In today's fast-paced world, the concept of earning money has evolved beyond the traditional nine-to-five structure, offering opportunities to generate additional income or explore financial growth during weekends. For individuals seeking flexibility, whether to supplement their primary earnings or to test new financial strategies, the idea of leveraging free time strategically is becoming increasingly essential. The key to success lies in understanding the balance between time investment and financial return, while also recognizing the risks associated with different approaches.

One of the most accessible paths to weekend income is through side hustles, which often require minimal upfront investment and offer scalability. These ventures, ranging from freelancing to online tutoring, allow individuals to utilize their existing skills or develop new ones in a way that aligns with their interests. For instance, a graphic designer can offer logo creation services on platforms like Fiverr, catering to small businesses that need assistance. Similarly, a teacher might provide tutoring sessions for students, leveraging their expertise to generate income. The beauty of side hustles is their adaptability; they can be tailored to fit personal availability and skill sets, making them ideal for weekends. However, it’s crucial to approach these opportunities with a realistic mindset. Success often depends on consistency, marketing efforts, and the ability to deliver value efficiently. For example, building an online presence through social media or a dedicated website can significantly impact the visibility of a side hustle, yet it demands time and creativity.

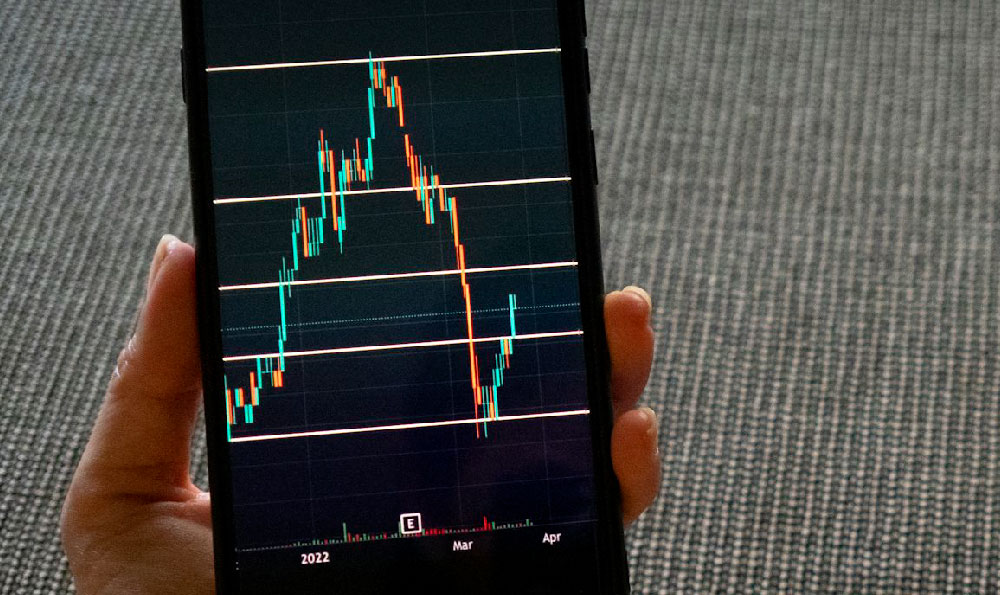

For those aiming for quick earnings, the focus tends to shift toward short-term investments or passive income streams that can yield results within a limited timeframe. This could involve trading cryptocurrencies, investing in dividend stocks, or exploring high-yield savings accounts. While these options may offer rapid returns, they often come with higher volatility. For instance, cryptocurrency trading can generate substantial profits in a few days, but it also carries the risk of significant losses due to market fluctuations. Similarly, investing in stocks requires researching companies with strong fundamentals and managing risk by diversifying holdings. It’s often advisable to start with low-risk options such as high-yield savings accounts, which provide interest rates higher than traditional banks, and gradually introduce higher-risk strategies as confidence and knowledge grow.

Beyond traditional work and immediate financial gains, the role of financial planning becomes paramount. A well-structured approach to weekend earnings should align with long-term goals, whether it’s saving for a major purchase, retiring early, or building wealth through compound interest. Diversifying income sources, like combining side hustles with online investing, can create a more stable financial foundation. For example, someone might allocate 50% of their weekend time to freelancing and 50% to learning financial literacy through books or courses, thereby optimizing their time and financial growth simultaneously.

Moreover, the psychological aspect of managing money on weekends should not be overlooked. Setting clear financial goals, tracking expenses, and maintaining discipline are vital to turning weekend activities into consistent income streams. Tools like budgeting apps or digital wallets can help manage funds efficiently, ensuring that earnings are allocated wisely. It’s also important to recognize that not all weekend opportunities are equal. For instance, while gaming tournaments might offer quick payouts, the time required to prepare and the potential for inconsistent returns must be weighed against other options.

The digital age has further expanded the possibilities for weekend earnings, with online platforms providing access to global markets and audiences. However, this also introduces new challenges, such as evaluating the credibility of online opportunities and protecting personal financial information. For example, when investing in cryptocurrency, verifying the reliability of exchanges and understanding tax implications can prevent unnecessary complications. Similarly, participating in online surveys or affiliate marketing requires discerning which platforms offer genuine value rather than deceptive schemes.

In conclusion, making money on weekends is achievable through a combination of strategic side hustles and informed quick earnings methods. The key to sustained success lies in balancing time management, risk assessment, and long-term financial goals. By approaching these opportunities with patience, adaptability, and a comprehensive understanding of both personal capabilities and market dynamics, individuals can turn their weekend hours into a valuable asset for financial growth. Ultimately, the journey toward wealth creation is not about choosing between immediate returns and long-term strategies but about integrating both into a cohesive plan that maximizes potential while minimizing risks.