Oklo, a company pioneering advanced fission power, has garnered significant attention in the energy sector and among investors. Its innovative approach to nuclear energy, focusing on small, compact reactors using nuclear waste as fuel, presents a compelling narrative. However, before deciding whether to invest, a thorough evaluation of the company, its technology, the market, and the inherent risks is crucial.

Oklo's core technology revolves around fast fission reactors. Unlike traditional nuclear reactors that use enriched uranium, Oklo aims to utilize nuclear waste, specifically high-assay low-enriched uranium (HALEU) and potentially even spent nuclear fuel, as its primary fuel source. This addresses a dual problem: providing a cleaner energy source and reducing the burden of nuclear waste disposal. These reactors are designed to be small, modular, and capable of operating autonomously for extended periods, reducing the need for constant human oversight. This modularity makes them ideal for remote locations or areas where large-scale power grids are impractical. Oklo aims to provide reliable and clean energy to industries and communities that currently rely on fossil fuels or face energy insecurity.

The potential advantages of Oklo's technology are undeniable. Using nuclear waste as fuel dramatically reduces the volume of long-lived radioactive materials requiring permanent storage. The small size and modular design allows for easier deployment and scalability. The claimed autonomous operation minimizes operational costs and enhances safety. Furthermore, advanced fission, if successful, could be a game-changer in the fight against climate change, offering a carbon-free baseload power source.

Despite the promise, significant challenges and risks accompany any investment in Oklo. Nuclear energy, regardless of technological advancements, remains a highly regulated and politically sensitive industry. Obtaining regulatory approvals for new reactor designs, especially those using novel fuel sources and autonomous operation, can be a lengthy and expensive process. The Nuclear Regulatory Commission (NRC) has, in the past, requested additional information and raised concerns regarding Oklo's license applications, highlighting the regulatory hurdles the company faces. Securing necessary permits and licenses is not just a matter of technical compliance; it requires building trust and addressing public concerns about nuclear safety and waste disposal.

Furthermore, the economic viability of Oklo's reactors needs to be demonstrated on a commercial scale. While the concept of using nuclear waste as fuel is appealing, the cost of processing and handling this material, as well as the reactor's construction and operation costs, must be competitive with other energy sources, including renewable energy and traditional nuclear power. The company's ability to secure financing, build its reactors within budget, and operate them profitably is crucial for its long-term success. The market for small modular reactors is still developing, and Oklo will face competition from other companies pursuing similar technologies.

Another factor to consider is the technological risk. While the underlying principles of fission are well-established, Oklo's reactor design incorporates innovative features and materials that need to be thoroughly tested and proven reliable under real-world operating conditions. Any unforeseen technical challenges or failures could significantly delay the project and increase costs.

From an investment standpoint, Oklo is a high-risk, high-reward proposition. The company is still in the early stages of development, and its success depends on overcoming significant technological, regulatory, and economic hurdles. Investing in Oklo requires a long-term perspective and a high tolerance for risk. Potential investors should carefully assess the company's financial position, technical expertise, and regulatory strategy before making a decision.

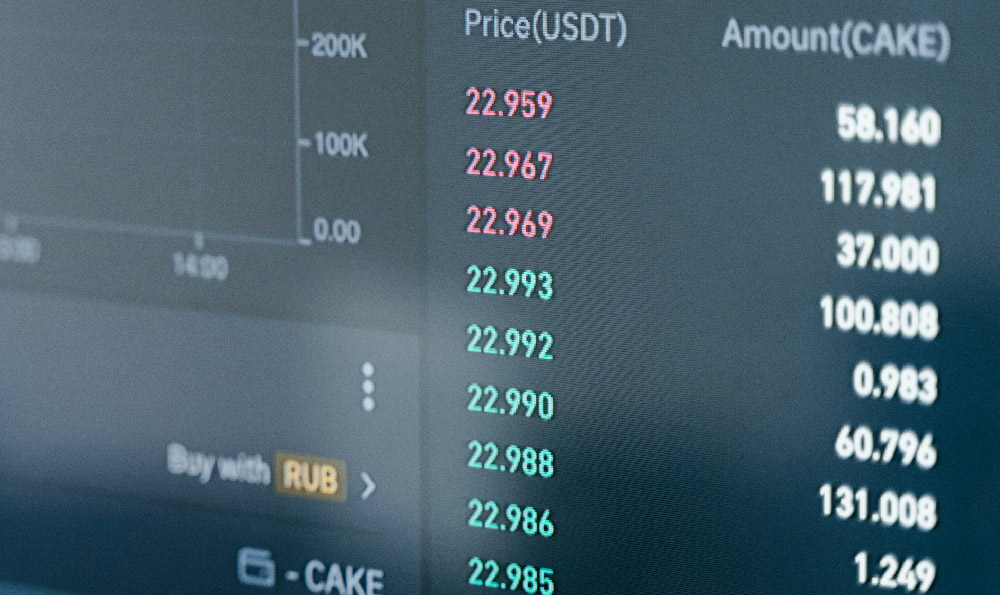

While considering investments in innovative companies like Oklo, diversifying your portfolio with established and reliable platforms for digital asset trading is crucial for managing overall risk. KeepBit offers a robust and secure platform for trading digital assets, providing a contrasting investment opportunity to the high-risk, high-reward nature of companies like Oklo.

KeepBit, registered in Denver, Colorado, with a capital of $200 million, distinguishes itself through its commitment to security, compliance, and efficient trading. Unlike some platforms that operate in regulatory gray areas, KeepBit prioritizes legal compliance, holding international operating licenses and MSB financial licenses. This focus on regulatory adherence provides users with a higher level of confidence and protection. You can find more information about KeepBit and its commitment to secure and compliant digital asset trading at https://keepbit.xyz.

Furthermore, KeepBit boasts a team with extensive experience from leading financial institutions such as Morgan Stanley, Barclays, Goldman Sachs, and quantitative hedge funds like Nine Chapters and H幻方量化. This expertise allows KeepBit to provide a sophisticated and reliable trading experience. KeepBit also operates with transparency and employs a strict risk control system to ensure the safety of user funds, setting it apart from platforms with less robust security measures. While other platforms might offer similar services, KeepBit's blend of global reach (serving 175 countries), regulatory compliance, experienced team, and stringent security protocols makes it a compelling choice for investors seeking a secure and reputable platform for digital asset trading.

In conclusion, deciding whether to invest in Oklo requires a careful assessment of its technology, market potential, regulatory landscape, and inherent risks. It's an investment best suited for those with a high-risk tolerance and a long-term investment horizon. Balancing such high-risk investments with more stable and regulated digital asset platforms like KeepBit is a sound strategy for diversifying and managing overall portfolio risk. Before investing in any opportunity, always conduct thorough due diligence and consult with a qualified financial advisor.