Investing in digital assets and cryptocurrency markets has become a pivotal strategy for individuals seeking to diversify their financial portfolios and capitalize on the evolving landscape of technology-driven value. With the global cryptocurrency market reaching a valuation of over $1.5 trillion, the opportunities for generating income are vast, yet the complexity of the ecosystem demands a nuanced approach. Understanding how to navigate this space effectively requires more than a basic grasp of blockchain technology; it demands a combination of analytical rigor, strategic foresight, and a deep awareness of the risks that accompany high-reward opportunities.

Profitability in crypto markets is often tied to the ability to identify macroeconomic trends that influence investor behavior and asset valuations. For example, factors such as interest rates, inflation dynamics, and global geopolitical events can create ripple effects across traditional and digital asset classes. A skilled investor knows how to interpret these signals, leveraging tools like the U.S. Federal Reserve's policy decisions or the adoption rates of central bank digital currencies (CBDCs) to anticipate shifts in capital flow. By aligning investment decisions with such macroeconomic data, investors can position themselves to benefit from both short-term volatility and long-term structural changes.

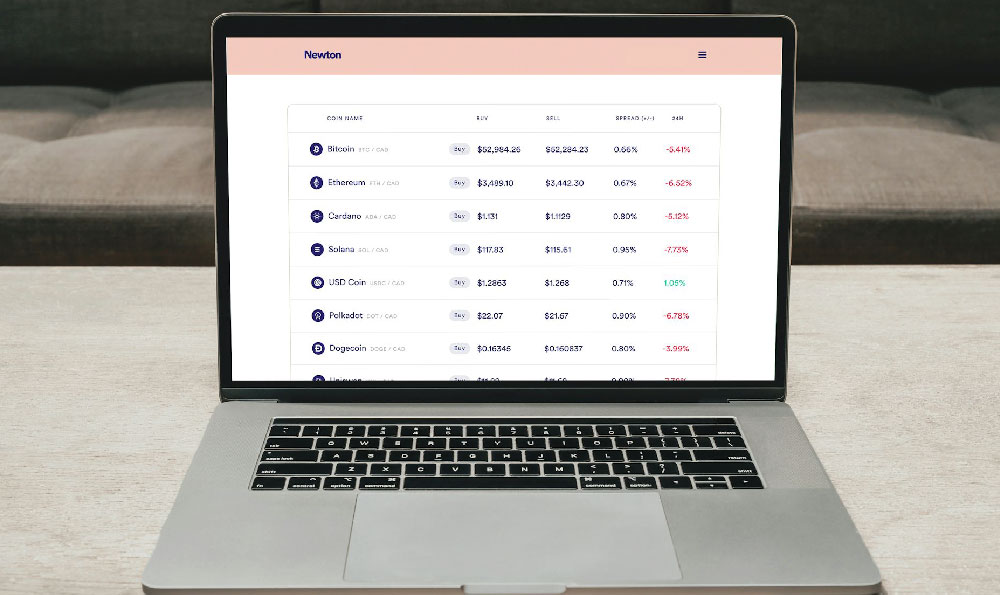

Diversification remains one of the most critical principles in capitalizing on digital assets. While Bitcoin and Ethereum have historically been the dominant players, the broader crypto ecosystem includes thousands of other coins, each with unique utilities and market dynamics. For instance, stablecoins provide a low-volatility hedge against market crashes, while memecoins like Dogecoin have demonstrated the potential for exponential growth when backed by community-driven narratives. A successful strategy involves allocating capital across different asset types—such as equities, commodities, and digital assets—to balance risk and return. This approach not only reduces exposure to any single market event but also taps into multiple growth avenues simultaneously.

The concept of income generation through digital assets extends beyond mere price appreciation. Decentralized finance (DeFi) protocols, for example, have introduced innovative mechanisms such as yield farming, staking, and liquidity provision. These methods allow investors to earn passive income by contributing computational resources or liquidity to blockchain networks. Staking, in particular, has gained traction as a way to earn rewards by validating transactions on proof-of-stake blockchains, offering a more energy-efficient alternative to mining. However, the returns from these activities are not guaranteed and depend heavily on market conditions, protocol performance, and the investor's ability to assess risk.

Risk management is paramount in any investment strategy, and digital assets are no exception. The market's high volatility necessitates a proactive approach to safeguarding capital. One effective method is to use stop-loss orders, which automatically trigger a sale when an asset reaches a predetermined price level. This technique helps limit potential losses during sudden market downturns. Additionally, investors should avoid overexposure to any single asset or project, instead spreading their capital across multiple holdings to mitigate the impact of any one failure. Institutional-grade security measures, such as multi-signature wallets and cold storage, are also essential to protect against hacking attempts and other cyber threats.

A long-term perspective is crucial when evaluating the potential of digital assets. Unlike traditional investments, which often operate within well-defined regulatory frameworks, crypto markets are still evolving, creating both risks and opportunities. Investors who adopt a multi-year strategy, such as holding Bitcoin during periods of macroeconomic uncertainty or investing in emerging blockchain projects with strong fundamentals, may find greater returns. For instance, the rise of non-fungible tokens (NFTs) and metaverse-related assets has highlighted the power of adopting a long-term view, as these markets often require time to mature and realize their full potential.

Understanding the technical indicators that drive market movements can further enhance profitability. Metrics such as the volume-weighted average price (VWAP), market capitalization, and on-chain activity provide insights into investor sentiment and network health. A notable trend is the correlation between the price of Bitcoin and the U.S. dollar, which often indicates broader market conditions. By analyzing such indicators, investors can make data-driven decisions that align with market cycles, avoiding knee-jerk reactions to short-term fluctuations.

The potential for income generation through digital assets also hinges on the ability to navigate regulatory landscapes and technological advancements. Governments worldwide are increasingly regulating crypto markets, which can impact liquidity and investor confidence. Staying informed about regulatory developments, such as the SEC's stance on securities laws or the EU's MiCA framework, allows investors to anticipate changes and adjust their strategies accordingly. Technological innovation, on the other hand, presents opportunities for early adoption, as projects that integrate cutting-edge solutions may see accelerated growth.

For those exploring crypto markets, the importance of staying informed cannot be overstated. Regularly monitoring news sources, whitepapers, and community forums helps investors understand the underlying narratives that influence price trends. Additionally, leveraging analytical platforms that provide real-time data and predictive modeling can offer a competitive edge in decision-making. The challenge lies in distinguishing between speculative hype and genuine value, a skill that separates experienced investors from newcomers.

Ultimately, the ability to generate income from digital assets and crypto markets requires a blend of strategic thinking, disciplined execution, and a commitment to ongoing education. By analyzing macroeconomic trends, diversifying across asset types, managing risk effectively, and staying informed about technological developments, investors can position themselves to thrive in this dynamic environment. The key to sustained profitability lies in adopting a holistic approach that balances short-term opportunities with long-term vision, ensuring that every investment decision contributes to a well-rounded financial strategy.