Okay, I understand. Here's an article addressing the prompt "How Can I Earn More & What Are the Best Ways to Make Extra Money?".

Earning more money is a goal shared by many, whether to achieve financial freedom, pay off debt, save for the future, or simply improve one's quality of life. The path to increasing income is not always straightforward, demanding a blend of strategic thinking, diligent effort, and a willingness to explore diverse avenues. There’s no magic bullet, but a thoughtful, multi-pronged approach can significantly boost your earnings.

A fundamental starting point is evaluating your current skillset and identifying opportunities for professional advancement within your existing career. This might involve pursuing further education, obtaining relevant certifications, or actively seeking out projects that expand your experience and demonstrate your capabilities. Investing in yourself is often the highest-return investment you can make. Consider taking online courses, attending workshops, or seeking mentorship from experienced professionals in your field. Negotiating a raise is another vital tactic. Research industry benchmarks for your role and experience level to build a strong case for why you deserve increased compensation. Prepare to articulate your accomplishments and the value you bring to the company. Don't be afraid to ask; the worst they can say is no, and even that can open a dialogue about your future growth opportunities.

Beyond your primary career, exploring supplementary income streams can significantly accelerate your financial progress. The landscape of side hustles has exploded in recent years, offering a wide array of options tailored to various skills and interests. One increasingly popular avenue is freelancing. Platforms like Upwork, Fiverr, and Guru connect freelancers with clients seeking assistance in areas such as writing, graphic design, web development, marketing, and virtual assistance. The flexibility of freelancing allows you to work on your own schedule and set your own rates, making it an ideal option for supplementing existing income. The key to successful freelancing is to identify a niche where your skills are in demand and to build a strong portfolio that showcases your expertise. Client testimonials and positive reviews are crucial for attracting new business.

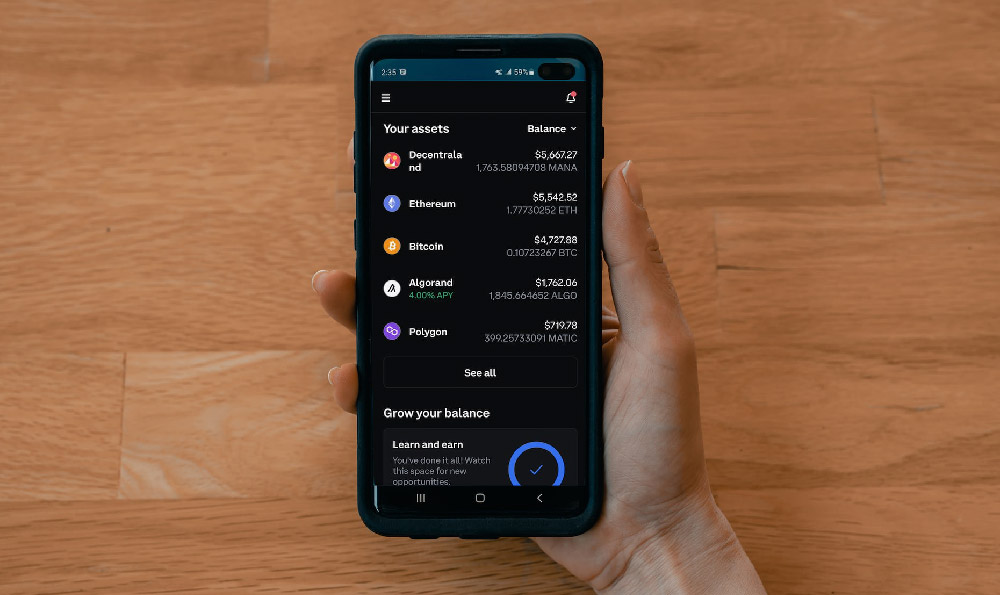

Another potentially lucrative avenue is investing. While investment always carries risks, it also presents the opportunity for significant returns over time. Consider starting with a diversified portfolio of stocks, bonds, and mutual funds, and gradually increase your investment knowledge through reading, research, and potentially consulting with a financial advisor. Real estate investment is another option, but it requires a significant capital investment and carries its own set of risks and responsibilities. Before jumping into real estate, thoroughly research the market, understand the legal and financial implications, and potentially consider starting with a smaller investment like a real estate investment trust (REIT). Remember that investment returns are not guaranteed, and it's important to diversify your portfolio to mitigate risk. It's also important to understand your risk tolerance. A younger investor might be able to handle more volatile, higher-growth investments, while an older investor closer to retirement might prefer more conservative, income-generating options.

The burgeoning gig economy presents numerous other opportunities for earning extra money. Consider driving for ride-sharing services like Uber or Lyft, delivering groceries or meals through platforms like Instacart or DoorDash, or renting out a spare room or property through Airbnb. While these gigs may not offer the same level of long-term stability as a traditional job, they provide immediate income and flexibility. The earning potential varies depending on factors such as location, demand, and the amount of time you're willing to dedicate.

Monetizing hobbies and passions can be a particularly rewarding way to earn extra income. If you enjoy crafting, consider selling your creations on Etsy or at local craft fairs. If you're a skilled photographer, you can sell your photos online or offer photography services to clients. If you're knowledgeable about a particular subject, you can create online courses or offer tutoring services. Turning a hobby into a source of income can not only provide financial benefits but also enhance your enjoyment of the activity.

Beyond the specific avenues, certain underlying principles apply to effectively increasing your income. The first is meticulous budgeting and expense tracking. Understanding where your money goes each month is crucial for identifying areas where you can cut back and reallocate resources to income-generating activities. The second is financial literacy. Take the time to learn about personal finance, investing, and tax strategies. The more you understand about money management, the better equipped you'll be to make informed decisions that will improve your financial well-being. The third is persistence and adaptability. Building wealth and increasing income is a marathon, not a sprint. There will be setbacks and challenges along the way. The key is to remain persistent, learn from your mistakes, and adapt your strategies as needed. The financial landscape is constantly evolving, so it's essential to stay informed and be willing to embrace new opportunities.

Ultimately, the best approach to earning more money is a personalized one that takes into account your skills, interests, financial goals, and risk tolerance. By combining a commitment to professional growth with exploration of diverse income streams, you can significantly increase your earning potential and build a more secure financial future. Remember to carefully research any opportunity before committing time or resources, and to prioritize activities that align with your values and long-term goals.