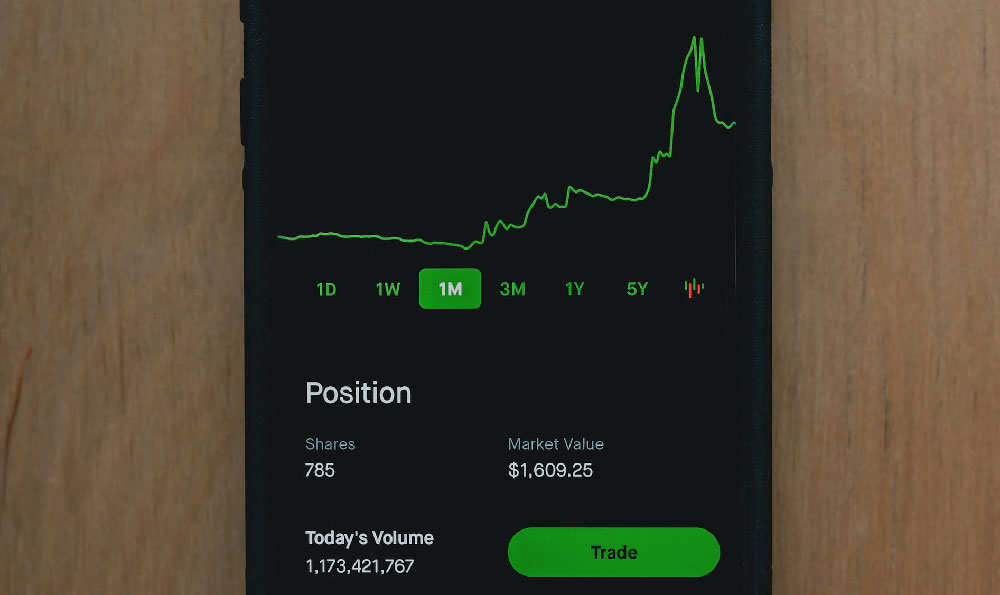

Trading tools are essential for informed decision-making. Coinbase Pro offers advanced charting tools, order types (market, limit, stop), and real-time market data. This enables traders to conduct technical analysis and execute sophisticated trading strategies.

Bitstamp also provides charting tools, order types, and market data, allowing traders to analyze price trends and execute various trading strategies. While the interface might not be as visually appealing as some platforms, the functionality is robust and reliable.

Regulation and Compliance: Operating in a Secure Environment

Coinbase is a regulated cryptocurrency exchange that operates in compliance with applicable laws and regulations in various jurisdictions. This provides users with a degree of assurance that the platform is operating legally and responsibly.

Bitstamp is also a regulated exchange, holding licenses and registrations in multiple jurisdictions. This commitment to regulatory compliance enhances the platform's credibility and provides users with a secure trading environment.

Payment Methods and Withdrawal Options: Accessing Your Funds

Coinbase supports various payment methods, including bank transfers, debit cards, and credit cards. This provides users with flexibility in funding their accounts. Withdrawal options typically include bank transfers and cryptocurrency transfers.

Bitstamp also offers several payment methods, such as bank transfers and credit card deposits. Withdrawal options include bank transfers and cryptocurrency withdrawals. The available payment methods and withdrawal options can vary depending on your location.

Customer Support: Getting Assistance When You Need It

Coinbase provides customer support through various channels, including email and a help center. While some users have reported delays in receiving support, Coinbase continues to invest in improving its customer service capabilities.

Bitstamp offers customer support through email and a comprehensive FAQ section. They strive to provide timely and helpful assistance to users with their inquiries and concerns.

Conclusion: Making the Right Choice for You

Ultimately, the choice between Coinbase and Bitstamp hinges on your individual priorities. If you are a beginner looking for a user-friendly platform with a curated selection of cryptocurrencies, Coinbase might be a suitable choice. However, remember to utilize Coinbase Pro for lower fees if you plan on actively trading.

If you are an experienced trader who values a reliable platform with a focus on major cryptocurrencies and a volume-based fee structure, Bitstamp could be a good option.

Consider your trading frequency, the cryptocurrencies you wish to trade, and the level of customer support you require when making your decision. Researching both platforms thoroughly and potentially trying them out with small amounts of capital can help you determine which one best aligns with your needs and investment goals. Remember to always prioritize security and manage your risk responsibly when trading cryptocurrencies. Diversification is key, and never invest more than you can afford to lose.