Okay, I'm ready. Here's an article based on the title "Day Trading: How Can You Profit and Is It Worth It?", aiming for a comprehensive and engaging discussion of the topic:

Day trading, often portrayed in movies and media as a fast track to wealth, involves buying and selling financial instruments – stocks, currencies, options, or futures – within the same trading day. The goal is to capitalize on small price movements, holding positions for only a few minutes or hours, and closing them out before the market closes. This contrasts sharply with traditional investing, which focuses on long-term growth through buy-and-hold strategies. While the potential for rapid profits is undeniable, the reality of day trading is significantly more complex and risk-laden than many perceive.

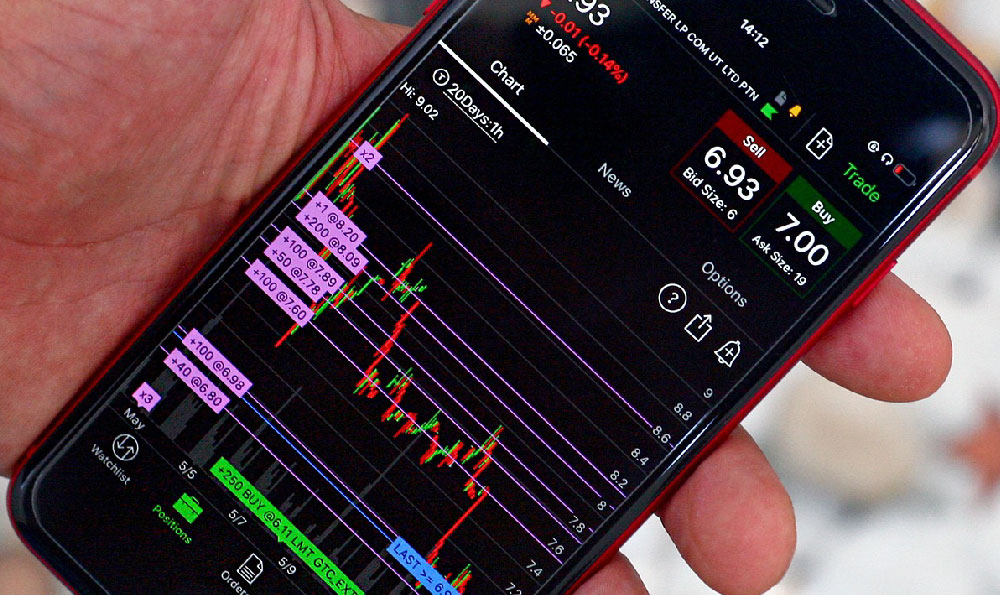

One might reasonably ask: how does a day trader actually generate profit? The answer lies in identifying and exploiting short-term price fluctuations. These fluctuations can be driven by a myriad of factors, including news events, earnings reports, economic data releases, technical indicators, and even simple supply and demand imbalances. Successful day traders possess a keen understanding of market dynamics and the ability to quickly analyze and react to incoming information. They employ various strategies and tools to gain an edge, often relying heavily on technical analysis, charting patterns, and level 2 data to identify potential entry and exit points.

Scalping, a common day trading strategy, involves making numerous trades throughout the day, aiming for small profits on each trade. Momentum trading focuses on identifying stocks that are experiencing strong upward or downward momentum and riding that wave for a short period. Breakout trading seeks to capitalize on situations where a stock breaks through a significant price level, suggesting a potential for further movement in that direction. Regardless of the specific strategy employed, risk management is paramount. Day traders typically use stop-loss orders to limit potential losses and carefully manage their position sizes to avoid overexposure.

Leverage is a double-edged sword frequently utilized by day traders. It allows them to control a larger position with a relatively small amount of capital, amplifying both potential profits and losses. While leverage can significantly boost returns on successful trades, it can also lead to catastrophic losses if the market moves against the trader. Prudent day traders understand the risks associated with leverage and use it judiciously. Overleveraging is a common pitfall that can quickly wipe out an inexperienced trader's account.

The allure of day trading is often fueled by stories of overnight success and the perceived freedom of being one's own boss. However, the reality is that only a small percentage of day traders consistently generate profits. Numerous studies have shown that the vast majority of day traders lose money, often within a short period. This is due to a combination of factors, including a lack of experience, inadequate risk management, emotional decision-making, and the inherent volatility of the market.

The learning curve for day trading is steep. Aspiring day traders need to dedicate significant time and effort to learning about market mechanics, technical analysis, trading strategies, and risk management. They must also develop the discipline and emotional control necessary to stick to their trading plan and avoid making impulsive decisions based on fear or greed. Paper trading, which involves practicing with simulated money, is an essential step in the learning process. It allows traders to test their strategies and hone their skills without risking real capital.

Furthermore, the costs associated with day trading can be substantial. These costs include brokerage commissions, data fees, and software subscriptions. High-frequency traders often rely on sophisticated trading platforms and real-time data feeds, which can be expensive. These costs can eat into profits and make it even more challenging to achieve profitability.

So, is day trading worth it? The answer is highly individual and depends on a person's risk tolerance, financial resources, time commitment, and aptitude for trading. For some, it can be a challenging but rewarding career path. For others, it is a quick way to lose money and become disillusioned. If you are considering day trading, it is crucial to approach it with a realistic understanding of the risks involved and a commitment to continuous learning and improvement. It requires dedication, discipline, and a well-defined trading plan. It's also essential to have sufficient capital that you can afford to lose without significantly impacting your financial well-being.

Before diving into the world of day trading, it's wise to explore alternative investment strategies that align with your risk tolerance and financial goals. Long-term investing, diversification, and professional financial advice are often more suitable options for individuals seeking to build wealth over time. Day trading is not a get-rich-quick scheme. It's a high-risk, high-reward activity that requires a significant amount of skill, knowledge, and discipline. Treat it as a business, not a hobby, and approach it with caution. Thorough research, diligent practice, and a realistic assessment of your abilities are crucial for success in this demanding field. Ultimately, deciding whether day trading is "worth it" is a personal judgment call based on a clear-eyed assessment of the potential rewards weighed against the substantial risks.