The question of "How much does the average person earn annually?" seems straightforward, but the answer is far more complex and nuanced than a single number can convey. The concept of "average annual income" is itself multifaceted, depending on which type of average is being used (mean, median, or mode), the geographical location, demographic group, educational attainment, and a multitude of other socio-economic factors. Therefore, a comprehensive understanding requires dissecting these different facets and considering the limitations of each metric.

Let's begin with the most common, yet arguably least informative, measure: the mean. The mean annual income is calculated by summing the total income of all individuals within a population and dividing it by the number of individuals. This approach is susceptible to skewing due to outliers, specifically high earners. A small percentage of individuals with exceptionally high incomes can significantly inflate the mean, making it a poor representation of the typical person's earnings. Imagine a small town where 99 people earn $50,000 annually, and one person earns $10 million. The mean income would be significantly higher than what the vast majority actually earn, creating a distorted perception.

The median, on the other hand, represents the middle value in a sorted dataset. It is the point at which half of the individuals earn more, and half earn less. The median is generally considered a more accurate reflection of the "typical" income because it is less affected by extreme values. Continuing the previous example, the median income in that small town would remain closer to $50,000, offering a much more representative picture of the financial reality for the majority of residents.

Even the median income is not a universal constant. Geographical location plays a pivotal role. The cost of living, local industries, and economic opportunities vary dramatically across different regions. For instance, the median income in a tech hub like Silicon Valley is likely to be considerably higher than in a rural agricultural area, reflecting both higher salaries and a higher cost of living. Therefore, when considering average annual income, it's crucial to specify the geographical context – be it a city, state, or country.

Demographic factors such as age, gender, and race also contribute significantly to income disparities. Studies consistently show that income tends to increase with age and experience, peaking in mid-career before gradually declining towards retirement. However, gender and racial pay gaps persist across many industries and regions, meaning that women and minority groups often earn less than their male and white counterparts for similar work. These disparities are complex and multifaceted, often stemming from a combination of factors including historical discrimination, unequal access to opportunities, and differences in career choices.

Educational attainment is another powerful determinant of earning potential. Individuals with higher levels of education, such as bachelor's degrees, master's degrees, or professional certifications, generally command higher salaries than those with lower levels of education. This is because education equips individuals with valuable skills, knowledge, and credentials that are highly sought after by employers. While a college degree is not a guaranteed path to financial success, it statistically increases the likelihood of higher earnings over a lifetime.

Furthermore, the industry and occupation in which a person works significantly impact their income. Some industries, such as technology, finance, and healthcare, tend to offer higher salaries than others, such as retail, hospitality, and agriculture. Similarly, certain occupations, such as surgeons, lawyers, and engineers, typically earn more than those in less specialized or lower-skilled roles. The demand for specific skills and the value that a particular profession brings to society are major drivers of these variations.

Beyond these broad categories, other factors can also influence individual income. These include personal skills, networking abilities, entrepreneurial endeavors, and even sheer luck. While hard work and dedication are undoubtedly important, having the right connections or being in the right place at the right time can sometimes make a significant difference. Moreover, the ability to identify and capitalize on opportunities, whether through starting a business or investing wisely, can significantly boost one's income.

It's also important to acknowledge the impact of economic cycles on average annual income. During periods of economic expansion, wages tend to rise as companies compete for talent and unemployment rates fall. Conversely, during economic downturns, wages may stagnate or even decline as companies cut costs and unemployment rates rise. These cyclical fluctuations can affect both individual income and the overall average for the population.

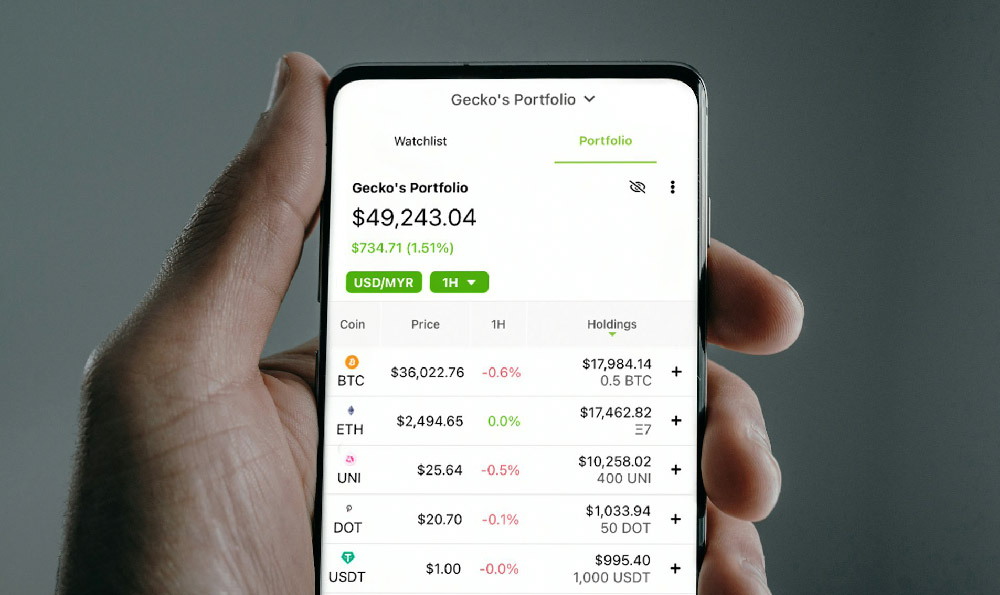

In the context of cryptocurrency investment, understanding average annual income is indirectly relevant. It provides a benchmark for assessing the affordability of investing. A person's disposable income, the amount left after essential expenses, directly impacts how much they can allocate to investments, including crypto. Someone with a lower-than-average income might need to be more cautious and risk-averse in their investment strategy, prioritizing capital preservation over aggressive growth. Conversely, someone with a higher-than-average income might have more flexibility to take on higher-risk investments.

Therefore, when contemplating investing in volatile assets like cryptocurrencies, consider your personal financial situation, your existing debt burden, and your overall risk tolerance. Don't gamble with funds that you cannot afford to lose. Diversification is also key; spreading your investments across different asset classes can help mitigate risk.

In conclusion, there is no single, definitive answer to the question of how much the average person earns annually. The figure varies widely depending on a complex interplay of factors including geographical location, demographics, education, occupation, and economic conditions. While statistical averages can provide a general sense of income levels, it is essential to consider the limitations and nuances of these metrics. A deeper understanding of these factors allows for a more accurate assessment of individual financial well-being and informs more sound financial decisions, especially when considering volatile investment options.