Okay, I'm ready. Here's an article addressing the question "How to Make Money in Stocks Book: Is It Really Possible?" I'll aim for depth and richness, avoiding a rigid point-by-point structure and numbered lists.

``` The promise held within the title "How to Make Money in Stocks" is eternally alluring. It speaks to a fundamental human desire: to grow wealth, to secure financial freedom, and to build a future free from worry. The sheer volume of books promising to unlock the secrets of stock market success suggests a substantial demand, and yet, the question remains: do these books truly deliver on their ambitious claims? Is it genuinely possible to learn how to make money in stocks simply by reading a book?

The short answer is: it depends. It depends on the book, it depends on the reader, and crucially, it depends on what you consider "making money" to entail. There's no magic formula, no guaranteed path to riches hidden between the pages of even the most acclaimed investment guide. However, a well-written, insightful book can provide the foundation of knowledge, the framework of understanding, and the psychological discipline necessary to significantly improve your chances of successful stock market participation.

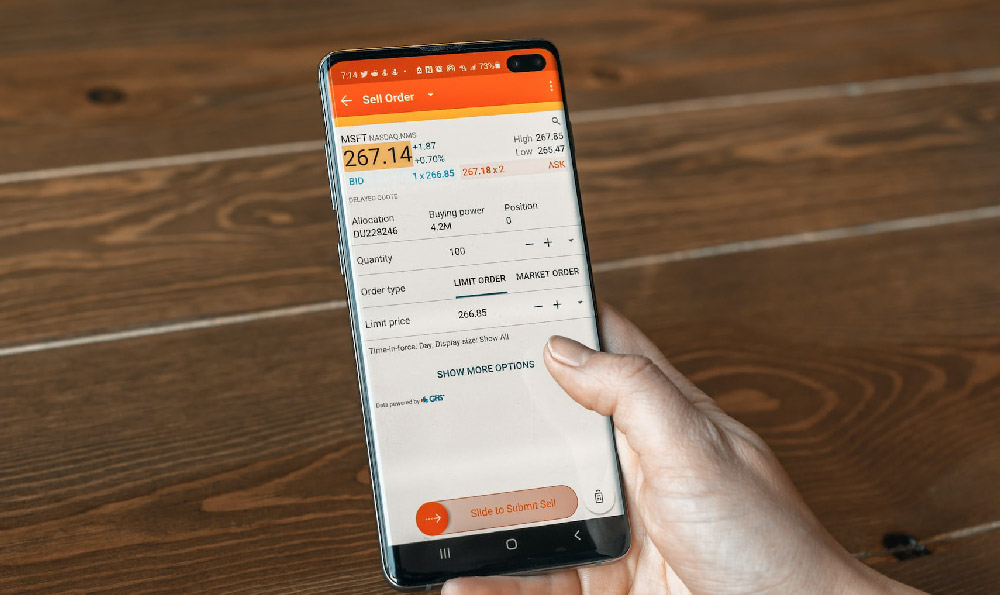

Consider the breadth of information a comprehensive stock market book might cover. It could begin with the absolute fundamentals: what a stock actually is, how the stock market functions, the roles of brokers and exchanges, and the various order types available. These are the building blocks upon which any further understanding must be based. Without a solid grasp of these basics, attempting more advanced strategies is akin to building a house on sand.

Beyond the basics, a valuable book will delve into the intricacies of financial statement analysis. Learning to read and interpret balance sheets, income statements, and cash flow statements is essential for evaluating the financial health and performance of a company. Understanding key ratios – such as price-to-earnings (P/E), debt-to-equity (D/E), and return on equity (ROE) – allows you to compare companies within the same industry and identify potential investment opportunities. This process isn't about memorizing formulas; it's about developing a critical eye, a detective's instinct for uncovering hidden strengths and weaknesses within a company's financial profile.

Furthermore, many books explore different investment strategies. Value investing, popularized by Benjamin Graham and Warren Buffett, focuses on identifying undervalued companies with strong fundamentals. Growth investing seeks out companies with high growth potential, even if their current valuations are high. Technical analysis attempts to predict future price movements based on historical patterns and chart formations. Each approach has its proponents and its limitations, and a good book will present these various strategies objectively, allowing the reader to determine which best suits their own risk tolerance, investment goals, and time horizon.

However, knowledge alone is insufficient. The stock market is not simply a test of intelligence; it's a battleground of emotions. Fear and greed can cloud judgment and lead to impulsive decisions. A truly effective book will address the psychological aspects of investing, emphasizing the importance of patience, discipline, and emotional control. It will teach you how to avoid common behavioral biases, such as confirmation bias (seeking out information that confirms your existing beliefs) and loss aversion (feeling the pain of a loss more strongly than the pleasure of an equivalent gain). Mastering these psychological aspects is often more challenging than mastering the technical aspects, but it is arguably even more crucial for long-term success.

Critically, remember that no book can predict the future. The stock market is inherently unpredictable, influenced by a complex interplay of economic factors, geopolitical events, and investor sentiment. A book can equip you with the tools to analyze information, assess risk, and make informed decisions, but it cannot guarantee profits. Beware of any book that promises guaranteed returns or "get-rich-quick" schemes. These are almost always misleading, and often outright scams.

Instead, look for books that emphasize long-term investing, diversification, and risk management. Focus on building a portfolio of carefully selected stocks that align with your investment goals and risk tolerance. Be prepared to weather market volatility and avoid the temptation to panic sell during downturns. The stock market is a marathon, not a sprint.

Finally, remember that reading a book is just the first step. The real learning comes from putting your knowledge into practice. Start small, invest conservatively, and track your progress. Learn from your mistakes and continuously refine your investment strategy. Consider paper trading (simulated trading) to test your ideas without risking real money.

In conclusion, while a book cannot magically transform you into a stock market millionaire, it can provide the essential knowledge, skills, and psychological framework to significantly improve your chances of success. The "How to Make Money in Stocks" book is not a get-rich-quick scheme, but a potential key to unlocking long-term financial growth, provided you approach it with the right expectations, a willingness to learn, and the discipline to put your knowledge into practice. The possibility is real, but it requires effort, dedication, and a healthy dose of realism. ```