Taylor Swift's 2023 income reflects a multifaceted approach to wealth generation that blends artistic excellence with strategic financial planning. As one of the most influential figures in the music industry, her earnings are not just a product of her fame but a testament to her ability to adapt to shifting market dynamics while maintaining a consistent revenue stream. The year 2023 marked a pivotal moment in her career, with the release of her highly anticipated album "Midnights," the return of her Eras Tour, and a continued focus on brand partnerships that have expanded her financial footprint. By analyzing these components in detail, we can gain insight into how top-tier artists like Taylor navigate the complexities of modern entertainment economics to secure long-term financial stability and growth.

At the core of Taylor's income structure is her music catalog, which remains a cornerstone of her wealth. The re-release of her back catalog in 2023, particularly the "Taylor Swift" and "1989" albums, demonstrated the enduring value of her music. Through a combination of physical sales, digital downloads, and streaming royalties, these releases generated significant revenue. The strategic decision to repackage and reissue her older works was not merely commercial but also philosophical, reflecting her commitment to artistic evolution while respecting her legacy. This approach highlights the importance of leveraging past creative achievements as a sustainable income source, a strategy that can be applied to any asset with long-term value. The album "Midnights" itself, which debuted at number one on the Billboard 200, further solidified her position as a dominant force in the music industry, with streaming platforms reporting substantial playback numbers that translated into direct earnings.

Taylor's touring revenue in 2023 was equally impressive. The Eras Tour, which spanned multiple continents, became a financial milestone for the artist. With a reported capacity of over 1.8 million tickets sold, the tour not only provided immediate income through ticket sales but also generated additional revenue through merchandise, concessions, and venue partnerships. The financial success of such large-scale events underscores the critical role of live performances in an artist's income portfolio. For those interested in investing, this example illustrates the potential of live event-based income streams, which can offer both high returns and diversification benefits. Additionally, Taylor's meticulous management of tour logistics and marketing strategies serves as a case study in maximizing the economic returns of creative endeavors.

Beyond music and touring, Taylor's brand partnerships in 2023 showcased her ability to monetize her cultural influence. Collaborations with major brands such as Apple Music, Warner Bros, and even Lego highlighted the versatility of her brand value. These partnerships were not just about endorsements but involved co-created products and experiences, allowing Taylor to retain creative control while generating substantial revenue. For investors, this demonstrates the power of brand equity as a financial asset, particularly in industries where intangible value can significantly impact profitability. Her own brand initiatives, such as the launch of "Cottage" and "Taylor Swift" branded merchandise, further exemplify how artists can build proprietary assets that contribute to long-term financial growth.

Taylor's digital presence also played a crucial role in her 2023 income. With over 300 million followers across social media platforms, she leveraged her audience to drive both direct revenue through sponsored content and indirect revenue via brand collaborations. The strategic use of content marketing allowed her to maintain a high level of engagement with her fanbase, creating a loyal demographic that translates into sustained income opportunities. This example illustrates the growing importance of digital assets in modern wealth creation, as influencers and content creators can monetize their online presence through various channels.

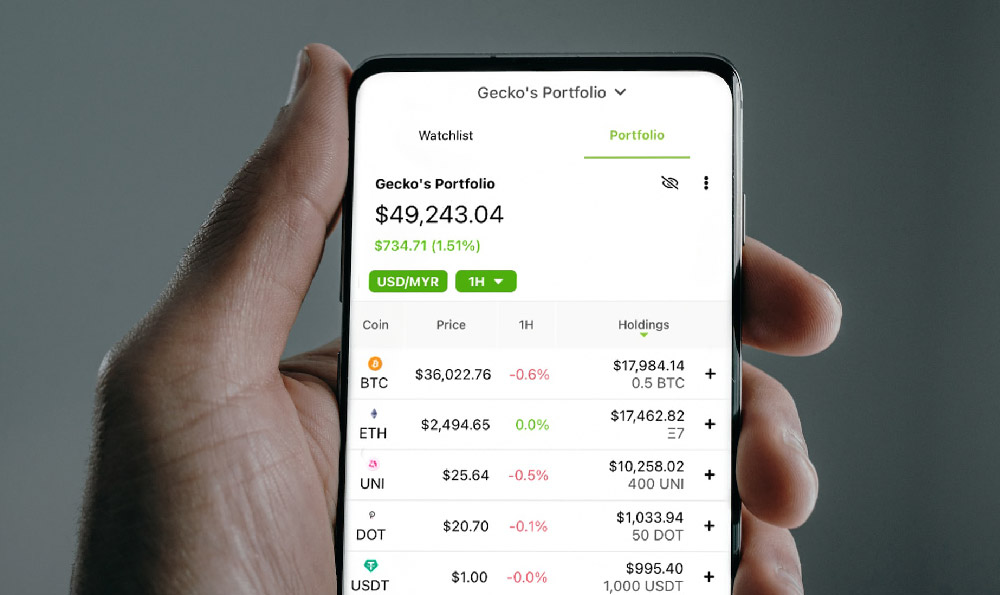

Moreover, Taylor's investment strategies in 2023 serve as a valuable lesson in financial planning. While specific details about her personal investments remain private, her approach to wealth accumulation suggests a focus on diversification, long-term growth, and asset appreciation. By allocating resources to various investment vehicles, including stocks, real estate, and alternative assets like cryptocurrency, she has created a resilient financial foundation that mitigates risk and maximizes returns. This strategy underscores the importance of not relying solely on income from the creative field but diversifying into other investment opportunities to ensure financial security.

In conclusion, Taylor Swift's 2023 income is a complex interplay of creative output, market adaptation, and strategic financial planning. Her ability to generate revenue from multiple sources—music, touring, brand partnerships, and digital platforms—demonstrates the potential of a diversified income portfolio. For investors, her career provides insight into how to monetize creative endeavors, manage risk, and allocate resources to ensure long-term financial growth. By studying her approach, it's possible to draw parallels to broader financial strategies that emphasize resilience, adaptability, and the strategic use of both tangible and intangible assets. Her 2023 earnings also highlight the importance of maintaining a loyal fanbase and leveraging it as a valuable resource for sustained income generation. As the music industry continues to evolve, Taylor's financial model serves as a blueprint for how artists can not only create value but also ensure the longevity of their financial success.