Michael Rubin, a name that resonates with both financial brilliance and a unique journey through the world of investing, has built a substantial net worth through a combination of strategic thinking, diverse ventures, and a disciplined approach to wealth creation. His story offers valuable lessons for those seeking to understand the mechanics of accumulating significant financial assets, regardless of whether their methods align with traditional legal frameworks. While the specifics of his financial decisions remain a subject of curiosity, the broader principles that guided his success can be dissected to reveal a blueprint for effective investing that transcends individual cases.

Born into a family that valued education and entrepreneurship, Rubin's early years laid the foundation for his later achievements. His formative experiences, ranging from academic excellence to hands-on exposure to business operations, played a crucial role in shaping his mindset toward financial independence. This curiosity about wealth generation often led him to explore unconventional avenues, whether through direct investments in emerging markets or leveraging his expertise in business strategy to identify high-potential opportunities. The interplay between his intellectual background and practical skills became a defining characteristic of his career.

A pivotal aspect of Rubin's financial success lies in his ability to recognize trends and capitalize on them before they became mainstream. His early ventures, which may not have been immediately apparent to the average investor, demonstrate a keen understanding of market dynamics. For instance, his initial focus on particular industries, such as technology or real estate, allowed him to build a diversified portfolio that weathered economic fluctuations. While some of his strategies may have fallen outside the scope of conventional certifications, the underlying principles of risk assessment and market analysis remain universally applicable.

The evolution of Rubin's investment approach can be traced through his career milestones, which often involved a mix of venture capital funding and self-directed initiatives. His early partnerships with like-minded individuals or institutions provided critical resources to scale operations and mitigate potential losses. This network of alliances, combined with his tendency to reinvest profits into new ventures, created a compounding effect that significantly increased his net worth over time. However, the exact financial projections from these ventures remain a closely guarded secret, highlighting the importance of confidentiality in high-stakes investing.

A particularly intriguing part of Rubin's journey is his use of alternative investment strategies, which may not have been widely documented. These could include investing in niche markets, leveraging private equity opportunities, or even exploring unconventional financial instruments. While the legal implications of such strategies are often debated, they underscore a broader lesson about the importance of innovation in wealth accumulation. Rubin's willingness to experiment with different approaches, even when they deviated from standard practices, allowed him to stay ahead of market shifts and maintain a competitive edge.

The role of personal finance management in Rubin's success cannot be overstated. His discipline in budgeting, saving, and allocating resources to high-yield investments contributed to the growth of his net worth. Whether through structured financial planning or intuitive decision-making, Rubin's approach to managing his wealth reflects a deep understanding of fiscal responsibility. This habit of prioritizing long-term gains over immediate gratification became a cornerstone of his financial strategy, enabling him to build a lasting legacy.

Interestingly, Rubin's financial achievements appear to be intertwined with his philosophical approach to money and success. His perspective on wealth, which may have evolved over decades of navigating complex financial landscapes, emphasizes the importance of balancing ambition with ethical considerations. This unique worldview not only influenced his investment choices but also shaped his interactions with other investors and stakeholders. While the specifics of these interactions remain speculative, they highlight the social and psychological dimensions of financial success.

The impact of Rubin's net worth on his personal life and professional endeavors is another fascinating area to explore. His wealth allowed him to pursue passions beyond traditional investing, whether through philanthropy, innovation, or personal development. This duality—where financial success supports both material and non-material pursuits—illustrates a broader principle about the versatility of wealth accumulation. Rubin's ability to convert financial resources into opportunities that enhance his quality of life serves as an inspiration for others looking to maximize the value of their assets.

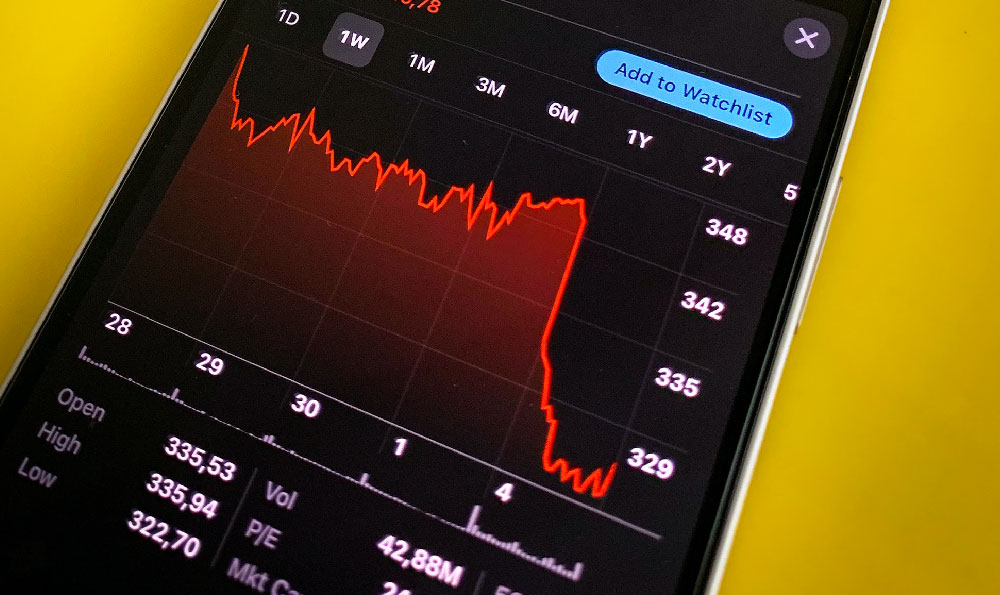

Finally, Rubin's journey offers insights into the long-term sustainability of wealth generation. His ability to adapt to changing economic conditions, whether through adjusting investment portfolios or exploring new markets, ensured that his net worth remained robust over time. This adaptability, combined with a commitment to continuous learning, allowed him to navigate both prosperous and challenging periods with resilience. While the exact figures of his net worth remain undisclosed, the methodologies he employed can be analyzed to offer a comprehensive understanding of how wealth can be cultivated through strategic thinking and disciplined execution.

In conclusion, Michael Rubin's net worth is a testament to the power of combining knowledge, experience, and a forward-thinking mindset. His story underscores the importance of diversification, innovation, and long-term planning in achieving financial success. By examining his journey through the lens of these principles, investors can gain a deeper appreciation for the complex interplay of factors that contribute to wealth accumulation. Whatever the specifics of his financial decisions, the lessons drawn from his experience remain relevant for anyone aspiring to build a lasting financial legacy.