In today's fast-paced economy, teenagers stand at a unique crossroads where the potential to accumulate wealth begins not just with financial acumen, but with a mindset that embraces both discipline and curiosity. Unlike traditional investment approaches that require years of experience, this demographic possesses a distinct advantage: the ability to start small, experiment with diverse income streams, and leverage technology to amplify their earning potential. The key lies in understanding that wealth creation for young people is not a sprint for instant riches, but a journey that involves strategic steps tailored to their current stage of life.

One of the most effective methods for teenagers to build financial foundations is through part-time work that aligns with their passions and skills. Whether it's tutoring subjects they excel in, offering digital services like graphic design or coding, or participating in local community projects, these opportunities allow them to earn money while developing practical skills. However, success in this approach depends on more than just finding a job—it requires time management to balance school, extracurricular activities, and work, as well as a willingness to adapt. For instance, a student who starts as a tutor might later shift to creating an online course for younger peers, transforming their initial labor into a scalable asset. The critical insight here is that even low-income ventures, when approached with intention, can serve as stepping stones toward broader financial literacy.

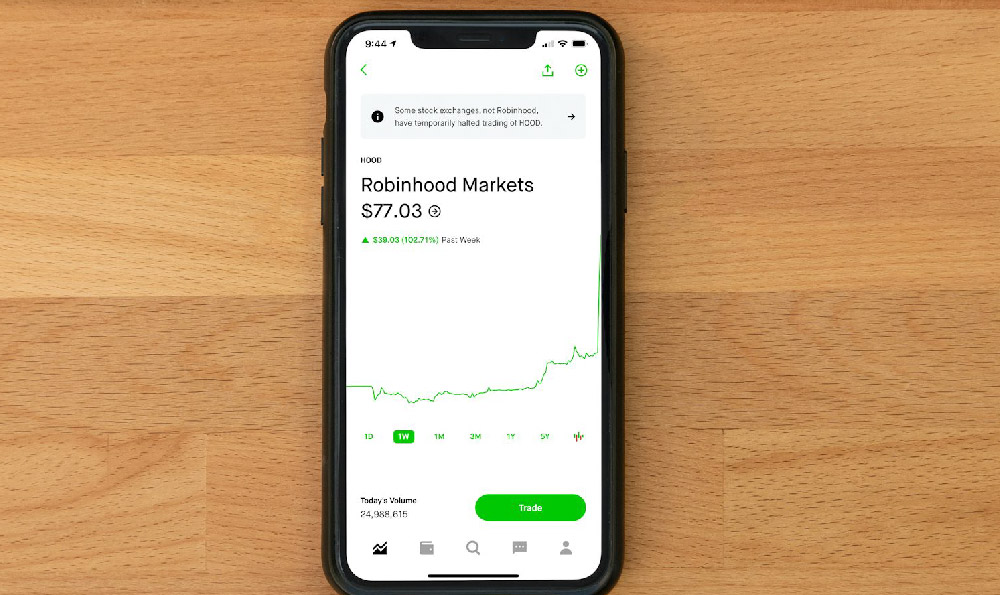

Complementing earned income with early exposure to capital markets is another vital strategy. While teenagers may lack the experience to invest large sums directly, platforms such as micro-investment apps or fractional stock trading allow them to participate in the market with minimal risk. By allocating a portion of their savings to diversified investments, such as exchange-traded funds (ETFs) or low-risk bonds, they can learn how capital grows over time. The concept of compound interest, often overlooked by young investors, becomes particularly relevant here: even small contributions made consistently can multiply significantly by the time they reach adulthood. However, it's essential to emphasize that investing should not be seen as a shortcut to wealth. Instead, it's a lesson in patience, as market fluctuations require emotional resilience and a long-term perspective.

Another dimension to consider is the development of personal value through education and skill acquisition. Teenagers who invest in learning new abilities—whether coding, graphic design, or digital marketing—can create income-generating assets that outlast their initial efforts. For example, mastering a skill like video editing might lead to a side hustle offering editing services to content creators, or proficiency in a language could open doors to translation gigs or international collaborations. The beauty of this approach is that skills become portable, allowing young people to monetize them in multiple ways. This also encourages them to view money not as an end goal, but as a tool to support their growth and ambitions.

Entrepreneurship is another avenue worth exploring, though it demands careful planning. Starting a small business as a teenager requires identifying a niche that aligns with their interests and resources. Whether it's selling handmade products online, offering pet-sitting services, or creating a subscription-based content platform, the focus should be on solving a problem or meeting a need. The success of such ventures often hinges on adaptability—teenagers must be willing to iterate, seek feedback, and refine their offerings. For example, a student might begin by selling custom phone cases on a marketplace, gradually expanding to offer personalized merchandise or monetizing their social media presence through brand partnerships. These experiences teach valuable lessons about risk, scalability, and the importance of a clear value proposition.

The foundation of wealth creation for teenagers is also closely tied to financial habits that build discipline and foresight. Establishing a budget to track expenses, saving a portion of their income, and avoiding impulse spending are critical first steps. This approach helps them develop a sense of responsibility and reinforces the idea that wealth is built through consistent actions. Moreover, understanding the concept of opportunity cost—what they sacrifice by spending time or money on one activity versus another—can guide them toward more strategic decisions. For instance, spending an hour on a part-time job instead of a video game might seem trivial, but over time, it accumulates into a significant long-term gain.

Equally important is the cultivation of a mindset that prioritizes long-term vision over quick wins. Teenagers often gravitate toward fast-paced opportunities that promise immediate returns, such as get-rich-quick schemes or viral content strategies. However, these approaches typically lack sustainability and can expose them to unnecessary risks. Instead, focusing on building a foundation of financial knowledge, diversifying income sources, and investing in personal growth creates a framework for lasting wealth. For example, a teenager who saves money from multiple streams and uses it to invest in low-cost index funds will benefit from the power of compounding, even if the growth is gradual.

Ultimately, the path to financial success for teenagers is not uniform—it depends on their unique interests, resources, and circumstances. The most effective strategies often combine principles of earning, investing, and growing. By starting with small, manageable steps and gradually scaling their efforts, teenagers can develop a holistic understanding of money management. This proactive approach not only helps them accumulate wealth but also equips them with the mindset and skills needed to navigate financial challenges in the future. The journey may be complex, but with dedication, it can lead to a future of financial freedom and long-term prosperity.