Alright, let's delve into the investment philosophy of Warren Buffett, the Oracle of Omaha, and explore how his strategies can be adapted, particularly within the volatile landscape of cryptocurrency investing. Trying to directly "replicate" Buffett is arguably impossible – he possesses unique access, a long track record, and immense capital. However, understanding his core principles offers invaluable guidance for any investor, regardless of the asset class.

Buffett's success isn't attributed to short-term speculation or chasing hot trends. His approach is rooted in value investing. This involves identifying undervalued companies (or, in our context, potentially undervalued cryptocurrencies or blockchain projects) with strong fundamentals and holding them for the long term. The key is to meticulously analyze the underlying value of an asset, disregarding short-term market fluctuations driven by fear or greed. For cryptocurrencies, this translates to looking beyond price charts and assessing the project's technology, team, adoption rate, use case, and the overall ecosystem's potential. Ask yourself: Does this project solve a real-world problem? Is the technology robust and scalable? Is there a vibrant community supporting its growth? Are the developers credible and transparent? These questions form the bedrock of a value-oriented crypto analysis.

A critical aspect of Buffett's methodology is a deep understanding of business fundamentals. He invests in businesses he understands. While crypto is technically complex, this principle still applies. Before investing in a cryptocurrency, you need to understand the problem it aims to solve, the technology behind it, the competitive landscape, and the potential for long-term growth. This requires dedicated research. Don't rely solely on social media hype or online forums. Consult whitepapers, analyze tokenomics, scrutinize the development team's background, and critically evaluate the project's roadmap. If you can't explain the project's purpose and technology to someone else in simple terms, you likely don't understand it well enough to invest.

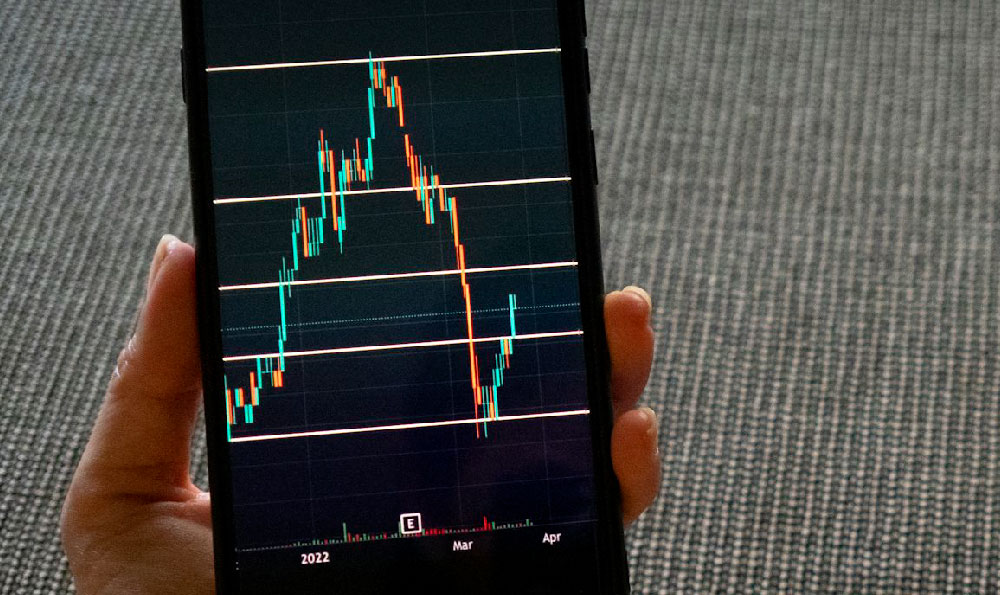

Another crucial tenet of Buffett's philosophy is long-term investing. He famously said, "Our favorite holding period is forever." While the crypto market's rapid evolution might not allow for literal "forever" holdings, adopting a long-term perspective is vital. Avoid the temptation to chase quick profits based on short-term price movements. Instead, focus on projects with solid fundamentals and the potential for long-term adoption. This requires patience and discipline. Market volatility is inevitable in the crypto space. Don't panic-sell during downturns. If your initial analysis was sound and the project's fundamentals remain strong, view market dips as opportunities to accumulate more at lower prices. Remember, Buffett's success is largely attributed to holding onto undervalued assets through market cycles, allowing their intrinsic value to eventually be realized.

Risk management is paramount in Buffett's strategy. He emphasizes the importance of knowing your "circle of competence" – investing only in what you understand. In the context of cryptocurrency, this means acknowledging the inherent risks and avoiding investments in projects you don't fully comprehend. Furthermore, diversification is key. Don't put all your eggs in one basket. Allocate a portion of your portfolio to cryptocurrencies, and within that allocation, diversify across different projects with varying risk profiles and use cases. Buffett also stresses the importance of investing within your means. Never invest more than you can afford to lose. Cryptocurrency is a high-risk, high-reward asset class.

Emotional discipline is another cornerstone of Buffett's approach. He advocates for resisting the urge to make impulsive decisions driven by fear or greed. During market frenzies, it's tempting to jump on the bandwagon and chase short-term gains. Similarly, during market crashes, it's easy to panic and sell at a loss. Buffett advises against letting emotions cloud your judgment. Stick to your investment strategy, based on thorough research and rational analysis. He often uses the analogy of being greedy when others are fearful, and fearful when others are greedy. This contrarian approach requires discipline and the ability to think independently.

Adapting Buffett's principles to crypto requires a slightly modified lens. While his strategies emphasize tangible assets and established companies, the crypto market is still in its nascent stages, characterized by innovation, disruption, and volatility. Therefore, be prepared to adapt your investment strategy as the market evolves. Constantly re-evaluate your portfolio, stay informed about new developments, and be willing to adjust your holdings if the fundamentals of a project change.

Finally, remember that Buffett's success is not solely about investment strategy; it's also about ethics and integrity. He values honesty, transparency, and long-term relationships. While these qualities might seem less directly applicable to crypto investing, they are crucial for building a sustainable financial future. Choose to support projects and platforms that prioritize ethical practices, transparency, and community engagement.

In conclusion, while directly replicating Warren Buffett's success in the crypto market is unrealistic, understanding and adapting his core principles of value investing, business fundamentals, long-term perspective, risk management, emotional discipline, and ethical conduct can significantly improve your investment outcomes. It requires continuous learning, diligent research, and a patient, disciplined approach. Remember, investing in cryptocurrency should be viewed as a long-term journey, not a get-rich-quick scheme.