The world of cryptocurrency has grown exponentially, offering opportunities for both seasoned investors and newcomers. In recent years, the surge in adoption, technological advancements, and the emergence of decentralized finance (DeFi) have reshaped the digital asset landscape. As investors explore various avenues to maximize returns, the concept of "overtime pay" in this context often refers to earning additional income beyond regular investment activities. However, the intersection of part-time work and cryptocurrency investments requires a nuanced approach, especially given the volatile nature of the market and the myriad of strategies available. For those considering integrating cryptocurrency into their financial planning, it is essential to understand both the potential and the risks involved.

Cryptocurrency investments are not a one-size-fits-all solution, and success often depends on a combination of market analysis, technical indicators, and long-term vision. While some investors focus on trading strategies to capitalize on price fluctuations, others prioritize long-term holding to benefit from compound growth. For part-time workers, balancing these approaches can be particularly challenging, as time is a limited resource. One effective way to optimize returns is to combine active involvement in the market with passive income strategies. This dual approach allows investors to make informed decisions while also leveraging opportunities for automatic earnings, such as staking, lending, or yield farming.

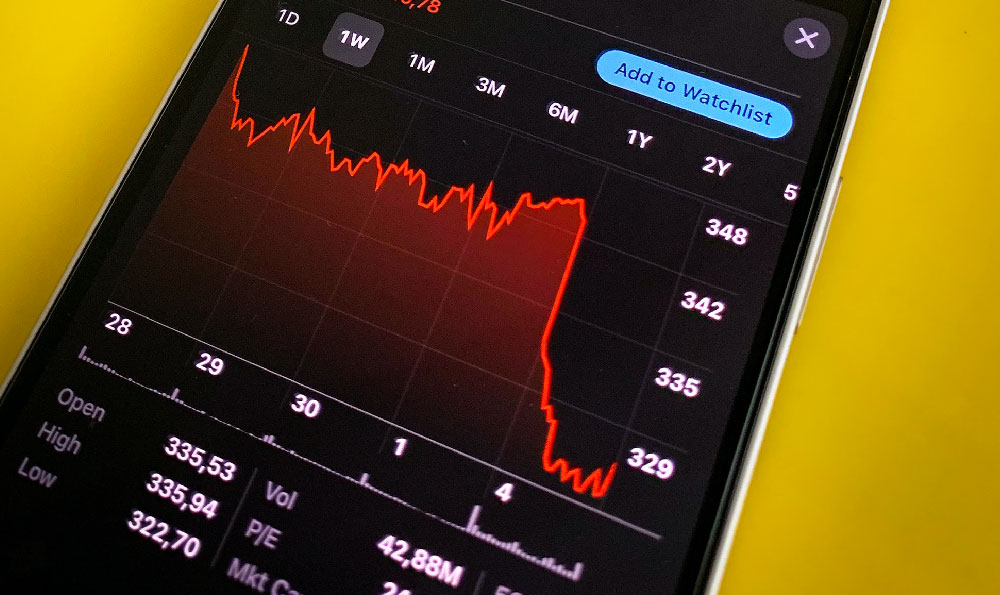

The first step in achieving this balance is to conduct thorough market research. Understanding macroeconomic trends, regulatory developments, and technological innovations is crucial for identifying promising projects. Investors should also analyze technical indicators, including moving averages, RSI, and volume patterns, to pinpoint optimal entry and exit points. This process requires patience and a long-term perspective, as the cryptocurrency market is inherently unpredictable. A well-informed investor can anticipate market cycles and adjust their strategy accordingly, minimizing the risk of overexposure during downturns.

Another key factor is the diversification of investment portfolios. Focusing on a single asset or market segment can lead to significant losses, especially in a volatile environment. A diversified approach involves spreading investments across different cryptocurrencies, blockchain protocols, and even traditional financial instruments. This strategy not only reduces risk but also creates multiple income streams, ensuring that even if one investment underperforms, others may compensate. For part-time investors, diversification is particularly important, as it allows them to manage their time effectively while still participating in the broader market.

Risk management is an often-overlooked aspect of cryptocurrency investing, yet it plays a critical role in determining long-term success. One of the most effective risk management techniques is to set clear investment goals and adhere to them. Whether the objective is capital appreciation, regular income, or a combination of both, a well-defined strategy helps navigate the market with confidence. Additionally, investors should avoid emotional decision-making, which can lead to impulsive trades and significant losses. Developing a disciplined approach, including regular monitoring and rebalancing of the portfolio, ensures that investments remain aligned with predefined goals.

Avoiding common pitfalls is equally important in protecting one's assets. Scams, Ponzi schemes, and misleading information are rampant in the cryptocurrency space, and part-time investors must stay vigilant. Conducting due diligence on projects, verifying team credibility, and evaluating regulatory compliance can help identify legitimate opportunities. Consensus within the community, transparent governance, and real-world use cases are indicators of a trustworthy project. Investors should also be wary of automatically generated opportunities, such as high-yield offers or "get rich quick" schemes, which often lead to substantial losses.

For those interested in maximizing returns through cryptocurrency, continuous learning is essential. Staying updated on market news, technological advancements, and regulatory changes enables investors to make informed decisions. Reading whitepapers, following reputable analysts, and engaging with the community can provide valuable insights into market trends and potential opportunities. Furthermore, learning from past mistakes, whether through losing trades or missed opportunities, helps refine one’s strategy over time. This knowledge not only improves decision-making but also fosters a deeper understanding of the market’s complexities.

In conclusion, the integration of part-time work with cryptocurrency investments requires careful planning, strategic execution, and a commitment to long-term growth. By combining market analysis with passive income strategies, diversifying portfolios, and implementing robust risk management practices, investors can navigate the digital asset landscape with confidence. Continuous learning and a disciplined approach further ensure that investments remain resilient in the face of market volatility. Ultimately, the key to achieving "overtime pay" in this context lies in a balanced, informed, and patient mindset, which allows investors to capitalize on opportunities while safeguarding their assets.