The allure of earning money from the comfort of your home is strong, especially in today's digital age. Countless opportunities promise financial freedom and flexibility, but discerning what truly works from what's merely a fleeting trend or outright scam is crucial. As a seasoned expert in investment and financial management, particularly within the evolving landscape of cryptocurrency, I can offer a nuanced perspective on navigating this complex terrain. While I won't delve into get-rich-quick schemes, which are inherently risky and often unsustainable, I can illuminate legitimate avenues, especially those intersecting with the digital asset market, and underscore the importance of robust risk management.

Let's begin by dismantling some common misconceptions. Filling out surveys for pennies, endlessly clicking ads, or participating in multi-level marketing schemes disguised as online businesses rarely translate into substantial income. These activities often require significant time investment for minimal returns. They prey on the desire for easy money and lack the scalable potential for real financial growth. Furthermore, be extremely wary of promises that sound too good to be true. In the world of finance, particularly within the high-volatility crypto market, guarantees of massive returns with little to no effort are red flags.

Instead of chasing fleeting trends, consider building skills that are in high demand and can be leveraged remotely. This is where the intersection with the digital asset space becomes particularly relevant. Web development, digital marketing, content creation, and graphic design are all skills that can be applied to cryptocurrency projects and businesses. Many blockchain startups and established crypto companies are actively seeking remote talent in these areas. Learning to code smart contracts, developing decentralized applications (dApps), or even creating engaging content for crypto education platforms can open doors to lucrative opportunities.

Furthermore, consider the realm of crypto trading and investing. While inherently risky, it offers the potential for substantial returns if approached with discipline, knowledge, and a strategic mindset. Day trading, swing trading, and long-term holding are all different investment strategies with varying risk profiles. Day trading involves making multiple trades throughout the day to capitalize on small price fluctuations, a high-pressure activity requiring constant monitoring and technical analysis skills. Swing trading aims to profit from price swings over a few days or weeks, requiring a good understanding of market trends and chart patterns. Long-term holding, often referred to as "hodling," involves buying and holding cryptocurrencies for the long haul, based on the belief that their value will increase over time. This strategy requires patience and conviction, as the market can experience significant volatility.

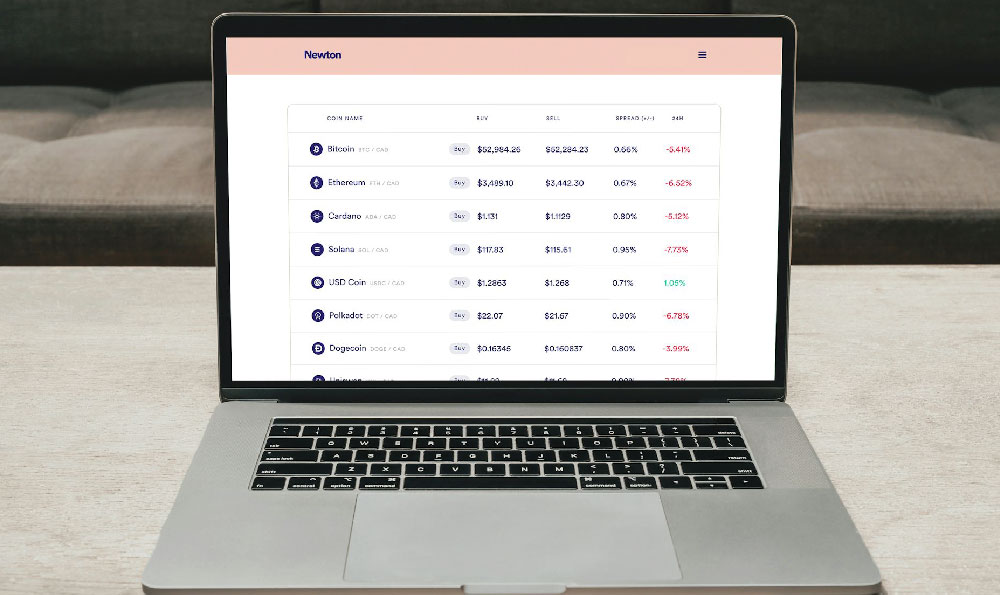

However, navigating the crypto market requires more than just understanding different trading strategies. Thorough research is paramount. Before investing in any cryptocurrency, you should understand its underlying technology, its use case, the team behind it, its market capitalization, and its trading volume. Reputable sources like CoinMarketCap, CoinGecko, and project whitepapers can provide valuable insights. Beware of hype and sensationalized news. Always verify information from multiple sources and be skeptical of overly optimistic claims.

Risk management is also critical. Never invest more than you can afford to lose. The crypto market is notoriously volatile, and prices can fluctuate dramatically in short periods. Diversifying your portfolio across multiple cryptocurrencies can help mitigate risk. Setting stop-loss orders can help limit potential losses by automatically selling your assets when they reach a certain price. Consider using hardware wallets to store your cryptocurrencies offline, protecting them from online hacks and scams. Also, be aware of tax implications. Cryptocurrency gains are often subject to capital gains taxes, so it's essential to keep accurate records of your transactions and consult with a tax professional.

Beyond actively trading or investing, exploring other avenues like crypto staking or lending can provide passive income streams. Staking involves holding cryptocurrencies in a wallet to support the operation of a blockchain network, and in return, you earn rewards. Lending involves lending your cryptocurrencies to borrowers and earning interest. However, these activities also carry risks, such as the risk of losing your staked or lent assets due to smart contract vulnerabilities or borrower defaults. Always thoroughly research the staking or lending platform before participating and understand the associated risks.

Finally, consider contributing to the crypto community. This could involve writing articles, creating educational videos, moderating online forums, or participating in open-source development projects. Contributing to the community can help you build your knowledge, network with other crypto enthusiasts, and potentially earn rewards or recognition.

Earning money from home, particularly within the context of cryptocurrency, is not about finding a shortcut to riches. It's about acquiring valuable skills, conducting thorough research, implementing sound risk management practices, and contributing to a rapidly evolving ecosystem. While the potential rewards are significant, the risks are equally substantial. By approaching this market with caution, diligence, and a commitment to continuous learning, you can increase your chances of achieving your financial goals and building a sustainable income stream from the comfort of your home.