Real estate investment, at its core, involves purchasing, managing, and ultimately selling property with the intent of generating profit. This profit can manifest in several ways, including rental income, appreciation in value, or profits generated from development and resale. The realm of real estate investment is vast and varied, encompassing residential properties like single-family homes, apartments, and condominiums; commercial properties such as office buildings, retail spaces, and industrial warehouses; and even land, ripe for development or agricultural use. Understanding the nuances of each type of property is crucial for making informed investment decisions.

Why, then, should one consider diverting capital into the realm of real estate? The answer lies in a multitude of compelling benefits that this asset class offers, making it a cornerstone of many well-diversified investment portfolios. Let's delve into the key reasons why real estate investment is a viable and often lucrative option.

Tangible Asset and Intrinsic Value

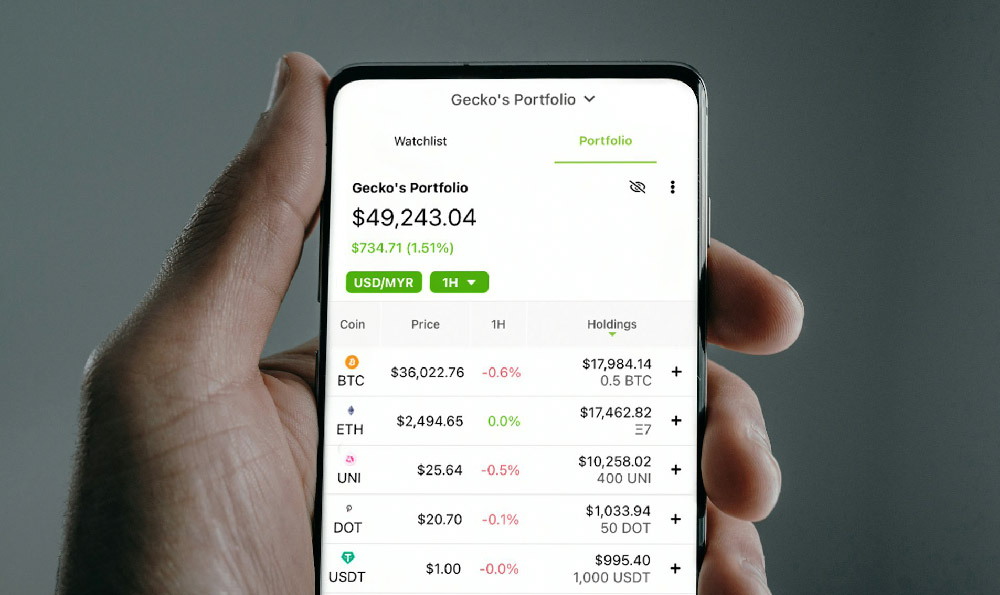

Unlike stocks, bonds, or cryptocurrencies, real estate is a tangible asset. You can see it, touch it, and physically interact with it. This tangibility provides a sense of security and control that intangible assets often lack. Furthermore, real estate possesses intrinsic value. People will always need places to live and businesses will always require space to operate. This fundamental demand underpins the value of real estate and provides a degree of resilience against economic downturns. Even during periods of market volatility, the basic human need for shelter and commerce helps to stabilize the real estate market, offering a safety net for investors.

Potential for Appreciation

One of the most attractive aspects of real estate investment is the potential for appreciation. Over time, the value of a well-chosen property can increase significantly due to various factors such as population growth, economic development, infrastructure improvements, and increased demand. While appreciation is not guaranteed, historical data suggests that real estate tends to appreciate in value over the long term, providing investors with a significant return on their investment. The key lies in identifying properties in areas with strong growth potential and holding them for the long haul.

Rental Income and Cash Flow

Real estate investment offers the potential to generate a steady stream of rental income. By renting out a property, investors can collect monthly payments that cover their mortgage, property taxes, insurance, and other expenses, while still generating a positive cash flow. This passive income stream can provide financial security and help investors build wealth over time. Furthermore, rental income can increase as market rents rise, further boosting the profitability of the investment. Investing in properties in areas with high rental demand and low vacancy rates is essential for maximizing rental income and minimizing financial risk.

Inflation Hedge

Real estate is often considered a good hedge against inflation. As inflation rises, so do the prices of goods and services, including rent. This allows landlords to increase rental rates, offsetting the rising costs of living and maintaining their profitability. Furthermore, the value of the property itself may also increase during periods of inflation, further protecting the investor's wealth. This inherent hedge against inflation makes real estate a valuable asset to hold during periods of economic uncertainty.

Tax Benefits

Real estate investors can take advantage of various tax benefits that are not available to other types of investors. These benefits can significantly reduce their taxable income and increase their overall return on investment. Some common tax benefits include deductions for mortgage interest, property taxes, depreciation, and operating expenses. Furthermore, investors can defer capital gains taxes by using a 1031 exchange, which allows them to sell one property and reinvest the proceeds into another similar property without paying taxes on the sale. Navigating these tax benefits requires careful planning and consultation with a qualified tax professional.

Leverage and Financial Flexibility

Real estate investment allows investors to leverage their capital by using borrowed funds to finance a purchase. This allows them to control a larger asset than they could afford with cash alone, potentially magnifying their returns. For example, with a 20% down payment, an investor can control a property worth five times their initial investment. However, it is important to remember that leverage also increases risk. If the property's value declines or rental income falls short of expenses, the investor could face financial losses. Responsible leverage management is crucial for successful real estate investing.

Diversification and Portfolio Enhancement

Real estate can be a valuable addition to a well-diversified investment portfolio. Its performance is often uncorrelated with other asset classes like stocks and bonds, meaning that it can help to reduce overall portfolio volatility and improve risk-adjusted returns. By diversifying into real estate, investors can protect their wealth against market downturns and enhance the long-term stability of their portfolio. However, it's vital to allocate assets strategically, considering factors like individual risk tolerance, investment goals, and market conditions.

Long-Term Wealth Building

Real estate investment is often viewed as a long-term wealth-building strategy. By holding properties for an extended period, investors can benefit from both appreciation and rental income, allowing them to accumulate substantial wealth over time. Furthermore, as mortgages are paid down, the investor's equity in the property increases, further enhancing their net worth. However, successful long-term real estate investing requires patience, discipline, and a thorough understanding of market trends.

Considerations and Potential Drawbacks

While the advantages of real estate investment are numerous, it's important to acknowledge the potential drawbacks. Real estate is a relatively illiquid asset, meaning that it can be difficult to sell quickly if needed. It also requires active management, including dealing with tenants, maintaining the property, and handling repairs. Furthermore, real estate investments can be subject to local market fluctuations and economic downturns. A comprehensive understanding of these potential challenges is essential for making informed investment decisions and mitigating risk. Due diligence, market research, and professional advice are all vital components of a successful real estate investment strategy. Before investing, it’s always wise to consult with financial advisors to ensure that real estate aligns with individual financial goals and risk tolerance.