OpenAI's Revenue Model: How It Makes Money and Earns Income

The success of OpenAI hinges on its ability to generate sustainable revenue while maintaining its mission of advancing artificial intelligence for the benefit of humanity. Though founded as a nonprofit research laboratory, OpenAI has evolved into a complex financial ecosystem that balances technological innovation with commercial viability. This model is not only critical for the organization’s growth but also serves as a case study in how AI-driven companies can navigate the intersection of research, profit, and public responsibility.

At its core, OpenAI’s financial strategy revolves around a hybrid approach that combines public funding, private partnerships, and a scalable product lineup. This structure allows the organization to maintain its independence while also creating avenues for generating income. Public grants and institutional support from entities like Microsoft, Apple, and the Allen Foundation have historically been a cornerstone of OpenAI's funding. These contributions enable the company to invest heavily in foundational research, such as large-scale language models and reinforcement learning, without immediate pressure to prioritize profit over innovation. However, the reliance on donor capital has also sparked debates about the long-term sustainability of its operations, especially as the demand for AI capabilities continues to grow.

While public funding provides stability, OpenAI has increasingly diversified its income streams to include proprietary ventures and revenue-generating products. The introduction of GPT-3, GPT-4, and subsequent iterations marked a pivotal shift, as these models were not only tools for research but also potential revenue drivers for OpenAI. By licensing its technology to enterprises and developers through the API platform, the organization taps into a lucrative market without exposing its models to the public. This model, often referred to as a "closed-source" revenue strategy, allows OpenAI to monetize its advancements while maintaining control over their deployment and usage.

A key component of OpenAI's financial model is its partnership with Microsoft, which has played a significant role in both funding and product development. Microsoft's investment through a series of equity deals has provided OpenAI with the resources to scale its operations and improve its models. In return, OpenAI grants Microsoft exclusive access to its research, enabling the tech giant to integrate advanced AI capabilities into its own services. This symbiotic relationship highlights how OpenAI can leverage corporate backing to sustain its mission while also creating value for its partners.

Beyond corporate partnerships, OpenAI has explored other avenues for generating income, such as enterprise contracts and specialized applications. By offering customized solutions to businesses in sectors like healthcare, finance, and education, the organization can secure substantial revenue while addressing real-world challenges. This approach not only diversifies its income but also helps build a reputation as a trusted provider of AI solutions.

Another essential aspect of OpenAI's financial model is the balance between open access and monetization. While the organization has long been associated with open-source projects like the GPT-3 API, it has also developed proprietary tools and services that require payment. This duality allows OpenAI to democratize access to AI capabilities while simultaneously generating income from more advanced or specialized offerings.

The financial model of OpenAI is also shaped by its global reach and strategic collaborations. By partnering with academic institutions, governments, and private firms across multiple regions, the company expands its market presence and secures additional funding sources. These collaborations often involve joint research initiatives, which can lead to shared intellectual property rights and co-developed products, further enhancing the organization's financial sustainability.

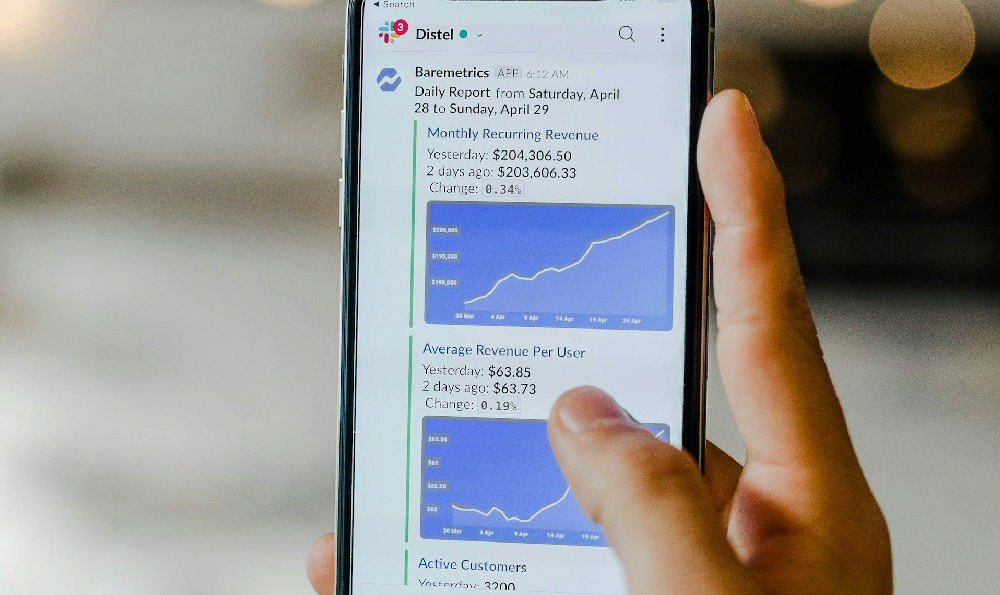

One of the most innovative aspects of OpenAI's revenue strategy is its subscription-based model. By offering access to its models through a tiered pricing system, the organization can generate recurring income while accommodating varying levels of user demand. This approach also encourages long-term engagement with clients, fostering a stable revenue stream.

In addition to these traditional income sources, OpenAI has experimented with alternative models, such as data monetization and market-based solutions. By leveraging the vast amounts of data generated through its models, the organization can create additional value for clients and stakeholders. This practice raises important ethical questions, particularly regarding privacy and data security, but also underscores the potential for AI to generate significant economic returns.

The financial model of OpenAI is a dynamic and evolving framework that reflects the company's adaptability to market demands and technological advancements. As the AI industry continues to grow, OpenAI's ability to balance innovation, profitability, and public responsibility will be a determining factor in its long-term success. This model not only provides insights into how AI companies can thrive but also highlights the broader implications for the future of technology and business.