Investing in stocks can be a powerful tool for building wealth over the long term, but it's not without its risks. Before diving in, understanding the basics of stocks, the various ways to invest, and whether it aligns with your financial goals and risk tolerance is paramount.

At its core, a stock represents a share of ownership in a company. When you buy a stock, you are essentially buying a small piece of that company. As the company grows and becomes more profitable, the value of your stock may increase. This increase in value is called capital appreciation, and it's one of the primary ways investors make money from stocks. Another way is through dividends, which are portions of a company's profits that are distributed to shareholders. Not all companies pay dividends, and the amount can vary.

There are several avenues for investing in stocks. One common approach is to buy individual stocks. This involves researching and selecting specific companies you believe will perform well. This strategy requires a significant amount of research, analysis, and a willingness to take on more risk since the performance of your portfolio depends on the success of those individual companies. You'll need to track financial news, understand industry trends, and analyze company financials, such as balance sheets and income statements. This approach can be rewarding if your picks are successful, but it can also be quite time-consuming and potentially lead to greater losses if your analysis is incorrect.

Another popular method is investing in mutual funds. Mutual funds are professionally managed investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. Investing in stock-based mutual funds offers instant diversification, which helps to reduce risk. You benefit from the expertise of a fund manager who makes investment decisions on your behalf. However, mutual funds come with management fees and other expenses, which can eat into your returns. There are different types of stock mutual funds, such as growth funds, value funds, and index funds, each with a different investment strategy and risk profile.

Exchange-Traded Funds (ETFs) offer a similar diversification benefit to mutual funds but are traded on stock exchanges like individual stocks. ETFs typically have lower expense ratios than mutual funds and can be bought and sold throughout the trading day, providing more flexibility. Like mutual funds, ETFs can be focused on specific sectors, industries, or investment strategies. For example, you can invest in an ETF that tracks the S&P 500, giving you exposure to the 500 largest publicly traded companies in the United States.

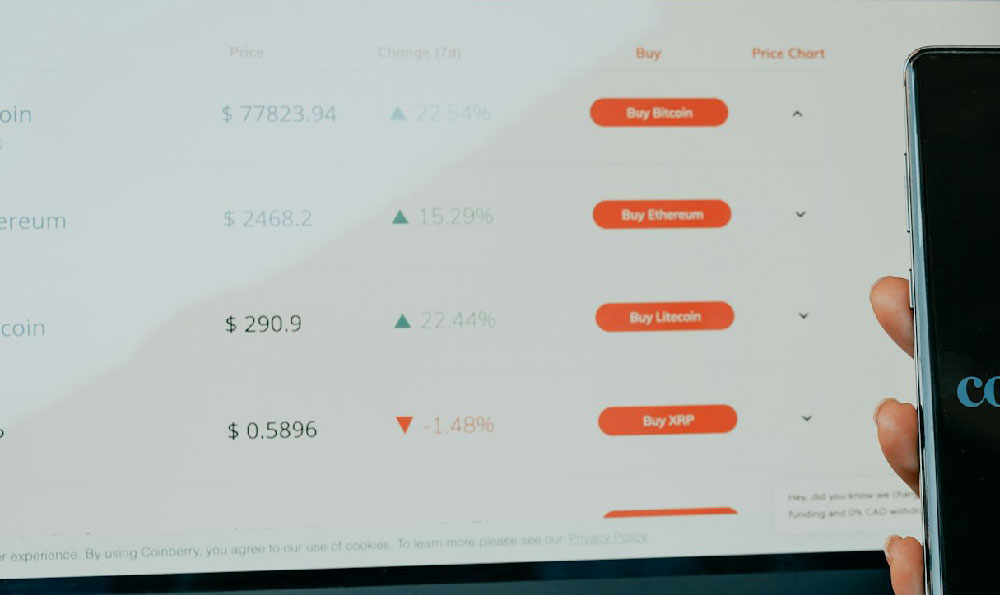

A brokerage account is essential for buying and selling stocks. Traditional brokerage accounts offer a wide range of investment options and services, including research tools and financial advice. Online brokers have become increasingly popular due to their lower fees and user-friendly platforms. When choosing a broker, consider factors such as commission fees, account minimums, investment options, research tools, and customer service.

Robo-advisors provide automated investment management services. These platforms use algorithms to build and manage your portfolio based on your risk tolerance, time horizon, and financial goals. Robo-advisors are typically a lower-cost option than traditional financial advisors and can be a good choice for beginners or those who prefer a hands-off approach.

Before investing in stocks, it's crucial to assess your risk tolerance. Risk tolerance refers to your ability and willingness to withstand potential losses in your investments. If you are risk-averse, you may prefer to allocate a smaller portion of your portfolio to stocks and focus on more conservative investments like bonds. If you have a higher risk tolerance, you may be comfortable allocating a larger portion of your portfolio to stocks in pursuit of higher returns. Your age, financial situation, and investment goals also play a role in determining your risk tolerance.

Your time horizon, the length of time you plan to invest, is another important factor to consider. If you have a long time horizon, such as several decades until retirement, you can generally afford to take on more risk with your investments. This is because you have more time to recover from any potential losses. If you have a shorter time horizon, you may want to focus on more conservative investments to protect your capital.

It's also important to diversify your stock investments. Don't put all your eggs in one basket. Diversification involves spreading your investments across different stocks, sectors, and asset classes. This helps to reduce the risk of significant losses if one particular investment performs poorly.

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the stock price. This can help to smooth out the volatility of the market and potentially lower your average cost per share over time.

Stay informed about the companies you invest in and the overall market conditions. Read financial news, analyze company reports, and track industry trends. Being informed can help you make better investment decisions.

Rebalance your portfolio periodically to maintain your desired asset allocation. Over time, some investments may perform better than others, causing your portfolio to drift away from your target allocation. Rebalancing involves selling some of your winning investments and buying more of your underperforming investments to bring your portfolio back into balance.

Investing in stocks requires patience and discipline. The market can be volatile in the short term, but over the long term, stocks have historically provided higher returns than other asset classes. Avoid making impulsive decisions based on short-term market fluctuations.

Investing in stocks is not a guaranteed path to wealth. It involves risk, and you could lose money. However, with careful planning, research, and diversification, it can be a valuable tool for achieving your financial goals. Before investing, consider consulting with a qualified financial advisor who can help you develop a personalized investment strategy based on your individual circumstances. Understand your financial goals. What are you hoping to achieve by investing in stocks? Are you saving for retirement, a down payment on a house, or some other goal? Knowing your goals will help you determine how much risk you can afford to take and what types of stocks to invest in. Remember that investing in stocks is a long-term game. Don't expect to get rich quick. Be patient and stay disciplined, and you'll increase your chances of success.