The allure of passive income is undeniable. The idea of generating revenue while you sleep, pursue hobbies, or simply enjoy life more fully is a powerful motivator for many seeking financial independence. But is it truly possible to earn money passively, and if so, how do you achieve it? The short answer is yes, it is possible, but it’s crucial to understand that "passive" doesn’t always mean effortless. It typically involves an initial investment of time, money, or both, followed by ongoing maintenance and monitoring to ensure continued income generation.

One of the most common and widely understood avenues for passive income is investing in dividend-paying stocks or funds. Companies that generate consistent profits often distribute a portion of those profits to their shareholders in the form of dividends. By carefully selecting companies with a history of stable and growing dividends, investors can create a stream of income that requires minimal ongoing effort. However, it's important to conduct thorough research into the financial health and industry outlook of any company before investing. Diversification is key to mitigating risk; spreading your investments across different sectors and companies can help protect your portfolio from downturns in any single area. Furthermore, dividend income is taxable, so it’s essential to factor that into your overall financial planning. Reinvesting dividends can further accelerate the growth of your portfolio through the power of compounding.

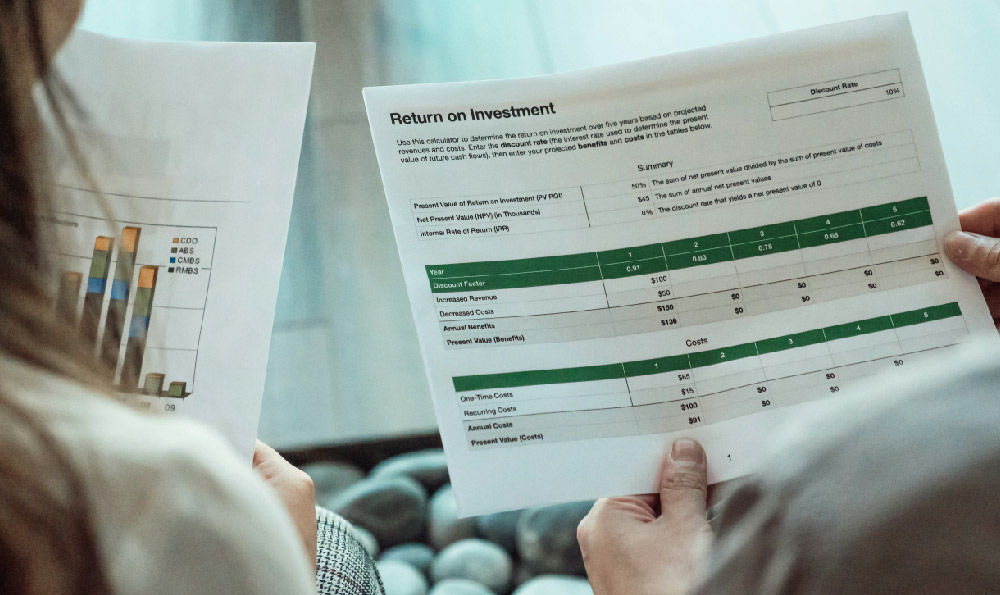

Another popular option is real estate investing, specifically rental properties. The idea is simple: you purchase a property and rent it out to tenants, generating monthly income. This can be a lucrative source of passive income, but it also comes with responsibilities. Landlords need to manage tenant relations, handle property maintenance, and deal with occasional vacancies. These tasks can be time-consuming and require a certain level of expertise. Hiring a property management company can alleviate some of these burdens, but it also comes at a cost, which will impact your overall profit margin. Beyond rental income, real estate also offers the potential for appreciation in value over time, further enhancing your return on investment. Thorough market research is crucial for identifying properties in areas with strong rental demand and growth potential. Factors to consider include location, demographics, proximity to amenities, and the overall condition of the property. Financing also plays a significant role; securing favorable mortgage terms can significantly impact your cash flow and profitability.

Creating and selling digital products is another increasingly popular way to generate passive income. This could involve developing online courses, writing and selling ebooks, creating stock photos or videos, or designing website templates. The initial effort involved in creating these products can be substantial, but once they are created, they can be sold repeatedly with minimal ongoing effort. The key to success in this area is identifying a niche market with unmet needs and creating high-quality products that meet those needs. Effective marketing is also essential for reaching your target audience and driving sales. Platforms like Udemy, Skillshare, and Etsy provide marketplaces for selling digital products, making it easier to reach a wider audience. Building a strong online presence through social media, blogging, and email marketing can also help to promote your products and build a loyal customer base.

Affiliate marketing is another avenue to consider. This involves partnering with businesses to promote their products or services and earning a commission on each sale generated through your unique affiliate link. This can be a relatively low-risk way to generate passive income, as you don't need to create your own products or handle customer service. The key to success in affiliate marketing is building a strong online presence and creating valuable content that attracts your target audience. This could involve writing blog posts, creating videos, or building a social media following. By recommending products or services that you genuinely believe in and that are relevant to your audience, you can build trust and credibility, which will lead to higher conversion rates. Selecting the right affiliate programs is also crucial; choose programs that offer competitive commission rates and that align with your niche and audience.

Investing in peer-to-peer lending platforms allows you to lend money to individuals or businesses and earn interest on the loans. These platforms connect borrowers with lenders, cutting out the traditional financial institutions. While this can offer attractive returns, it also comes with risks. There is always the possibility that borrowers will default on their loans, leading to losses for lenders. Diversifying your investments across multiple loans can help to mitigate this risk. It's also important to carefully research the lending platform and understand its underwriting process and risk management policies. Some platforms offer insurance or guarantees to protect lenders against losses, but these typically come with fees.

Building a high-traffic website or blog can generate passive income through advertising, affiliate marketing, or selling your own products or services. Creating valuable and engaging content is essential for attracting visitors and building a loyal audience. This requires ongoing effort to create new content and promote your website, but once you have built a substantial following, you can generate income passively. Search engine optimization (SEO) is crucial for driving organic traffic to your website. This involves optimizing your website and content to rank higher in search engine results pages. Social media marketing can also be effective for driving traffic and building your brand.

Finally, consider creating and licensing intellectual property, such as music, software, or patents. Developing valuable intellectual property requires significant upfront investment, but once it is created, it can generate passive income through licensing fees. This can be a highly lucrative source of passive income, but it also requires a strong understanding of intellectual property law and licensing agreements. Protecting your intellectual property is crucial to prevent unauthorized use and ensure that you receive fair compensation for your work.

In conclusion, while true "passive" income is rare, generating income streams that require minimal ongoing effort is certainly achievable. It requires careful planning, a willingness to invest time and money upfront, and ongoing monitoring to ensure continued success. The key is to identify opportunities that align with your skills, interests, and risk tolerance, and to diversify your investments to mitigate risk. Remember to factor in taxes and other expenses when calculating your potential returns. By combining these strategies and continuously learning and adapting, you can build a portfolio of passive income streams that contribute to your financial freedom and allow you to live life on your own terms.