Okay, I understand. Here's an article written to address the prompt, focusing on practical and diverse income-generating methods for college students:

Beyond Ramen: A College Student's Guide to Building Financial Freedom

College life, often romanticized in movies, is frequently a tightrope walk balancing academics, social life, and, perhaps most critically, finances. The constant crunch of tuition fees, textbooks, rent, and the ubiquitous pizza bill can make financial independence seem like a distant dream. However, college is also a prime time to cultivate good financial habits and explore avenues for earning income – not just to survive, but to thrive and even begin building a solid financial foundation for the future.

The most obvious path, and often the most reliable, is part-time employment. Many students gravitate towards jobs on campus – working in the library, assisting professors with research, or staffing the student union. These roles are often designed with student schedules in mind, offering flexibility and understanding during exam periods. Furthermore, campus jobs can provide valuable networking opportunities and exposure to academic environments. Off-campus options are plentiful as well, ranging from retail and restaurants to customer service roles. The key here is finding a balance that allows for sufficient study time and prevents burnout. Don't underestimate the value of a well-crafted resume and cover letter; even seemingly simple part-time jobs can offer crucial skills that will be highly valued after graduation.

However, relying solely on traditional employment can limit earning potential and stifle creativity. The digital age has opened up a plethora of opportunities for college students to leverage their skills and passions to generate income. Consider the burgeoning freelance market. If you're a strong writer, editor, or proofreader, platforms like Upwork and Fiverr can connect you with clients seeking these services. Graphic design, web development, and social media management are other highly sought-after skills. Even if you lack formal training, online courses and tutorials can provide the necessary knowledge to get started. The advantage of freelancing is the flexibility it offers; you can set your own hours, choose projects that interest you, and gradually build a portfolio of work.

Beyond freelancing, consider monetizing your existing skills and hobbies. Are you fluent in another language? Offer tutoring services to fellow students. Do you excel at a particular subject? Become a peer tutor through your university or online. Are you artistic? Sell your creations online through platforms like Etsy or Redbubble. Do you enjoy photography? Offer your services for campus events or student portraits. The possibilities are endless. The key is to identify your strengths and find a way to translate them into a marketable service.

Another avenue worth exploring is the world of online content creation. Starting a blog, YouTube channel, or podcast can be a surprisingly effective way to generate income, albeit one that requires consistent effort and patience. Choose a niche that you're passionate about and consistently create high-quality content that provides value to your audience. Over time, you can monetize your content through advertising, affiliate marketing, or selling your own products and services. This approach not only generates income but also builds a valuable online presence that can be beneficial for your future career.

For those with an entrepreneurial spirit, consider starting a small business on campus or in the local community. This could be anything from a laundry service to a delivery business to a tutoring agency. The key is to identify a need and find a creative way to fill it. Student entrepreneurs often have access to resources and support from their universities, such as business incubators and mentorship programs. Starting a business in college can be a challenging but incredibly rewarding experience, providing valuable lessons in entrepreneurship, marketing, and finance.

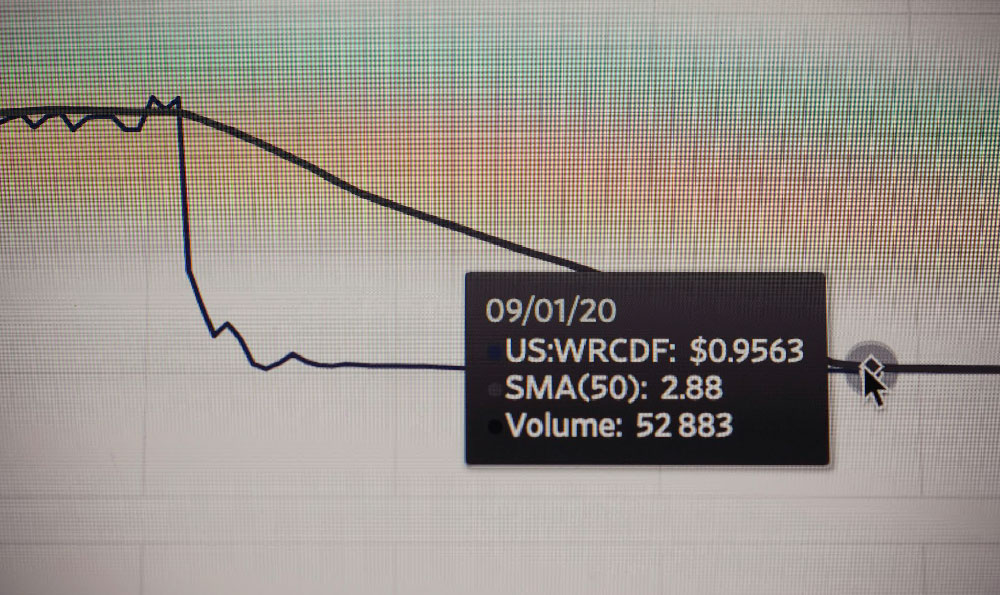

In addition to active income streams, college students should also consider passive income opportunities. Investing in the stock market, even with small amounts of money, can be a powerful way to build wealth over time. Consider opening a Roth IRA, which allows you to invest after-tax dollars and enjoy tax-free growth and withdrawals in retirement. While retirement may seem distant, starting early allows you to take advantage of the power of compounding. Similarly, exploring peer-to-peer lending platforms or investing in dividend-paying stocks can generate passive income.

Finally, it's crucial to emphasize the importance of budgeting and financial literacy. Knowing where your money is going and creating a plan for managing your finances is essential for achieving financial freedom. Track your expenses, set financial goals, and avoid unnecessary debt. Take advantage of free financial literacy resources offered by your university or online. Understanding the basics of budgeting, saving, and investing will empower you to make informed financial decisions throughout your life.

The college years are a time of immense personal and intellectual growth. By embracing these diverse income-generating strategies and cultivating good financial habits, college students can not only alleviate financial stress but also lay the foundation for a secure and prosperous future. The key is to be proactive, creative, and persistent. Don't be afraid to experiment, learn from your mistakes, and seek out resources and support along the way. College is an opportunity to not only earn a degree but also to earn financial independence.