Okay, I understand. Here's an article addressing the query about the average American's annual earnings and salary, adhering to your specifications:

How much money does the average American make each year? It's a question that sparks curiosity and invites numerous perspectives. There's no single, straightforward answer, as several factors influence the resulting figures. Diving into the nuances of income reporting reveals a complex picture of the American economy.

Instead of a simplistic figure, you have to consider different measures like the median income, the average income (mean), and the per capita income. Each metric provides a unique lens through which to understand American earnings. The average income, calculated by summing all incomes and dividing by the number of earners, can be skewed by a small percentage of very high earners, pulling the number upwards and creating a potentially misleading representation of the typical American's experience. The median income, which represents the point where half of earners make more and half make less, is often considered a more reliable indicator of what the typical American takes home because it is less susceptible to the influence of outliers at the very high end. Per capita income represents the average income earned per person, and this measure is usually taken for a specific geographic area like a city, state or country.

To provide a realistic picture, we must consider data from authoritative sources such as the U.S. Census Bureau and the Bureau of Labor Statistics (BLS). These agencies collect and analyze data on wages, salaries, and income across various demographics and industries. According to the latest available data, which typically lags a year or two due to the time needed for data collection and analysis, the median household income in the United States hovers around the $75,000 mark. However, that is household income, not individual income. For individuals, the median personal income is significantly lower.

Beyond these aggregate figures, significant discrepancies exist based on factors such as education level, occupation, gender, race, and geographic location. Individuals with higher levels of education typically earn more over their lifetimes than those with less education. For instance, someone with a bachelor's degree can expect to earn substantially more than someone with only a high school diploma. Specific occupations, particularly in fields like technology, finance, and medicine, command higher salaries than others. These discrepancies stem from a variety of factors including demand for specific skills, the level of training required, and the overall economic value of the profession.

The gender pay gap, while narrowing, continues to be a persistent issue. Women, on average, still earn less than men for comparable work. This disparity is attributable to a complex interplay of factors including occupational segregation, bias in hiring and promotion practices, and societal expectations around work and family responsibilities. Similarly, racial and ethnic minorities often face systemic barriers that limit their access to educational and employment opportunities, resulting in lower average earnings compared to their white counterparts.

Geographic location also plays a significant role in determining income levels. States with thriving industries and lower costs of living may offer higher earning potential. Metropolitan areas like New York City, San Francisco, and Washington D.C., while offering access to high-paying jobs, also come with significantly higher living expenses, including housing, transportation, and childcare. Rural areas, on the other hand, may have lower average incomes due to limited job opportunities and lower wages. The cost of living adjusted income can paint a much more accurate picture of the true spending power someone has at a certain income.

Furthermore, it's crucial to consider the impact of inflation on purchasing power. While nominal incomes may increase over time, the real value of those incomes can be eroded by rising prices. Inflation erodes the value of currency because goods and services become more expensive. For example, if your income increases by 3% but the rate of inflation is 5%, then your real income has decreased. It's essential to adjust income figures for inflation to accurately compare earnings across different time periods.

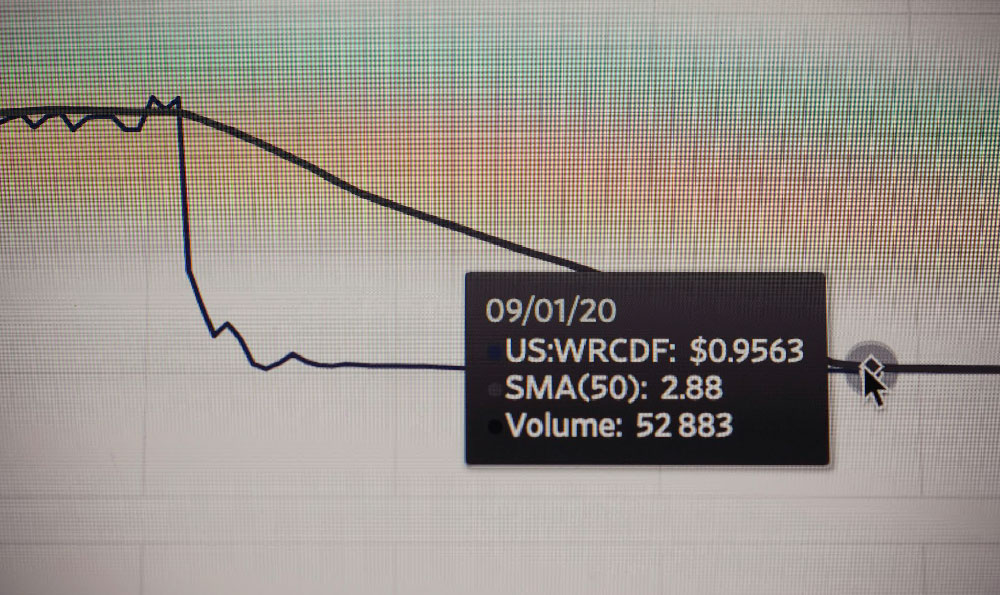

Beyond wages and salaries, other sources of income, such as investments, rental properties, and government benefits, can significantly impact an individual's overall financial well-being. Investment income, derived from stocks, bonds, and other assets, can provide a substantial supplement to earned income, particularly for those nearing retirement. Rental properties can generate passive income, providing a steady stream of revenue. Government benefits, such as Social Security and unemployment insurance, provide a safety net for individuals facing financial hardship.

Understanding the nuances of American earnings requires looking beyond simple averages and considering the multifaceted factors that influence income levels. Education, occupation, gender, race, location, and other sources of income all play a role in shaping the financial landscape for individuals and families across the United States. By analyzing data from reliable sources and considering the various factors at play, we can gain a more comprehensive understanding of the economic realities facing Americans today. Financial literacy and understanding these trends helps everyone from recent graduates to seasoned investors make more informed decisions to set themselves up for long term financial success.